Deleveraging COVID Bubble – Possible Volatility Risks In Foreign Financial Markets

Stock-Markets / Stock Market 2021 Dec 10, 2021 - 12:44 PM GMTBy: Chris_Vermeulen

I get asked all the time what my opinions are regarding the markets. As much as I could go into really deep details regarding technical analysis and other factors of my research, the simple answer is that we’ve been living through 2~4+ years of incredible market trends and unprecedented global central bank efforts to support and contain market risks. This is something we have not seen at these levels since the end of WWII and after the Great Depression.

Is there a Speculative Bubble Deleveraging Risk In The Global Markets?

The one thing that keeps popping up in my mind is the deleveraging of credit/debt and speculative risk assets over the next 2 to 3+ years. Let me explain what I mean by this statement.

Before the first COVID event (February 2020), the global markets were already within a moderate strengthening phase with relatively stable global trade, economic, and central bank participation. Everyone was still waiting for inflation to rise while employment and economic data continued to strengthen. When COVID hit, things changed very quickly.

- Global lockdowns disrupted the labor and supply markets.

- Consumers shifted gears while settling (or moving) into more rural locations attempting to wait out the new COVID threat.

- Global central banks and governments attempted to navigate the catastrophic COVID event while settling population and finance issues.

- An unprecedented amount of stimulus, global central bank financing, and speculative capital was unleashed over a very short 3 to 4-year span of time.

- The success of the global economy prior to 2020 prompted a very deep and efficient speculative market trend in 2020 and beyond.

- Now, that speculative bubble appears to be bursting – at least in certain areas of the markets.

Let’s explore a bit of data and charts.

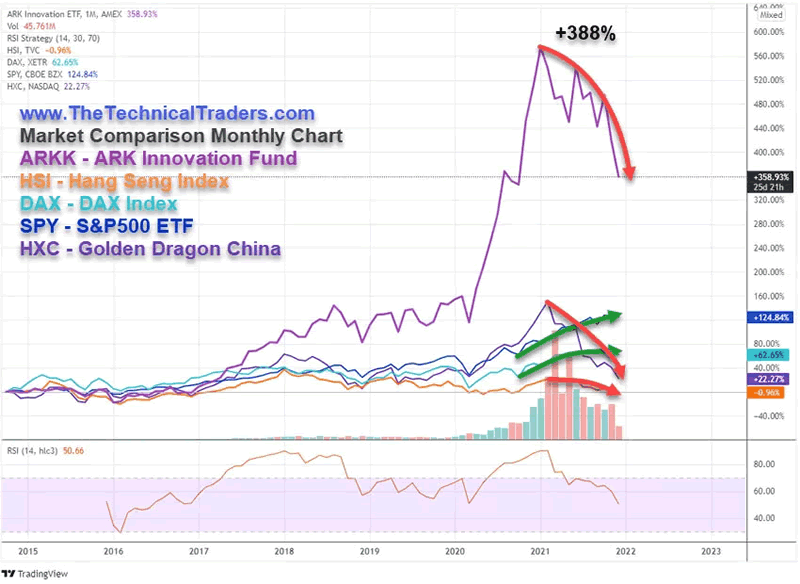

This first Monthly chart highlights trends in various global market indexes. ARKK, the ARK Innovation Fund, HSI, the Hang Seng Index, DAX, the DAX Index, SPY, the S&P 500 ETF, and HXC, the Golden Dragon China Index. Each of these represents a unique component of global markets and sectors.

ARKK represents technology, innovation, and a more broad global investment style focused on stronger or more highly volatile price trends.

HSI represents a broad market China Index that includes various markets sectors – including Technology, Medical, Consumer, Real Estate, Finance, and others. These companies are listed in China and do a majority of their business in China.

DAX represents a broad market German Index.

SPY represents a broad market US Index

HXC represents the US-listed Chinese Companies doing a majority of their business in China.

The purpose of showing you this chart is to highlight the deleveraging that is already taking place in ARKK, HXC, and the HSI. The DAX and the SPY are still trending higher, while the ARKK, HSI, and HXC are trending strongly to the downside.

It is my opinion that the global markets, particularly China/Asia, are already in the midst of a massive speculative deleveraging event – a post-bubble rally phase initial collapse process. Certain technicians sometimes call this an “unwinding” or “unraveling” event. Ultimately, the US has seen two of these types of events over the past 30 years – the 1999-2000 DOT COM bubble burst and the 2008-09 Housing Market collapse.

What I found interesting is the HXC price levels have already fallen to levels near the March 2020 COVID lows. Whereas the HSI price levels have also fallen to very near the March 2020 COVID lows, it has also fallen into negative price trending from 2014-15 price levels.

Could Speculative Deleveraging Stay Localized This Time?

I think global volatility and bigger price trends will be something we need to prepare for in 2022 and 2023 – possibly even longer. Yet, my opinion is the US, and other stronger global economies may be partially immune from this speculative deleveraging event.

Why?

Because not every US corporation or citizen has put themselves in a similar scenario as I believe many in China and Asia possibly have after nearly 30+ years of extreme growth trends.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

The US has experienced the 1999-2000 DOT COM bubble and the 2008-09 Housing Market crisis over the past 30 years. At the same time, China/Asia has grown from moderate obscurity in the 1980s-1990s into extensively powerful economies. Along the way, over a relatively short period of time, a generation or two of the populous has seen assets rise thousands of percent over the past 20 years. This leads to a highly speculative investment class – almost feeling as though anything they touch turns to gold.

But it doesn’t always work out that way – does it?

This HXC chart highlights the incredible rally after the February 2020 COVID event as well as the moderate growth phase from 2005 to 2016. Notice the big growth that took place in 2017. This was a period of very strong economic growth where Chinese companies started listing on US exchanges to tap into a strong US investor class.

After COVID hit in 2020, this speculative investing trend skyrockets over 180%. Then, it collapsed.

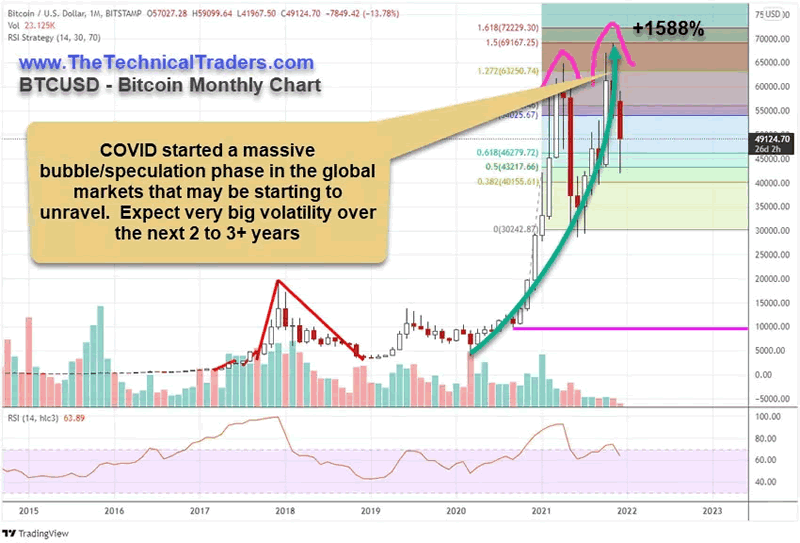

Bitcoin May Follow This Deleveraging Trend If Panic Sets In

The recent rally and peak in Bitcoin have also caught my interest in seeing if this deleveraging event follows through in large Cryptos? Since the initial Bitcoin collapse in early 2021, Bitcoin has rallied strongly as the US markets recovered and inflation started to rise later in 2021. Now, a very strong pullback in Bitcoin has started at the same time large Chinese Real Estate developers and other corporations are beginning to experience severe credit/debt concerns.

Is there a correlation between Chinese/Asian consumer/economic strength and Bitcoin? Has the rise in Bitcoin prices over the past since 2015 been fueled by the rising speculative and investment trends in China/Asia?

We’ll know soon enough.

If the global markets continue this process of speculative trading deleveraging, we’re going to see an increase in volatility and deeper price trends take place before the process completes. I suspect there is a huge amount of underlying credit/debt that is struggling in certain areas of the world right now. This type of speculation tends to drive a mentality of FOMO (fear of missing out) and YOLO (you only live once). I remember after the DOT COM bubble burst, I would talk to people that were so entrenched in the bubble, and they bought all the way through the collapse – believing it would bounce back.

This deleveraging event should stay somewhat immune from certain larger market economies. Yes, there will likely be more volatility and bigger price swings. But, eventually, the strength of consumers and economic trends will settle most of this process fairly quickly for the largest global economies.

2022 and 2023 are sure to be great years for traders. Sectors will rotate and trend. The world’s strongest economies will rotate and trend. The increased volatility will create risks, but it will also create incredible opportunities for profits.

Get ready; it looks like this deleveraging event is just getting started.

Want to learn more about what affects the markets?

Learn how I use specific tools to help me understand price cycles, set-ups, and price target levels. Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may start a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into Metals.

If you need technically proven trading and investing strategies using ETFs to profit during market rallies and to avoid/profit from market declines, be sure to join me at TEP – Total ETF Portfolio.

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.