What Is A Golden Cross Pattern In Trading?

Stock-Markets / Trading Systems Dec 04, 2021 - 02:08 PM GMTBy: Submissions

Trading is very interesting and rewarding when you have proper knowledge, nerves of steel, and fast decision-making skills. All of this starts with knowing the basics of trading.

Today in this article, let us find out more about the golden cross trading pattern.

A brief intro

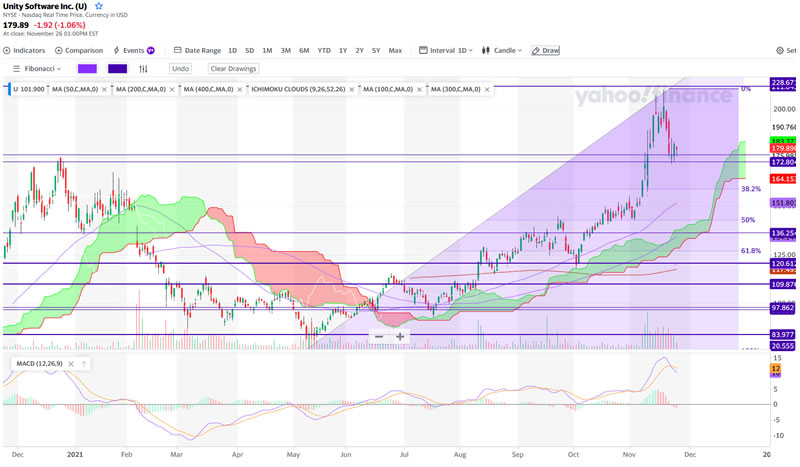

The golden cross pattern is an indicator of the onset of a bull market. Noticing a golden cross is a piece of cake. It is basically when the short-term moving average of a stock crosses above the long-term moving average. Specifically, when the 50th-day moving average crosses above the 200th-day moving average.

You can consider it as a definitive indicator of a bull market, as trading volume increases because of golden cross trading. After the cross occurs, consider the long-term moving average as the resistance level for the market, and a higher trading volume above that resistance level is considered to be a bull run.

There is no factual study conducted to prove its usefulness, and this has led many analysts to question it. But since the last occurrence of the gold cross pattern, the S&P index has gained over 50%. This method is often used in conjunction with the crypto fear and greed index.

There is yet another indicator called the death cross pattern. This is just the reversal of the golden cross pattern. A death cross occurs when the short-term moving average crosses down the long-term moving average.

Specifically, when the 50th-day moving average crosses down the 200th-day moving average. Thus showing higher selling pressure and the onset of the bear market.

Stages of Golden cross

There are three definitive stages to recognize a golden cross:

- First, a clear downtrend exists, but it is in its last stage because the buying pressure is well above the selling pressure.

- Second, in this stage, we see a new uptrend when the short-term moving average crosses above the long-term moving average, thus forming a golden cross.

- Third, in this final stage, we see a continuing uptrend thus confirming a bull market. Even with a downside movement due to correction, as long as the price remains above the 200th-day average, the golden cross remains intact.

Golden cross for intraday trading

Most day traders use intraday trading with a smaller period for intraday golden cross trading. The most common way is when the 5-period crosses above the 15-period, then you can say an intraday golden cross has appeared.

But this is quite a risky proposition, as these small trends can reverse at any moment and can lead to huge losses. So, try to use the golden cross with a larger period, where you can see a stronger and lasting golden cross trend.

How to use the Golden cross

The golden cross, like all other indicators, is a lagging indicator, which means you cannot predict the future. You can only recognize it well after the 50th-day moving average crosses the 200th-day moving average.

This means you can see its reversal of trend only after the market has turned from a bear to a bull market. That is why traders usually start buying well before the onset of the golden cross.

The golden cross helps traders to determine the best time for entry and exit from a particular trade. Traders can also use it as a tool to understand the reason behind buying into a particular trade and whether to hold it or sell it.

Limitations of a golden cross

Since the golden cross is a lagging indicator, you only get to know about it well after the short-term moving average crosses above the long-term moving average. This can sometimes lead to a late entry into the trade and leads to a decreased profit margin.

The golden cross trading pattern is often said to produce false signals. Even after the appearance of a golden cross, the bull market failed to manifest. Thus, it is preferable to use the golden cross with other indicators and filters for a safe trade.

Remember to always use other indicators and filters with the golden cross, which will lower your risk factor and lead to better results.

Conclusion

As you can see, that golden cross is not quite the definite indicator to enter a trade. So it is better to be careful if you are only relying on it.

By Leslie Wilder

© 2021 Copyright Leslie Wilder - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.