Dow Stock Market Trend Forecast Into Mid 2022

Stock-Markets / Stock Market 2021 Nov 16, 2021 - 05:05 PM GMTBy: Nadeem_Walayat

Dear Reader

This is the fourth and final part of my extensive analysis that maps a stock markets trend forecast into Mid 2022 - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Part 1 - Stock Market FOMO Going into Crash Season

Part 2 - Why Most Stocks May Go Nowhere for the Next 10 Years!

Part 3 - Dow Stock Market Trend Analysis

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

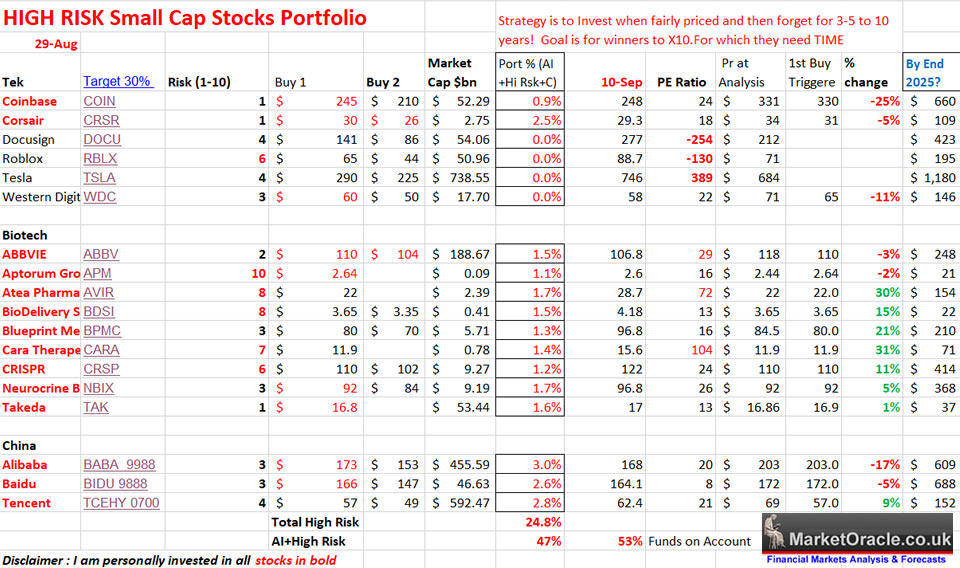

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

The whole of which was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Whilst my most recent analysis updates AI stocks buying levels and zones in the wake of recent earnings reports and the current state of the brewing Financial Crisis 2.0

AI Tech Stocks Portfolio Updated Buying Levels and Zones as Financial Crisis 2.0 Continues Brewing

Contents:

Financial Crisis 2.0 Checklist

The China Syndrome

Stock Market Begins it's Year End Seasonal Santa Rally

Stock Market Trend Forecast Current State

INVESTING LESSON - BUYING VALUE

Peloton 35% CRASH a Lesson of What Happens When One Over Pays for a Loss Making Growth Stock

INVESTING LESSON - Give your Portfolio Some Breathing Space

INVESTING LESSON - Give your Portfolio Some Breathing Space

How Stagflation Effects Stocks

INTEL Bargain - 15.5% Discount Sale

Why Intel stock price dropped 15%?

FACEBOOK - 10% DIscount

IBM - 20% Discount

Amazon - 5% Discount

APPLE 4% Discount

AMD $136 on Route to $200

TSMC - $117

Microsoft $336

Google $2980, PE 28.7, EC 30.

Nvidia Leaves planet Earth - $299, PE of 106

Heads Up on NEW Potential Tech Stocks

AI Stocks Portfolio Updated Buying Levels

AI Stocks Buying Plan B

FREE TRADE the Perfect Stocks and Shares ISA?

FREE SHARE FROM FREETRADE

High Risk Stocks Brief

Crypto's 20% Discount Event

Bitcoin Trend

Palladium Brief

Also gain access to my recent highly timely analysis on why it is time to get onboard the crypto gravy train heading for millennial FOMO 2022 -

Bitcoin NEW All time High is TRIGGER for Future Alt Coins Price Explosion

Contents:

- Bitcoin & Ethereum 2021 Trend

- Crypto Portfolio Current State

- The BITCOIN NEW ALL TIME HIGH Changes EVERYTHING!

- Ravencoin to the MOON!

- What am I doing?

- How to Invest in Crypto's

- Bitcoin 2022 Price Target

- Ethereum 2022 Price Target

- Ravencoin 2022 Price Target

- Cardano (ADA) 2022 Price Target

- Chainlink 2022 Price Target

- Pokadot 2022 Price Target

- Solano 2022 Price Target

- Litecoin 2022 Price Target

- Arweave 2022 Price Target

- Stellar Lumens - XLM 2022 Price Target

- Eth Classic 2022 Price Target

- Vechain 2022 Price Target

- EOS 2022 Price Target

- Earnings Noise Delivers INTEL And IBM Buy Opps

- Facebook and Google Could CRASH 10% Post Earnings Day

- High Risk Stocks Swings and Roundabouts

For trading crypto's at probably the worlds safest exchange see Coinbase (affiliate links).

For one of the best crypto trading platforms see Binance for 10% discount on trading fees - Discount Code LZ728VLZ

For mining with your GPU check out Nicehash.

As well as access to why inflation will be far from transitory, batten down the hatches for what's to come-

Protect Your Wealth From PERMANENT Transitory Inflation

- Best Real Terms Asset Price Growth Countries for the Next 10 Years

- Worst Real Terms Asset Price Growth Countries for the Next 10 Years

- The INFLATION MEGA-TREND

- Ripples of Deflation on an Ocean of Inflation!

- Stock Market Trend Forecast Current State

- US Dollar - Stocks Correlation

- US Dollar vs Yields vs Dow

- Stock Market Conclusion

- 34th Anniversary of the Greatest Crash in Stock Market History - 1987

- Key Lesson - How to REALLY Trade Markets

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Can US Save Taiwan From China?

And my extensive analysis of Silver concluding in a trend forecast into Mid 2022.

Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month,https://www.patreon.com/Nadeem_Walayat.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

Formulating a Stock Market Trend Forecast

The stock market is overbought on multitude of measures and ripe for significant correction even if many people are expecting it to happen. Though I hear many people stating that because so many are expecting a correction therefore it's sods law that it's not going to happen so don't risk missing out on another 10% bull ruin by waiting for a correction!

The range of lows is wide, from filling the gap down to 28.5k at the low end to barely a blip lower to 33.5k. Unfortunately I do not have the benefit of hindsight so several days have been spent pondering what is the most probable outcome.

Elliott wave expectations are for a corrective ABC style pattern going into and probably beyond Mid October, possibly all the way into the End of October . Where we are currently in the A wave down, so we should get a B wave correction rally before the final C wave sell off during October. How low, not much below 33.5k, then it's off to the races, 40k! Hard to imagine 40k by the end of this year .I will have to moderate that down to under 38k.

So down into October and then up into the end of the year, perhaps into early January, for the next correction, probably when many bears will be crowing that the top is in, just before the bull takes off again to rally well into April and probably early May. So we could get as much as a 20% rally off the October lows, a cushion of sorts to cope with any bad news for the bull market during the remainder of 2022. Still I expect the bull market to continue for many years, probably into 2027!

What game is the Biden administration playing with its huge deficit spending programme? Don't they realise it is highly INFLATIONARY and DESTRUCTIVE? MMT madness, there is No FREE LUNCH! The US is on the fast track to becoming the Weimar republic as US real inflation is about 10% and rising! This is why one needs to contemplate the likes of crypto's! Of course I understand why, it's because the US economy has been in a depression SINCE 2008! I think most folks have forgotten that QE is a PANIC MEASURE, instead PANIC MEASURES have become the NEW NORMAL for which there will be a day of reckoning.

However where stocks are concerned my message is simple - BUY the deviation from the high whenever the opportunity presents itself.

Margin debt is falling that tends to be harbinger for lower prices ahead.

Annual percentage change indicator suggests to expect Dow 28k, which would be nice.

And of course we are in the seasonal weakest month of the year - September that should end down, with a likely lower low during October before a rally into the end of the month.

Short-term seasonal's suggest down into late September, up unto early October and then down into Late October.

Presidential cycle suggests Biden the Democratic President has come to the rescue for 2021! BUT mid-terms tend to be BAD years for Democrats which means take any rally into Mid 2022 to SELL for stocks could end 2022 down on the year..

Trend analysis suggests not to expect much of a correction, i.e. we will be lucky to see the Dow trade lower than 33.5k and at best 31.5k.

As for 2022, January could mark the start of a significant correction that resolves in a weak trend higher into Late April for either a double top or even a lower top ahead of a more serious decline during the remainer of 2022.

Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

Therefore my primary forecast conclusion is for the Dow to target a relatively mild correction into late October 2021 towards 33,500 in advance of the next leg higher for the bull market into early January 2022, towards a new high of at least $37k, and could even have a blow off all the way to 40k! To be followed by my secondary forecast for the Dow to target a correction into Mid February 2021, that should result in another run to all time highs late April / Early May, though this could turn out to be a double top, or even a lower high than the early Jan high, but more on that closer to the conclusion of my primary forecast.

As for beyond April 2022, stocks could be in for a rough patch, even a bear market of sorts for a good 6 months.

And here is an updated trend forecast chart of what has transpired since my analysis was posted to Patrons.

Investing fundamentals

I am repeatedly reminded in communications that many people do not understand how to invest in stocks. Holding a stock for 2 weeks or 2 months is not investing, it is gambling! Holding stocks for less than 1 year is not investing it is trading. Holding stocks for 2 years should be the bare minimum in terms of investing time horizon though during such a time period one is at the whim of market volatility, i.e. crashes and bear markets where if one did not buy at a fair valuation and did not get sucked into hype then such volatility could in a worse case scenario even for a good stock resolve in a couple of years before the stock trades back to where one bought it.

So I consider 3 years to be the minimum where personally I try to forget about the stock for a good 5 years and then revaluate where it stands at that time, and I KNOW I should be looking to hold the stock for a good 10 YEARS to fully capitalise up on it.

So get this right before one invests a single penny! That once one has selected a good stock for the long-run then one really must invest and forget about it for at least 3 years! If one cannot do that then DO NOT INVEST! Because YOU WILL LOSE!

Recently I invested in a selection of high risk stocks for the first time that I made public to Patrons before the fact, I can tell you that I will still be invested in ALL of these stocks in 3 years time (excluding china), I won't have sold anything no matter what happens, and likely I will remain invested in most 5 years from now and likely more than 50% 10 years from now. For I know that is how one actually makes the X5 and X10 returns.

You are NOT going to to get X10 by investing in a stock for 10 weeks or 10 months! It is going to require 10 YEARS to X10!

This is why I know Cathy Wood is a garbage fund manager because of her portfolio churn, constantly buying and selling that is a recipe for disaster as was the case with her buying chinese stocks at their highs and selling at their recent lows and now after they have gone up she's started buying some again so given her bad luck they will now probably fall!

1. Buy Deviation form the High, the greater the deviation form the high the greater the buying opportunity.

2. Always try and remain invested at at least 50% of ones stocks portfolio allocation.

3. Buy the market if it is at 20% or more below where it was a year ago

IBM Continuing to Revolutionise Computing

IBM the corner store of innovations and patents if not ability to capitalise on it's intellectual property is once more at the forefront of what's needed to progress computing and where the cutting edge of retail technology is concerned that is in GAMING, not the gaming of PS5's and X-boxes, but the gaming systems that every teenager aspires towards, high end systems where no expense is spared to shave those extra ms off response times, immersed in a high resolution game play experience through powerful processors, GPU's and fast memory, overclocked and cooled to the hilt. And the thing about high end gaming systems is that they are just what one needs for a whole host of high end compute power multipurpose applications from machine learning to crypto mining to CAD, video editing, to creating virtual worlds for videos and of course games, all done on the same system.

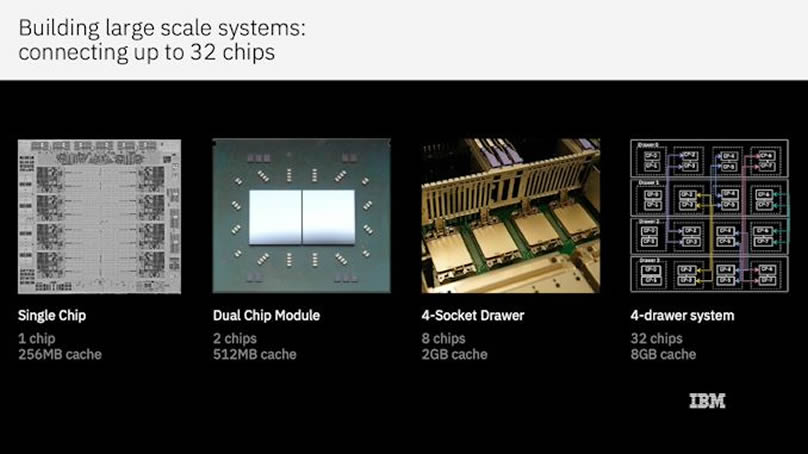

So what breakthrough have IBM achieved this time not long after news of their 1nm gate technology. Whilst IBM may be dust where desktop PC systems are concerned but have been quietly continue to chug along in the background with their mainframe systems powered by their IBM Z platform processors. Where their latest breakthrough processor is the Z16, without getting technical it basically concerns the amount of cache memory available to each Z15 processor that in addition to L1, L2 and L3 cache also has 1gb of L4 cache.

So you may ask what's the big deal these are mainframe processors arranged in, multiple boards of 4 Z15's per rack. How does this effect gaming?

In steps their latest processor the Z16. Which is basically taking their Z15 systems of caches per core to the next level by shrinking much of it down to one die where each core has it's own L2 cache! Telium chips will have 32mb PER CORE, so a 8 core Telium chip has 256bmb of cache, set this against AMD's Zen 3 processors only have 512k of L2 cache per core! IBM's processors have 62 times the level of L2 cache as AMD's best! Which results in a huge reduction in latency. Yo may ask what about L3 and L4 cache, well with 32mb of L2 cache per core there is no need for slower L3 and L4 cache! I.e. AMD processors have 32mb of L3 core per 8 core chip let and no L4 cache.

Furthermore each core can utilise ALL of the cache on a chiplet, for instance of a core uses up all of it's 32mb of L2 cache then it can access the L2 cache of other cores on the chiplet as virtual L3 cache. But this sharing of L2 caches does not stop there, for instance if a chiplet has used up all of the L3 virtual cache then it can call on L2 cache on the other chiplets in say a 4 chiplet 32 core system as virtual L4 but at a latency of 19 cycles or access to 1gb of virtual L4 cache and so on for 32core, 64 core, 128core....

This is ground breaking new technology that is going to result in a huge performance spike that I am sure the likes of Intel and AMD will licence the technology from IBM, it may not be akin to going form single core to multi core processors but it's not far off!

If it actually works as IBM states then this is they way that all multi-core processors will go. And this is the mere tip of innovation at IBM which may be crap at selling products but is a giant when it comes to innovations and patents that IBM will ultimately seeks to licence to others to use as IBM has clearly learned it's painful lesson from the 1980's when it let in the Microsoft wolf in Sheep's clothing into the then IBM PC market.

As for Intel and AMD? We'll Intel has a cross patent deal with IBM so this technology is coming to Intel processors within the next few years.

All whilst IBM continues to innovate towards Quantum Computing dominance, regardless of what the likes of Google state, IBM could be deploying commercial rather than largely research quantum computers by 2026, several years ahead of the pack, so as was the case from the 1940s to the mid 1980's IBM could once more come to dominate the computing world.

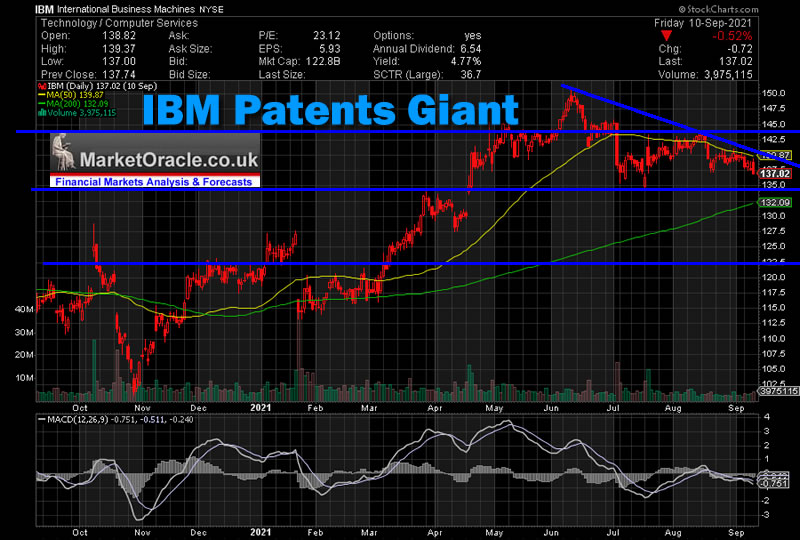

(Charts courtesy of stockcharts.com)

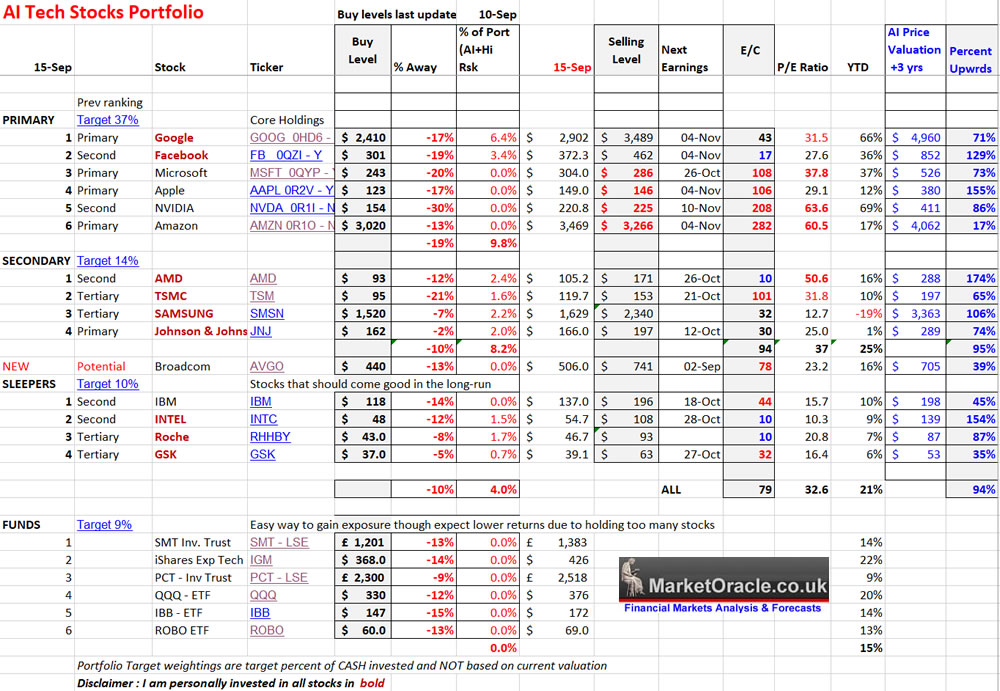

IBM is definitely one stock to be invested in for the long-run, so remains at the top of my list to regain exposure to during October where whilst I can dream of buying at a PE of sub 20, nevertheless may have to bite the bullet and pay 23 X earnings, which in part is sweetened by it's high 4.8% annual dividend yield all of which is ahead of IBM splitting into 2 by the end of this year, Kyndryl in which IBM shareholders will receive shares.AI Stocks Portfolio Current State

Buying Levels

The closest stock to it's buying level right now is Johnson and Johnson at 2% away, though I am not personally looking to buy more J&J. Next is Samsung at -7% again I am not looking at add more to my Samsung holdings either.

The rest are some distance away, for instance Nvidia would need to fall by about 1/3rd and even then it would not be at the top of my buy list.. Though we were in a similar situation in late January 2020 when at the time when asked by Patrons I stated that I would not buy anything at right now, instead will wait for much lower prices and we all know what happened some 7 weeks later! EVERYTHING WAS A BUY at Bargain basement prices of typically 1/3rd lower than where they were trading in January 2020.

Stocks that I will consider buying higher than their buying levels are Facebook, Intel, IBM and maybe some Apple during the 2nd half of October 2021.

Best Value Stocks Right Now

INTEL Is by far the best value stock right now. This is a stock that I am definitely going to buy more of before the end of October 2021. Next is Facebook which is 19% away from it's buying level, but I am seriously considering buying more given it's low EC ratio. Next is AMD, high PE but low EC ratio. And then we have Roche which is a good steady as she goes pharma stock, pays a good dividend which at it's buying level would be about 3%.

So those are the best value stocks right now, Intel, Facebook, Roche and AMD.

My Late October Stocks Buying Plan

Regardless of what happens to the stock market, my plan is to double my position in Intel, Buy more Facebook,and Buy back in to IBM at roughly the same size stake I sold a couple of months ago at $146, where I may get lucky and see IBM trade down another 10 bucks to around $127 from the current $137 which would represent a significant 13% discount against the current 6%, which net of fees would be equivalent to 2 years of dividends.

After that I would be looking to buy AMD and Apple on a correction towards their buying levels.

I have a limit order to buy some Amazon at $2933 which I am contemplating scrapping and instead will just see where the stock is trading late October and then make up my mind.

I probably won't be buying any Nvidia or Microsoft unless they fall to BELOW their buying levels, similarly for Google and TSMC.

And I may buy some Roche given how much further cheaper it will become by late October.

As for funds, I would probably buy SMT at -13%. as it is a much better performer than PCT.

So that is roughly what I have in mind, to buy Intel, IBM, Facebook, Apple, AMD and SMT.And maybe pick up some Amazon at a more distant price i.e. at well below $3020. And if I bought all of these then my AI stocks position will be about half what it was when I sold i.e. I sold 80% and I would be buying back about 30%, whilst since having invested about 23% in to high risk stocks. So I will still have about 25% of my portfolio in cash.

HIGH RISK STOCKS - Invest and Forget!

Unlike the over valued AI stocks, most high risk stocks are still trading below or near their buying levels, and if I was not fully loaded on high risk stocks then I would buy more stocks trading at their buying levels today. Where I still consider CRSR to be dirt cheap, a coiled spring! And I may be tempted to take a nibble at Coinbase if it fell towards $220. I may also consider my first buy of WDC at around $50 (revised buying levels).

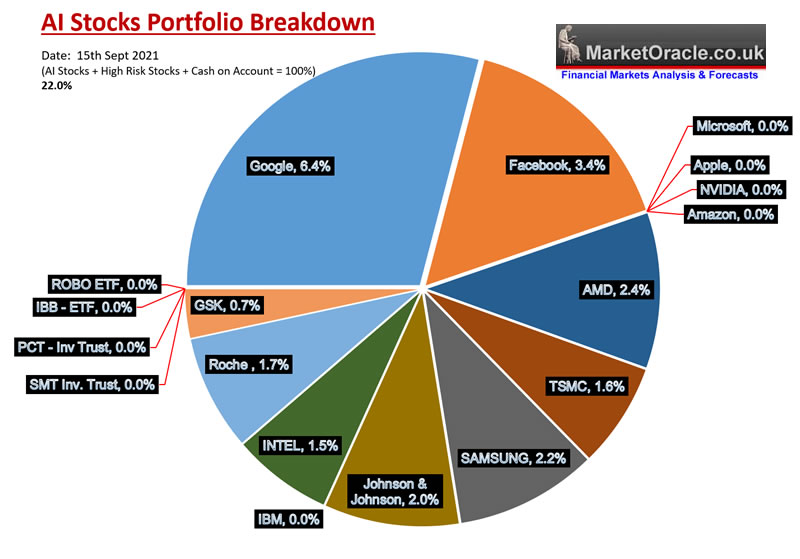

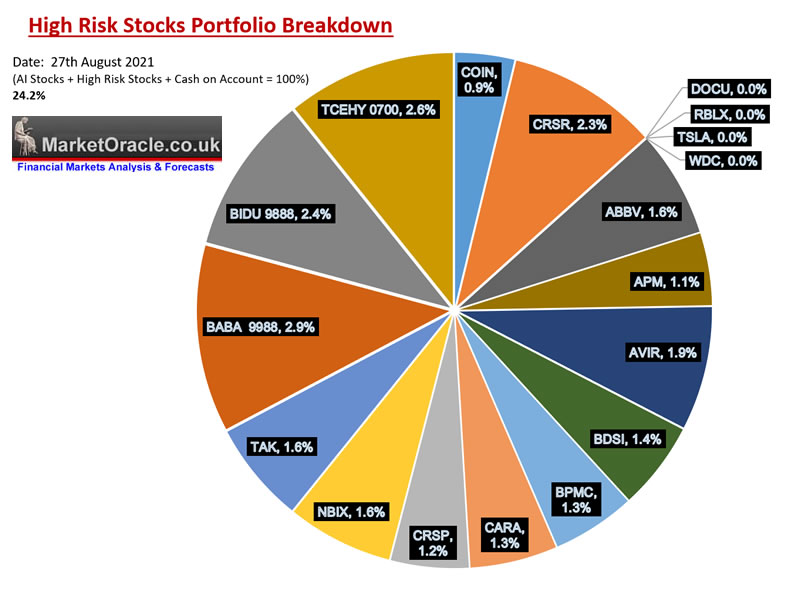

As for the Chinese tek giants, well the pie chart illustrates that I am fully loaded so no matter what their stock prices do next I won't be buying any more.

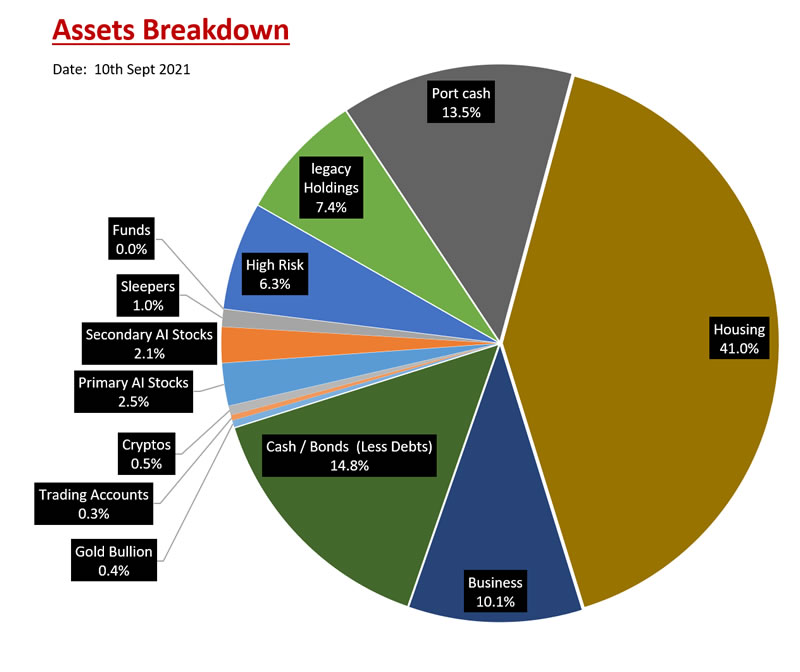

The following pie chart further breakdowns my portfolio which roughly shows that about 1/3rd of my assets are allocated to stocks of which about 60% is invested leaving 40% in cash (Port Cash 13.5%).

AI and High Risk Stocks Portfolio's KEY

Stock Name in bold maroon / red means I have a position in that stock, conversely a stock in black means I hold no position in that stock

Risk 1 to 10 - (High Risk stocks) 1 means basically I consider it a done deal, to just forget about the stock and light time do it's magic. Whilst 10 means this really is a high risk stock that could go bust, so definitely not a stock to get carried away with! With a spectrum of risk in between.

Buying Level - Below which where I would consider buying a stock, I buy most of the stocks at or very near their 1st Buy levels, and some additionally at their 2nd Buying Levels when achieved. Though actual action depends on where my portfolio stands, which is why I also state what I intend to do.

Market Cap - (High Risk) The smaller the market cap the easier it will be for the stock to multiply its valuation i.e. it is relatively easy for CRSR to X2 than for instance ABBV. Though market caps under $1 billion carry increasing risks of going bust.

Port % (AI +Hi Risk+C) - My holding in each stock as a percent of AI stocks + High Risk stocks + Cash on account. So basically my public portfolio. I do hold more that I call legacy stocks, that I have long since forgotten why I bought them decades ago, such as BHP, UU, BP, BAT, Bailie Gifford Japan and so on. Most of which I just let ride with limit orders to sell on a few such as BP.

Selling Level - An earnings derived level that I would consider selling holdings at or beyond due to over valuation, good until next earnings release.

E/C Ratio - A formulae encompassing 15 inputs such as Price to Book, Price to Sales, P/E etc to better determine what is cheap or expensive in relative terms.

P/E Ratio - Price divided by earnings, the indicator most investors are familiar with, though which at times can give a mis leading picture thus the EC Ratio..

Price valuation and Upwards Pressure - What the AI thinks about the future prospects for each stock updated at the time of each earnings report. Where the key metric is the Percent Upwards Pressure which indicates how strong the stock could be relative to others over the coming weeks and months. Whilst for sleepers indicates how good or bad of a buy the stock is relative to others. Most high risk stocks lack data to generate this output.

Price at Analysis - (High Risk) Where the stock was trading when I first added it to high risk stocks list which is a new construct as of July 2021.

1st Buy Trigger - (High Risk) When the stock first got triggered which is usually around the price where I would have first bought the stock using limit orders to at least squeeze the trading and forex fees.

End 2025? - (High Risk) My rough target for where the stock could trade to between now and the the end of 2025.

Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

Biden suffering from Alzheimer's hands Afghanistan to China on a plate, and I thought Trump was stupid! What is it with Americans electing the dumbest person in the room as their President?

For many years I have concluded that the US and it's allies will be able to contain the emerging Chinese Empire but by scoring own goals such as Afghanistan I have to wonder if this really could be the start of Game Over for the US Empire which would be very bad news as the chinese totalitarian state spreads its wings across Asia likely first to annex Taiwan and then slowly proceed to annex and colonise much of Asia at huge costs to native populations with the key prize in Chinese Empires Crown not Taiwan, or Afghanistan,.not even Japan, but AUSTRALIA! For the Chinese Empires No1 objective is to replace European influence with Chinese dominance and nothing reflects European influence more than the theft of a whole continent. It may sound far fetched today but that is likely Chinas' end game, to ultimately turn Australia into a string of Chinese provinces for which they will manufacture plenty of propaganda to call upon, after all Australia was itself stolen from the Aborigines.

The US imagines that the Taliban will become allied to the US administration following limited cooperation in advance of ejection of the US influence form Afghanistan, talk about being naive! Many if not most of the Taliban leadership have been through the CIA's torture programme at one time another via the hundreds of black sites situation across the world, from the Guantanamo torture chambers to those across eastern Europe, Africa and of course Afghanistan. They are NOT going to forget what the US actually is under the hood, the blunt truth is that ALL Empires are EVIL and it is a case of nations of the world trying to allie themselves with the least evil, evil empire/ We have seen what the the US is like, carpet bombing weddings and hundreds of black prisons, the Chinese Empire well be worse more along the lines of the Nazi's if given the opportunity to do so. At least Afghanistan has that advantage in that they have experienced the full force of Imperial occupation and thus may not let China have as much of a free reign as they have across many african nations, where Africa is literally being colonised through the back door.

The War on Terror was a disaster, it cost American's many of their civil liberties and has brutalised nations such as Iraq and Afghanistan where the net result is a couple of hundred of Al-Qeeda thugs had grown to movements encompassing many tens of thousands most notorious of which is ISIS where it's leaders are a direct product of US Iraqi Prison camps such as Abu Graib, US administrated terror universities.. Great job CIA morons! You have achieved the OPPOSITE of the propaganda that the CIA spews across the airwaves, CIA = Central Idiots Agency! If one tortures people than one is going to create many more determined enemies not friends!

Meanwhile here in 2021, the Biden administration hands Afghanistan to China to start stripping it bare of more than $1 trillion of rare earth metals for China's war machine. Well done idiot in the White House! What's Next? Vacate Pearl Harbour and let China take possession?

Unless I am missing something strategic, the US appears to be in retreat in asia, and it does not seem like Republicans or Democrat administrations make much difference.

China is the clear winner! Russia thinks they are a winner but they are too incompetent in economic terms to capitalise upon anything, and of course Russia is the previous empire that the Afghans killed off, so it's hardly likely their presence and influence will amount to much going forward as slowly China seeks to pull the strings in Afghanistan, perhaps one day doing to Afghanistan what they have done to every land that China has invaded and then sought to absorb into greater China and then enacting their own version of concentration camps final solutions just just as has been the case of every invaded and conquered land china will muster up an supposedly ancient map that will show that Afghanistan has always been part of China! That is the blue print of how neo nazi states behave, rewrite history as the outer Mongolians and Uighurs and countless others are experiencing today so will the Afghans and the rest of Asia experience tomorrow as the US retreats from Afghanistan and gives China the green light to start it's Imperial expansion.

I would not be surprised if Chinese planning played a large part in the Taliban's take over of Afghanistan and why the Taliban appear to be resisting the urge to do what they did some 25 years ago, when they effectively pressed the reset button as their Chinese masters require a functioning state with infrastructure intact to build upon.

Meanwhile expect China to escalate it's activities in the South China Sea and with regards Taiwan. I would not be surprised if the US retreat from Afghanistan emboldens China to attack Taiwan, perhaps a Chinese version of Desert Storm, a quick knock out punch before the US can mobilise forces in the the defence of Taiwan. And if China game plays this properly then they would also at least take out US air strips and ports in the region in the opening hours of a conflict so as to ensure a quick decisive outcome i.e. the bases in Okinawa.

Whilst the chinese masses are being brainwashed on a level that even Goebbels would be envious of for instance the masses have been convinced that the chinese virus was actually created by the US and realised as biological warfare against China. This from a nation that keeps over 1 million Uighurs in concentration camps as it enacts its own version of the final solution.

Be under no illusion the chinese empire is going to take advantage of US weakness and where I consider military action probably starting with Taiwan is now more probable in the not too distant future..

Meanwhile the Chairman of the Joint Chiefs of Staff General Mark Milley effectively admitted to committing treason during the last few months of the Trump Presidency as he went behind the Presidents backs to communicate US military intentions to his counter part in China, unless it's all BS for the book he is busy trying to pump in the media then this traitor should be put on trial to account for his actions.

UNITENDED CONSEQUENCES

The US surrender of Afghanistan sends a clear message to all US military partners and allies across the globe that when the chips are down the US could do a runner which has huge potential for unintended consequences. For instance the whole reason why the US can get away with rampant money printing without sending the dollar collapsing and interest rates soaring are the carefully cultivated military pacts that the US has such as that with Saudi Arabia that forms the cornerstone of the Petro dollar system. UNINTENDED CONSQUENCES of retreat from Afghanistan could mark the start of the end of the global US dollar reserve currency system of the past 50 years!

CHINA! CHINA! CHINA!

Most commentators are convinced that china is going to rule the roost, that we will all soon be living in the Chinese century as China's economy passes that of the US. However they all miss one crucial point about CHINA, in that it is TOTALITARIAN STATE! IT DOES NOT HAVE MECHANISMS TO CORRECT HUGE BLUNDERS THAT SUCH STATES WILL TEND TO MAKE FROM TIME TO TIME! As an example Saddam invading Kuwait. China WILL make huge blunders, and likely is already on the path towards making such blunders with it's artificial Islands in the South China sea which WILL GET NUKED!

Or it's intentions to sooner rather than later invade TAIWAN Saddam style which it will SUCCEED in doing so but as was with the case with Saddam it will mark the start of the end of the CCP and probably CHINA as defacto state as ultimately provinces that are NOT Chinese breakaway from the China, the likes of Outer Mongolia and most of the Western provinces, and Tibet no matter how hard the Chinese attempt to erase indigenous populations.

So sorry to burst ones chinese bubble, China is NOT going to rule the world, it may try to do so but ultimately it will fail for the fact that it is a totalitarian state so will make huge nation destroying blunders along the way probably such as invading AUSTRALIA. That's not to say Democracies don't also make huge Blunders for instance the US invasion of Iraq was the mother of all blunders based on a cocktail of lies. So yes in many respects the US has a tendency to deviate towards totalitarianism itself, as clearly the CIA tail at times tends to wag that dog into entering into huge blunders such as Iraq War that has damaged the US to great extent.

Ultimately China cannot win because it WILL make huge blunders, by virtue of everyone bowing to the dictator in charge, but in the meantime China can do huge damage to itself and much of Asia as it follows through on the Great Leaders latest crackpot master plan such as Hitler thinking it was a good idea to invade Russia.

The bottom line is not to take China at face value, it's economy, it's infrastructure, it's social cohesion, it's stock and housing markets all are built on the corrupt monstrosity that is the CCP. Look at the collapsing birth rate that the CCP has been hiding for more than a decade trying to mask it's huge catastrophic blunder in limiting births that has led to men far out numbering women, resulting in some 50 million left over men, as the one child policy favoured the live births of men over women. Which is one of the reasons why up until very recently I avoided investing in China, however now approx 1.2% of my wealth is exposed to China, and I am definitely not going to add any more to my 3 chinese stocks no matter how appealing valuations become and so a word of caution to others to not get carried away for there are bigger forces at work than price earning multiples to take notice of!

I fear the best time to invest in China was several years ago as we may be witnessing PEAK CHINA! As what will follow is going to be bloody on a scale we have not seen since World War 2! My expectations remain for a hot war with China around 2028.

For more on what's to come with regards China then do check out my earlier articles as we count down to the emerging empire militarily breaking out of it's borders 3rd reich style.

- 27 Dec 2016 - The Trump Reset - Regime Change, Russia the Over Hyped Fake News SuperPower (Part1)

- 28 Dec 2016 - US Empire's Coming Economic, Cyber and Military War With China (Part 2)

Evergrande China's Lehman's Moment

Meanwhile Financial Crisis 2.0 continues to unfold where China's giant property developer Evergrande is the canary in the coal mine, tip of the ice-berg, China's Lehman's moment that looks set to default on $300 billion of debts. Here's what the giant property developers stock price looks like.

I don't have the time to go deep into china's debt crisis right now, just that it illustrates the fraud that is China's corporate accounting, why one should NOT get carried away with investing in Chinese stocks as I often repeat and hopefully people are taking notice of! Look at the chart, all those poor fools who bought at presumably a 50% discount during the Summer months when many fools where touting the stock as 'cheap' have now all been wiped out! There is no coming back from a 92% loss!

The facts are this that they are a lot worse than that which is known hence we will only know the true magnitude of China's financial crisis / property crash with the benefit of hindsight so start by discounting the worst possible case which is a Lehman's style collapse as the chinese dominos start to fall.

Given China's immature society i.e. lack of accountability then this could be the trigger for much civil unrest across China as the facts become known that the China Clown Party's dictats were the trigger for the collapse.

Aukus Ruckus

Latest breaking news is of the US, UK and Australia launching a new military pact to counter China in Asia and the Pacific . It's primary purpose is to sell arms to Australia including nuclear powered submarines side stepping the EU including a very angry France who just got their order for $50bn of nuclear powered subs scrapped, and of course China is fuming.

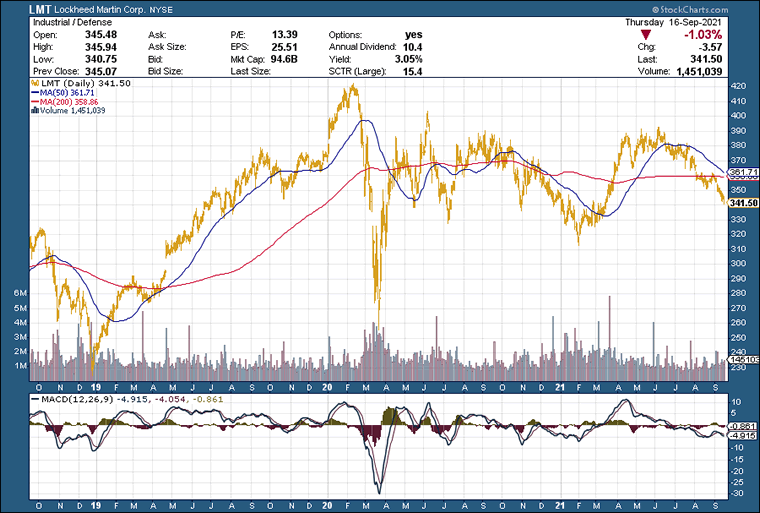

What does this means? To take an updated look at defence stocks for any opportunities.

A quick look at Lockeed Martin shows pretty good value for money, trading on a PE of 13, paying a 3% dividend and sub $100bn market cap. unfortunately I need to get this article posted so cannot continue digging deeper into LMT and other defence stocks right now, but maybe later I will take the time to update my list of War with China defence stocks. But on a quick glance LMT is apparently showing as a cheap stock i.e. it's 1st buying level would be at $330, so virtually there! 2nd at $280 which would translate into a PE of just 11.

The bottom line is that Trump or Biden, Republicans or Democrats, the War with China is a Mega-trend! Trump did his part, now Biden his doing his.

FREE TRADE the Best Stocks and Shares ISA?

There is a UK based fractional share ISA solution called FREE TRADE, that similar to Etorro offers a commission free fractional shares platform that has two crucial differences that makes it a far better INVESTING platform to Etorro's TRADING platform.

1. An ISA tax free wrapper at a cost of £3 per month along with their FREE general investing account (non ISA). Though there is a way to offset their monthly fees completely via their plus account by keeping £4k in cash on account that earns 3% / £120 per annum..

2. The platform charges a 0.45% F/X fee for when buying US stocks which acts to DISCOURAGE over trading, 0.45% may sound like a lot when compared against ETorro's zero FX costs. However it is a lot cheaper than AJ Bells 1% and II.co.uk's rip off 1.5% FX fee per TRADE, That's 3% to buy and sell! And those are before commissions of £10 and £8 are applied, but there are ways to diminish both costs especially of AJ Bell's by buying UK listings of US stocks..

So where I am concerned FREE TRADE's ISA hits the nail on the head. A platform with the advantages of Etorro in terms of fractional shares with no trading fee's whilst the 0.45% FX fee discourages over trading and thus acts to encourage investing by accumulating a long-term position.

FREE SHARE FROM FREETRADE

Free Trade have a promotion running where all those who open an account by following this referral link get 1 free share worth upto £200! However you must follow my link as just downloading the app from the app store won't work, you wont get a free share. In fact we both get 1 free random share worth upto £200.

Steps to Get a free Share

1. Click this link that takes you to he Free Trade Free Share web page

2. Follow instructions to download the Free Trade App

3. Deposit £1

4. Get your free share worth upto £200 within 7 to 10 days.

Free trade looks like a good shares ISA! Much better than the likes of ii.co.uk, as all of the monthly fees can be covered by keeping £4k deposited on account that earns 3% interest per annum.

How to "Really" Get Rich (Wealthy) Coming Soon EXCLUSIVE to Patrons

A good 6 months of thought and effort has gone into this analysis - How to get rich! NOT the get rich quick schemes / scams everyone is constantly exposed to but really, truly how to ACTUALLY get rich, straight to the point strategies, rules and mechanisms of what it takes to get rich. For it is possible for anyone to get rich! Look humans are hard wired to get rich! All people need is a road map of how to do so, after all we all like playing games for points, and keep playing as we count up the points on the leader boards, trying to better our best scores each time we play as our skill improves with experience, and that is basically what getting rich amounts, to playing the game to the best of our ability towards maximising our scores where the points in this case are measured in pounds, dollars and euros!

My analysis schedule includes:

- Silver Price Trend Forecast - 10% done

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- How to Get Rich! - 90% done.

- Gold Price Analysis - 10% Done

- US Dollar and British Pound analysis

Your analyst eyeing cheap defence stocks.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.