Stock Market Wall of Worry Meets NFPs

Stock-Markets / Stock Market 2021 Oct 11, 2021 - 12:59 PM GMTBy: Monica_Kingsley

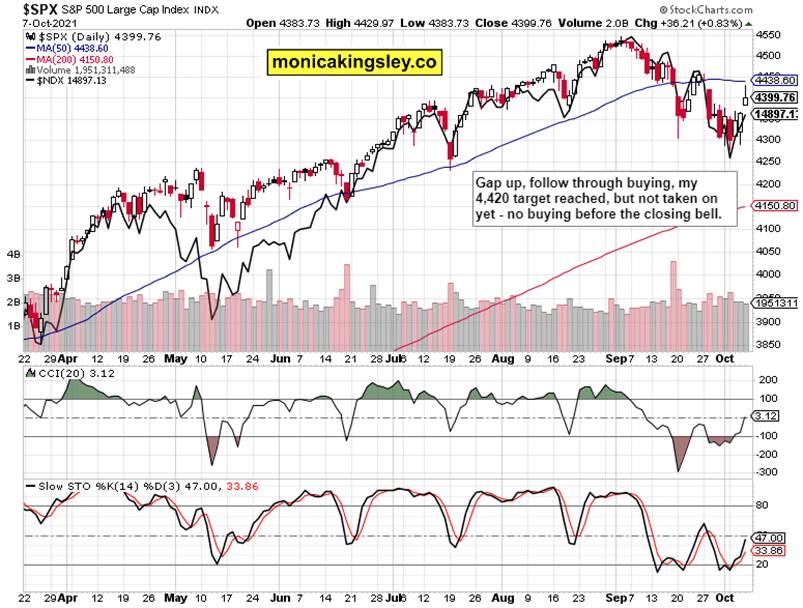

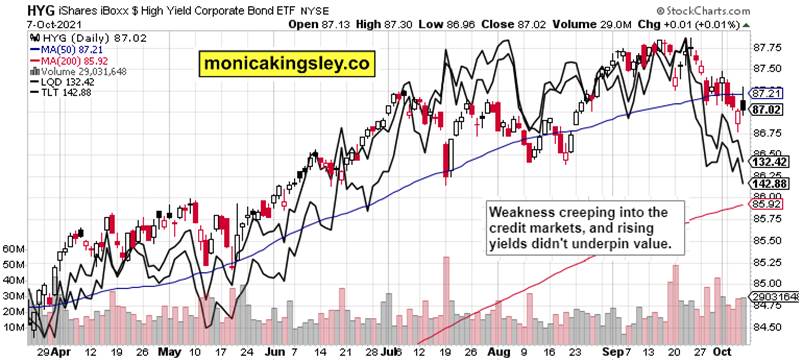

S&P 500 reached my target, and then folded like a cheap suit – into an overnight correction, without attempting to overcome 4,420. As much as the prior advance was broad based, so was the retreat. Tech, value, credit markets – but the decline wasn‘t sold into heavily, and that means the bulls can recover. Still, sizable long profits had been taken overnight automatically, as neither the buyers nor the sellers got anywhere.

The non-farm payrolls thesis goes like this – unless the figure is truly disappointing, the Fed would have to execute on the practically promised Nov taper announcement. Treasury yields aren‘t though buying it, and have ventured higher on their own already, just as inflation expectations did. The debt ceiling has turned into a drama that wasn‘t as the can was kicked down the road into early Dec. The dollar didn‘t react much to the wrangling, but the selling will soon revisit the world reserve currency that is taking its time.

Commodities aren‘t budging, and cryptos continue appreciating while precious metals see encouraging, yet intermittent signs of life that would be delivered through monetary stance reevaluation (that equals no taking the foot off the gas pedal). More follow through is needed in gold and silver, and the white metal should lead the upswing. Copper did confirm it on a daily basis yesterday, but the red metal remains still internally weak – unlike oil that didn‘t even properly pierce the $75 level.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 formed more of a consolidation than a true reversal candle – the volume wasn‘t there, but the bears can attempt to take on yesterday‘s gap.

Credit Markets

HYG signalled the retreat, and moved practically in a straight line lower after reaching the daily top. Closing at daily lows on significant volume isn‘t a bullish sign.

Gold, Silver and Miners

Gold and silver are directionless, but attempts to move to the downside, are being rejected, and miners keep improving. Much more needs to happen, and be confirmed by the turn in copper, too. Stagflationary data would be the catalyst.

Crude Oil

Crude oil downswing was immediately bought – the bulls aren‘t yielding yet, and energy remains the key commodity upswing driver. Whether the bulls keep most of the high ground and consolidate there, is the key question. My answer is that they likely will.

Copper

Copper continues oscillating in a narrowing range, and the volume is declining – it‘s slowly getting ready for a sizable move, which would help precious metals too.

Bitcoin and Ethereum

Bitcoin and Ethereum arte pushing higher after a daily pause, and the open profits are rising. Similarly to oil, the reprieve is being immediately bought – little wonder given the macro environment of stagflationary worries and Fed doubts.

Summary

Stocks are pausing, and have to broadly turn into risk-on mode so as to extend gains above 4,420. We aren‘t yet there, but the bulls will keep climbing the wall of worry once NFPs disappointment wears off. The most beneficial effect would be on real assets – in line with my latest tweet.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.