Inflation to the Moon - Gold Wears a Space Suit!

Commodities / Gold and Silver 2021 Nov 14, 2021 - 04:14 PM GMTBy: Arkadiusz_Sieron

Inflation rears its ugly head, surging at the fastest pace since 1990. The yellow metal has finally reacted as befits an inflation hedge: went up.

Inflation rears its ugly head, surging at the fastest pace since 1990. The yellow metal has finally reacted as befits an inflation hedge: went up.

Do you know what ambivalence is? It is a state of having two opposing feelings at the same time –this is exactly how I feel now. Why? Well, the latest BLS report on inflation shows that consumer inflation surged in October, which is something I hate because it lowers the purchasing power of money, deteriorating the financial situation of most people, especially the poorest and the least educated who don’t know how to protect against rising prices.

On the other hand, I feel satisfaction, as it turned out that I was right in claiming that high inflation would be more persistent than the pundits claimed. After the September report on inflation, I wrote: “I’m afraid that consumer inflation could increase even further in the near future”. Sieron vs. Powell: 1:0!

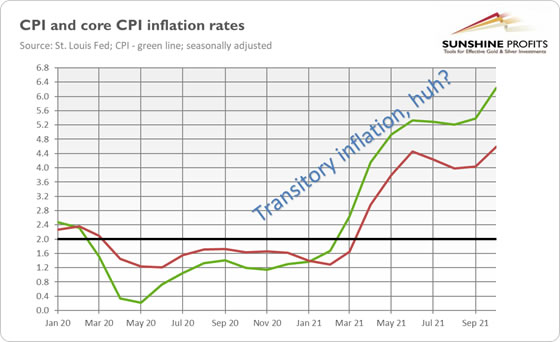

Indeed, the CPI rose 0.9% last month after rising 0.4% in September. The core CPI, which excludes food and energy prices, accelerated to 0.6% in October from 0.1% in the preceding month. And, as the chart below shows, the overall CPI annual rate accelerated from 5.4% in September to 6.2% in October, while the core CPI annual rate jumped from 4% to 4.6%. This surge (and a new peak) is a final blow to the Fed’s fairy tale about transitory inflation.

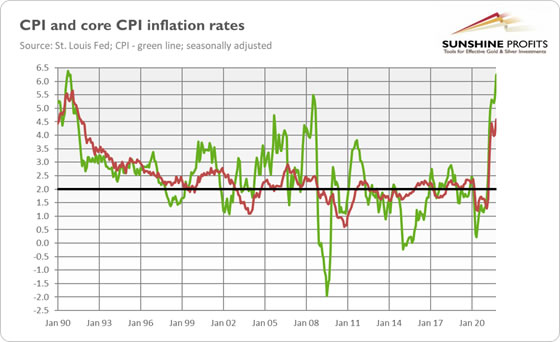

As one can see in the chart above, the CPI rate has stayed above the Fed’s target since March 2021, and it won’t decline to 2% anytime soon. This contradicts all definitions of transitoriness I know. What’s more, the October surge in inflation was not only above the expectations – it was also the biggest jump since November 1990, as the chart below shows.

Unfortunately for Americans, it might not be the last word of inflation. This is because over 80% of CPI subcomponents were above the Fed’s target of 2%, which clearly indicates that high inflation is not caused merely by the reopening of the economy but also by the broad-based factors such as the surge in the money supply.

Implications for Gold

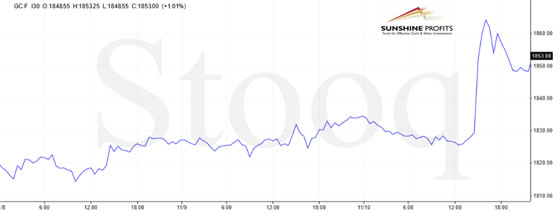

Ladies and gentlemen, gold finally reacted to surging inflation! As the chart below shows, the price of gold (Comex futures) spiked from below $1,830 to above $1,860 after the BLS report on CPI.

Why did gold finally notice inflation and react as a true inflation hedge? Well, it seems that the narrative changed. Until recently, investors believed the Fed that inflation would be transitory. Reality, however, has disproved this story.

Another factor I would like to mention is the FOMC’s recent announcement of tapering of its quantitative easing. That event removed some downward pressure from the gold market. By the way, this is something I also correctly predicted in the Fundamental Gold Report that commented on September inflation report: “it seems that until the Fed tapers its quantitative easing, gold will remain under downward pressure. Nonetheless, when it finally happens, better times may come for gold.”

Indeed, yesterday’s rally suggests that gold recalled its function as a hedge against inflation. Until today, I was cautious in announcing the breakout in the gold market, as the yellow metal jumped above $1,800 only recently. However, the fact that gold managed not only to stay above $1,800 but also to continue its march upward (in tandem with the US dollar!) suggests that there is bullish momentum right now.

Having said that, investors should remember about the threat of a more hawkish Fed. Higher inflation could support the monetary hawks within the FOMC and prompt the US central bank to raise interest rates sooner rather than later. The prospects of a tightening cycle could weigh on gold.

However, as long as investors focus stronger on inflation than on tightening of monetary policy, and as long as the real interest rates decrease, or at do not increase, gold can go up.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.