The real reason Facebook just went “all in” on the metaverse

Companies / Metaverse Nov 18, 2021 - 11:18 AM GMTBy: Submissions

By Justin Spittler - Imagine if McDonald’s (MCD) started selling cars…

Or Netflix (NFLX) got out of the movie business to deliver burritos…

Or Walmart (WMT) said it was developing a new cancer drug…

To many investors, Facebook’s (FB) big pivot is just as big a head-scratcher.

As you’ve probably heard by now, the social media giant announced it’s becoming a metaverse company.

The metaverse is the new “3D internet” we first introduced you to in February.

Facebook changed its name to Meta. It’ll change its stock ticker from “FB” to “MVRS” on December 1. And it plans to spend $10 billion and hire 10,000 people to build out the infrastructure of the metaverse.

You may be thinking…

Facebook? Metaverse? Why?

It makes perfect sense when you consider the business Facebook’s really in.

See, Facebook doesn’t make its money being a social media company.

- Facebook grew into the 5th largest company in America because it’s an advertising powerhouse.

97% of Facebook’s revenue comes from advertising sales.

Advertising has been a lucrative business for Facebook. It’s made CEO Mark Zuckerberg the 5th richest guy on Earth.

It’s made shareholders rich, too…

Facebook has handed investors 10X their money since 2012… by selling ads on the internet.

At this point, the “regular” internet is saturated with advertising.

That’s why Facebook has its sights on bigger things.

- Back in June, Facebook quietly made a genius move…

As I showed you, Facebook announced it would start testing ads in its Oculus VR platform.

Facebook acquired VR headset company Oculus in 2014 for $2 billion. It was Facebook’s first major move in the virtual reality space.

As I said in June, there’s a huge pot of gold waiting for the company that figures out how to profitably advertise on VR and augmented reality: both key technologies needed to access the metaverse.

In short, Facebook is gearing up to dominate this entirely new world of advertising.

And please understand… advertising in the metaverse isn’t some outlandish prediction.

It’s already happening.

- The world’s biggest brands are entering the metaverse in droves…

If you’ve been following my work, you know exactly what I’m talking about.

Luxury brands Gucci and Louis Vuitton are already marketing inside the metaverse. A virtual Gucci bag sold for more money in the game Roblox than its physical version did in real life. And Louis Vuitton has made virtual outfits for League of Legends characters.

Warner Bros. and Hyundai have built their own virtual worlds in the metaverse. Coca-Cola (KO), Anheuser-Busch (BUD) and Crockpot have started selling their own non-fungible tokens (NFTs), or digital goods. Coca-Cola’s first NFT auctioned off for $575,884.

At the same time, Sephora and HBO are experimenting with how to use augmented reality (AR) and virtual reality (VR).

NASCAR also partnered with metaverse platform Roblox (RBLX) to brand itself in front of younger audiences. Players will be able to outfit their video game characters in custom NASCAR uniforms.

A couple weeks ago, Nike (NKE) filed seven trademark applications as it prepares to enter the metaverse. The company will make and sell virtual branded sneakers and apparel.

- The metaverse is jam-packed with innovative marketing potential.

There’s marketing opportunity in virtual stores, fashion shows, product launches, content production, live flagship events, enhanced social media platforms, Zoom calls, and NFTs.

The possibilities in this hybrid digital/physical world are endless.

There’s a ton of money up for grabs as advertising migrates from the “regular” internet to the metaverse.

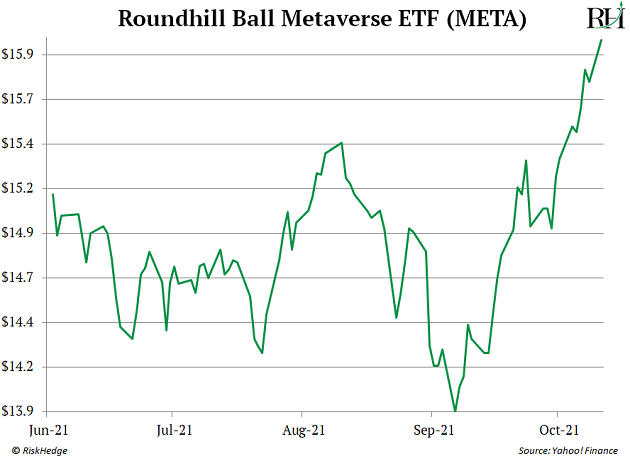

One easy way to profit is by buying the metaverse fund META.

It holds a basket of companies that have a presence in the metaverse, including Facebook, chip maker Nvidia (NVDA), and Microsoft (MSFT).

You can see that META recently broke out to new all-time highs. Since then, it’s been on an absolute tear.

This is incredibly bullish for metaverse stocks as a whole. But let’s face it…

Facebook, Nvidia, and Microsoft aren’t metaverse pure plays. They operate huge, heavily diversified businesses.

So, I suggest focusing on smaller metaverse stocks.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.