Shrinking US Crude Reserves Might Confirm the Trend Now!

Commodities / Crude Oil Oct 29, 2021 - 04:54 PM GMTBy: Submissions

Oil prices rose again on Tuesday, approaching multi-year highs amid concerns over steadily shrinking US crude reserves.

Fundamental Analysis

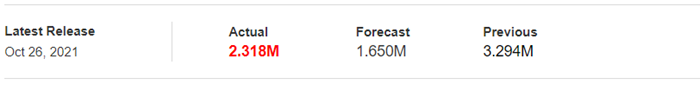

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via Investing

Regarding the API figures published Tuesday, the increase in crude inventories (with 2.318 million barrels versus 1.650 million barrels expected) implies weaker demand and is normally bearish for crude prices. However, we have a strongly bullish context, where the supply is still voluntarily – or not – narrowed by the OPEC+ and the global demand increases. What has to be synthesized from this report are the consecutively decreasing figures week-on-week, which are lifting prices higher.

Today, we have to see whether or not these figures will be confirmed by the weekly Energy Information Administration's (EIA) report… But there is very little doubt that they won’t be, given the current environment in which black gold is progressing.

Geopolitical Context

On the international scene, a meeting between Iran and the European Union is likely to happen fairly quickly since the Iranian deputy minister in charge of the nuclear issue, Ali Bagheri, will meet with an European negotiator Enrique Mora this week in Brussels to discuss a resumption of negotiations in Vienna. There is no need to specify that if the negotiations are successful, the easing of sanctions will lead to the return of a large-volume market of black gold, which is currently under embargo.

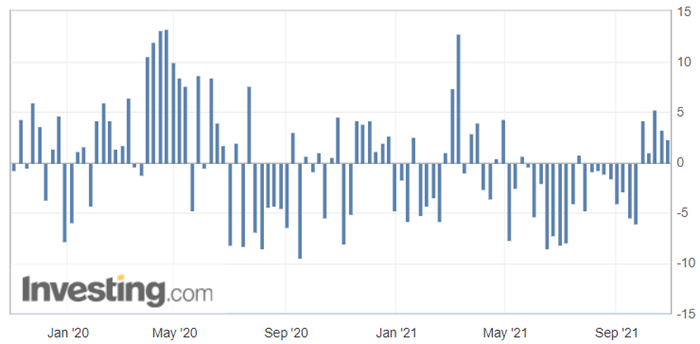

Chart

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

To sum up, we now have some context on how the oil market might develop in the forthcoming days, with some events and news to monitor, as they could have a moderated to strong impact on the ongoing lack of supply…

In our daily alerts, we also analyze other markets and assets (ETFs, Futures, MLPs, stocks, etc.) of the oil and gas sector in order to get some exposure to the energy industry. Regarding natural gas, yesterday we provided a new trade plan to our members, following the last trading position, which successfully hit all the projected targets.

Stay tuned to receive our next projections!

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.