Stock Market Correction: One More Spark to Light the Fire?

Stock-Markets / Stock Market 2021 Oct 05, 2021 - 10:00 PM GMTBy: P_Radomski_CFA

With earnings season beginning in October, a profound correction of the S&P 500 could add fuel to the fire of the already well-supported U.S. dollar.

While the USD Index was largely flat on Sep. 30, the EUR/USD closed at a new 2021 low. And because the currency pair accounts for nearly 58% of the movement of the USD Index, its performance is material. Moreover, while I’ve been warning for months that the Fed and the ECB are worlds apart, the EUR/USD still hasn’t priced in the magnitude of the divergence.

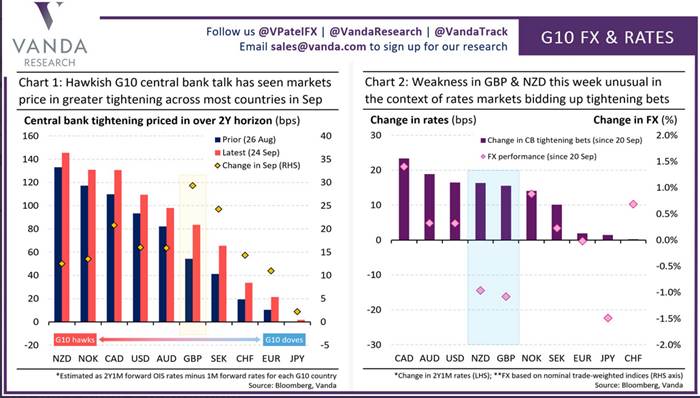

Please see below:

To explain, the chart on the right is where you should focus your attention: the purple bars above depict the change in investors’ hawkish central bank bets since Sep. 20, while the pink diamonds above depict the performance of various currencies during that same timeframe. If you analyze the column labeled “USD,” you can see that the Fed’s hawkish rhetoric has ramped up bets on further tightening. However, if you analyze the pink diamond near the bottom of the purple bar, you can see that the U.S. dollar’s performance hasn’t matched the fervor. Conversely, if you analyze the column labeled “EUR,” you can see that investors’ expectations of lower-for-longer Eurozone interest rates haven’t budged, and the euro has held up quite well. For context, the GBP (11.9% of the USD Index’s movement) and the CAD (9.1% of the USD Index’s movement) have largely offset one another. With the former not pricing in any of investors’ hawkish bets and the latter pricing in nearly all of investors’ hawkish bets, the divergence is largely a wash. However, with the U.S. dollar still underpriced and few upside catalysts available for the euro, more EUR/USD downside should commence over the medium term.

Supporting that argument, Jeremy Stretch, Head of G10 FX Strategy at CIBC Capital Markets, told clients that “the ECB is intent upon maintaining favorable financing conditions to perpetuate the recovery narrative. As a consequence, we expect the central bank to consider PEPP transitioning into the Asset Purchase Programme [APP].” And with that, “slower growth into 2023 will help limit medium-term price gains. Although headline HICP risks testing 13-year highs, the ECB’s adjusted inflation remit will allow the bank to look through short-term price spikes, especially as core prices are expected to remain relatively well-contained. Alongside fiscal policy developments, that will promote a lower-for-longer trajectory for interest rates, and as a result, a weaker EUR in 2022.”

And advocating for just that, ECB Governing Council Member Mario Centeno told CNBC on Sep. 27 that “we were fooled by some news on inflation in the past, which prompted us to act in the wrong way, so we don’t want, definitely, to commit the same sort of errors this time.... We need to guarantee favorable financing conditions to all sectors in our economy as we go out of [the] crisis, and we are not yet there, we are not yet out of the woods.”

And how does all of this impact Centeno’s taper timeline?

Source: CNBC

In addition, while the ECB’s PEPP program should conclude at the end of March 2022, its APP program isn’t going anywhere. And when the central bank announced its PEPP “recalibration” on Sep. 9, I warned that the ECB’s liquidity spigot should remain on full blast much longer than the Fed’s.

I wrote:

While the deceleration may seem like a monumental shift, the move is much more semblance than substance: net APP purchases will still be reinvested “for an extended period of time past the date when [the ECB] starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favorable liquidity conditions and an ample degree of monetary accommodation.”

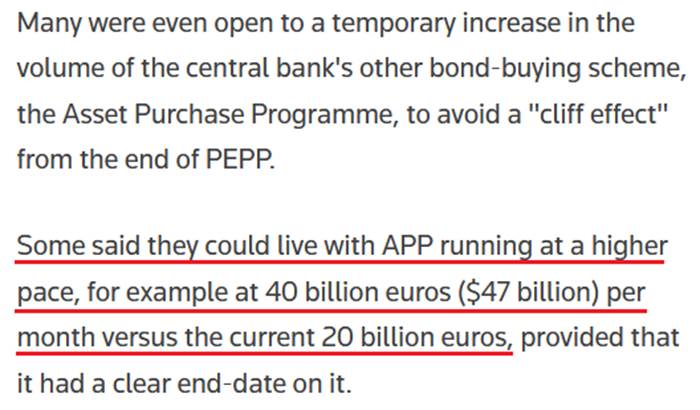

Likewise, with many ECB officials aiming to avoid a “cliff effect” when the PEPP program unwinds, Reuters reported that the central bank could expand its APP program to offset the damage. The bottom line? Tapering in Europe is nothing like tapering in the U.S.

Please see below:

Source: Reuters

Reverse Repos Strike Again

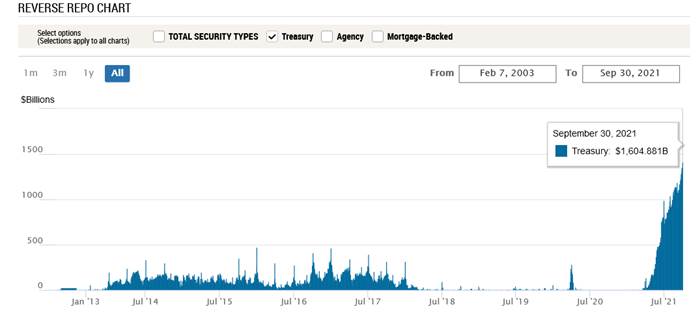

Also supporting a stronger U.S. dollar, the Fed’s waterfall of QE is running out of reservoirs. And after 92 counterparties drained nearly $1.605 trillion out of the U.S. financial system on Sep. 30, the Fed’s daily reverse repurchase agreements hit another all-time high.

Please see below:

Source: New York Fed

To explain, a reverse repurchase agreement (repo) occurs when an institution offloads cash to the Fed in exchange for a Treasury security (on an overnight or short-term basis). And with U.S. financial institutions currently flooded with excess liquidity, they’re shipping cash to the Fed at an alarming rate. And while I’ve been warning for months that the activity is the fundamental equivalent of a taper – due to the lower supply of U.S. dollars (which is bullish for the USD Index) – as we await a formal announcement from the Fed, the U.S. dollar’s fundamental foundation remains robust.

Furthermore, with the Fed’s daily reverse repos averaging $642 billion in June, $848 billion in July, $1.053 trillion in August, and $1.211 trillion in September, the accelerated liquidity drain further supports a stronger U.S. dollar.

Stock Market On Its Last Legs?

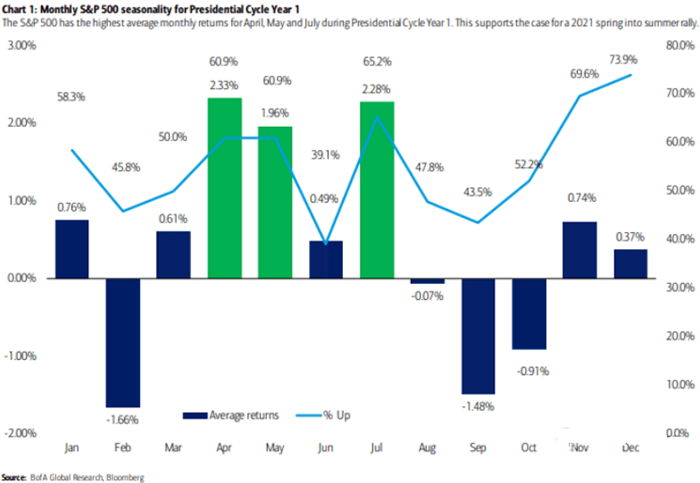

What’s more, with the safe-haven bid also an important piece of the USD Index’s puzzle, the stock market’s recent struggles still haven’t manifested into a full-blown correction. However, with seasonal factors signaling more weakness ahead, a profound drawdown of the S&P 500 could accelerate the pace of the USD Index’s uprising.

Please see below:

To explain, the blue and green bars above track the average monthly performance of the S&P 500 after a new U.S. President takes office. If you analyze the columns labeled “Sep” and “Oct,” you can see that the end of summer often elicits the worst monthly performances. And while the S&P 500 capped off September with a 1.19% decline, the weakness should continue in October.

As evidence, Bed Bath & Beyond’s stock plunged by more than 22% on Sep. 30. And with supply chain disruptions and weak demand clashing with U.S. policy uncertainty, optimism is on shaky ground. For example, the retailer’s second-quarter adjusted EPS came in at $0.04 vs. $0.52 expected, while revenue came in at $1.99 billion vs. $2.06 billion expected. Moreover, the company slashed its third-quarter adjusted EPS guidance to between flat and $0.05, with revenue ranging from $1.96 billion to $2 billion. Analysts were expecting figures of $0.28 and $2.02 billion respectively.

And while I’ve highlighted the issue on several occasions, CFO Gustavo Arnal lamented the fervor of surging freight costs. He said during the company’s Q2 earnings call:

“What we're seeing now in the second quarter is, look, significant freight cost increases well above what we had anticipated. We had anticipated 240 basis points. We got 360 basis points. We're still projecting some sequential increase in freight costs as we go from Q2 to Q3.”

Furthermore, CEO Mark Tritton said that the Delta variant has also “created a challenging and volatile environment:”

“In August, the final and largest sales month of Q2, traffic unexpectedly slowed, and, therefore, sales did not materialize as we had anticipated. External disruptive forces such as the resurgence of COVID-19 cases and growing Delta fears created a challenging and volatile environment. This is particularly evident in large southern states, such as Florida and Texas, as well as California, which, in aggregate, represent approximately 30% of our total sales. From July to August, traffic trends evolved in this state and worsened by double-digit percentages.”

As a result:

“As the quarter progressed, particularly in August, conditions worsened relative to our thoughtful preparations. The speed of industry inflation and lead time pressures outpaced our plans to offset these headwinds, and as a result, we did not pivot fast enough, especially on price and margin recovery.”

The bottom line? With the U.S. dollar already supported by a strong technical and fundamental foundation, a profound correction of the S&P 500 could be the next spark that lights the bullish fire. And with earnings season beginning in early/mid-October, more disappointments like what we witnessed with Bed Bath & Beyond could encourage the next correction. More importantly, though, given the PMs’ strong negative correlations with the U.S. dollar, a sharp move higher in the greenback could coincide with a sharp move lower in the PMs.

In conclusion, the PMs rallied on Sep. 30, but the bearish thesis remains unchanged: the USD Index is poised for an upward re-rating and U.S. Treasury yields still have the medium-term wind at their backs. Moreover, with the general stock market showing signs of stress, a real bout of panic could also uplift the USD Index and upend the PMs. As a result, lower precious metals prices should materialize over the next few months.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.