Crude Oil Didn’t Like Thanksgiving Turkey This Year

Commodities / Crude Oil Nov 28, 2021 - 04:09 PM GMTBy: Submissions

It appears that the US markets didn’t find the Thanksgiving turkey very tasty this year.

CBOE Volatility S&P 500 Index (VIX) Futures (daily chart)

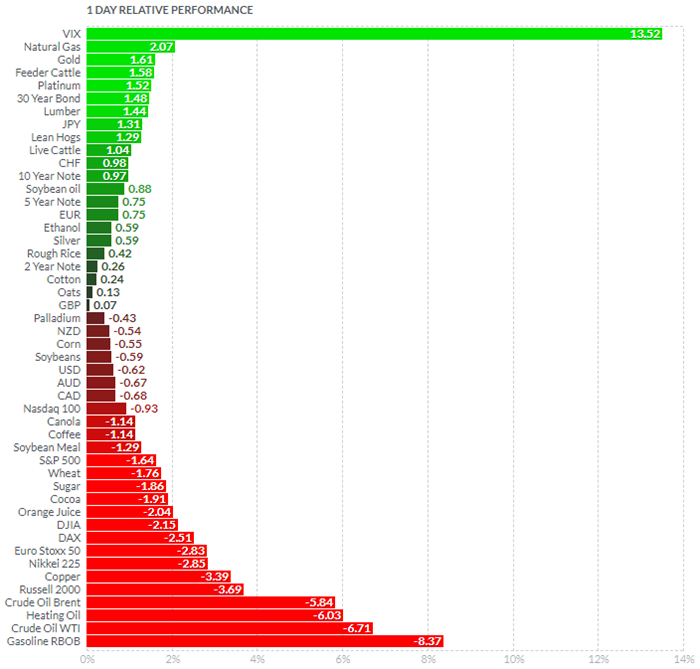

With the “indicator of fear” (also known as the VIX or Volatility Index) spiking over 13.5 % in the European session, propelling some precious metals (gold and platinum) and natural gas to the roof, while sending the crude and petroleum products to the lower ground, the volatility has just clearly reached a higher level.

(Source: FINVIZ)

Most of our premium subscribers enjoyed a last ride on the long side for WTI crude oil this month while following our trade projections. For more details of the last oil trading position provided last week, I have just released that trade as it got very close to reach its projected target on Wednesday (Nov. 24).

WTI Crude Oil (CLF22) Futures (January contract, daily chart)

The main fears on the oil market come from the possibility of a demand slowdown starting from Q1 2022. Additionally, that timing happens when the United States, along with a larger group of countries (including China, India, Japan, Republic of Korea, and the UK) have made the decision to release some of their strategic oil reserves on the market, aiming at artificially increasing the supply, and thus lowering oil prices. Well, this may represent one driver of prices indeed, although a more general economic slowdown associated with a non-sustained demand as we are getting into the winter, may be the main concern now.

On the other hand, the winter – expected to be colder in certain regions – is also supporting the gas prices, hence the recent surge on the Henry Hub futures, along with sustained US exports of Liquefied Natural Gas (LNG) that are also supporting natural gas prices.

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart)

In conclusion, we could be entering a new volatile period on the global markets, associated with various fears maintained through headlines by media (Covid variants, restrictions, etc.). For now, I would suggest staying away from the noisy headlines and just relax and enjoy some new pieces of turkey leftovers, or whatever else if you don’t eat meat. Ignore the noise and trade what you see (not what you think). Stay tuned and enjoy your weekend!

As always, we’ll keep you, our subscribers well informed.

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.