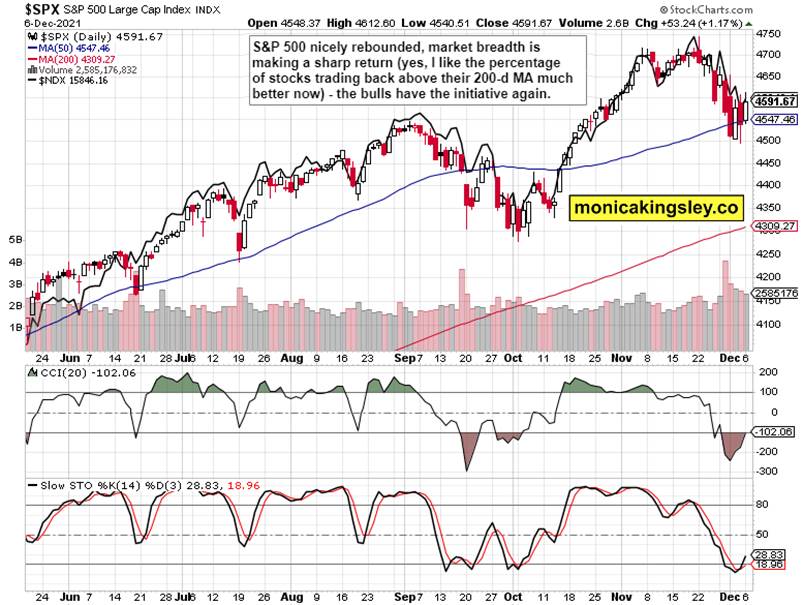

Stock Market Turning the Corner in Style

Stock-Markets / Stock Market 2021 Dec 09, 2021 - 05:49 PM GMTBy: Monica_Kingsley

S&P 500 bulls delivered, and the revival in risk-on is increasingly getting legs as HYG rebounded sharply. The sharply increasing participation is counterbalanced by still compressing yield curve, but yields finally rose yesterday. Finally, we saw a truly risk-on positioning in the credit markets – and that won‘t be without (positive) consequences.

Still, it pays to be ready for the adverse scenario that I‘ve described in yesterday‘s key analysis, in connection with which I have received an interesting question. It‘s essentially a request to dig in some more so that my thinking can‘t be interpreted as being on the verge of immediately flipping bearish:

Q: Your analysis of today: "Downside risks having sharply increased since Thanksgiving. Not only for stocks, where we might not be making THE correction's low, but also for commodities, cryptos and precious metals". I am not sure if I am interpreting this right (English is not my native language). Are you saying that the market might turn down spectacular, even for precious metals?

A: it's specifically the market breadth for larger than 500 stock indices that tells me we possibly aren't out of the woods yet - no matter the technical improvements that I looked for us to get yesterday, and that are likely to continue thanks not only to solid HYG performance. What I'm saying is that unless there is broader participation in the unfolding S&P 500 rally (and in the rally of other indices), we're in danger of a more significant move to the downside than we saw already (those few percents down).

You can also watch for the sensitivity to Fed pronouncements - on one hand, we have the taper, even accelerated one on the table, yet through Nov, total assets grew by practically $100bn, and it was only the 7-day period preceding Dec 01 that marked balance sheet contraction. This sensitivity to hawkish statements would show in downside hits to risk-on assets (cyclicals), and also in VIX spikes. There, my mid-session Friday call made on Twitter for VIX to better reverse from its highs for Friday's close, came true.

So, should a sharper decline happen (as said, the risks thereof haven't disappeared), it would (at least initially) influence precious metals too, and not remain limited to stocks and commodities.

Having answered, let‘s move on.

I like the strength returning to energy – both oil and natural gas as I tweeted yesterday. While financials are taking their time, and consumer discretionaries lagged hugely on a daily basis behind staples, I look for more strength to return to cyclicals at expense of interest rate sensitive sectors (that includes utilities also). Rising yields (however slowly) would underpin commodities, and it‘s showing already. Precious metals continue needing the newfound Fed hawkishness image to start fracturing, or causing inordinate level of trouble in the real economy. The latter would take time as manufacturing is pretty much firing on all cylinders, which is why I‘m not looking for overly sharp gold and silver gains very soon.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 bears were more than a bit tired, and Friday‘s candle being unable to break below preceding day‘s lows while not too much stood in the way, was telling. What can‘t go down, would sooner or later go up.

Credit Markets

HYG upswing is a pleasant sight for the bulls – half of the prior decline has already been erased. Quite some more still needs to happen, and the lack of volume yesterday is a sign that patience could very well be required (let‘s temper our expectations while still being positioned bullishly).

Gold, Silver and Miners

Precious metals are still looking stable, and are waiting for the Fed perceptions to fade a little. CPI inflation hasn‘t peaked neither in the U.S. nor around the world (hello, Europe), neither have energy prices or yields – so, get ready for the upswing to continue at its own pace.

Crude Oil

Crude oil confirmed the bullish turn, and the modest volume isn‘t an issue for it indicates lack of sellers willing to step in. Plenty of positioning anticipating the upswing happened in the days before, I think.

Copper

Copper prices are taking the turn alongside the CRB Index – it‘s starting to lean as much as APT in the direction of no economy choking response to Omicron that would necessitate further GDP downgrades. I‘m looking for the red metal to continue gradually favoring the bulls even more.

Bitcoin and Ethereum

Bitcoin and Ethereum attempt base building, but both cryptos (Bitcoin somewhat more) remain vulnerable. There are a few good explanations for that, and the most credible ones in my view revolve around stablecoins backing.

Summary

- S&P 500 reversal higher is looking increasingly promising, and the signs range from sharply broadening market breadth to encouraging HYG performance. Commodities aren‘t being left in the cold, and I‘m looking for their own reversal to gradually spill over into precious metals – depending upon the evolving Fed perceptions, of course. The odds of us having seen the worst in this correction have considerably improved, and while positioned appropriately, I‘m not yet sounding the analytical all clear of blue skies ahead.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.