Inflation Consequences for the Stock Market, FED Balance Sheet

Stock-Markets / Stock Market 2021 Oct 24, 2021 - 10:58 PM GMTBy: Nadeem_Walayat

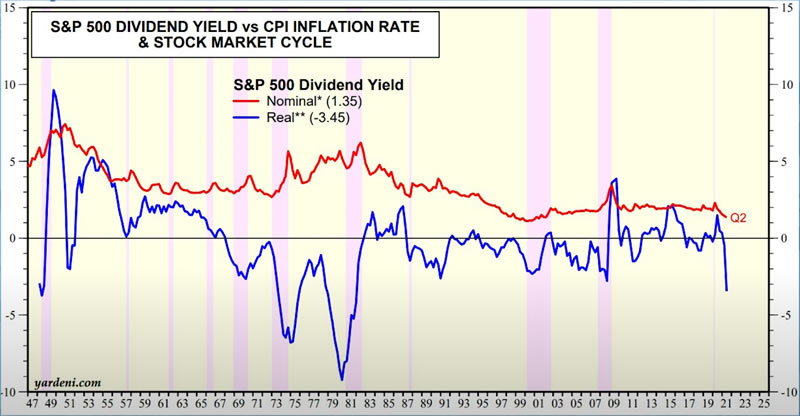

Here's another indicator to pile on top of a mountain of indicators that I have been covering over the past few months all flashing RED . The S&P real terms dividend yield is now LESS than at the dot com bubble peak! In fact one would need to go back to the depths of the early 1980s' inflationary depression to reach such poor returns.

Real terms dividend rate is another harbinger for lower stock prices or at least sustained stagnation. So whilst stocks do tend to be leveraged to inflation, however that is only if earnings and dividends are able to keep pace with inflation and as we have seen inflation is surging higher whilst dividend yields are not.

FED Balance Sheet

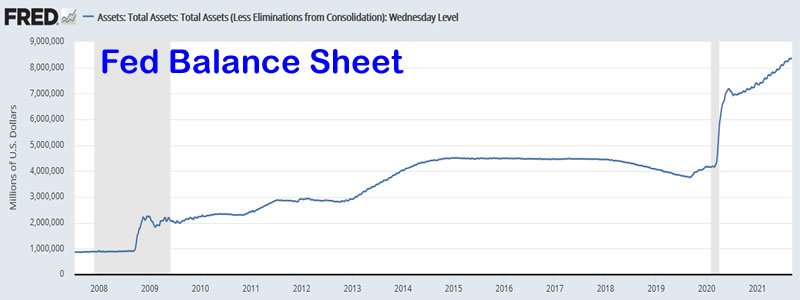

Not to forget the inflation mega-trend courtesy of rampant central bank money printing to monetize government debt coupled with the fake inflation indices where up until recently the Fed had succeeded in hoodwinking the masses that US inflation was just 1%. Instead at that time I warned it was more like 6%! Now it's more like 10%. Anyway the money printing binge now totals $8.4 trillion, up from $4 trillion at the start of 2020.

The bottom line is forget what the bond market is implying because interest rates are manipulated, instead the real impact of money printing 'should' be seen in a falling Dollar, though every central bank is printing money, so it's going to be a bumpy ride. In the meantime if you think there is deflation compare the price of the stuff that you really want against what they were selling for a year ago! That's if you can get what you as illustrated by the tech market which tends to be OUT OF STOCK of GPU's, CPUs, and MEMORY! A market that is seeing price hikes on a near DAILY basis to typically DOUBLE MSRP! Hence my message for the duration of 2020 to buy your big ticket items now before the price hikes materialise which are now materialising, for instance in the UK even the price of 2nd hand cars has gone up in price by typically 18% compared to a year ago! Maybe a good time to get rid of my Land Rover and buy a Tesla?

This article was an excerpt from my recent extensive analysis on the prospects for the stock market into Mid 2021 see - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent extensive analysis updating AI stocks buying levels as we head towards the window for a significant correction even a possible stock market crash.

Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

And my latest analysis Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

My analysis schedule includes:

- Silver Price Trend Analysis, AI Stocks Portfolio Update - Complete

- Warning Crypto Markets Are About to Explode Higher!

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your AI data preprocessing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.