NASDAQ Stock Market Head-n-Shoulders Warns Of Market Weakness – Critical Topping Pattern

Stock-Markets / Tech Stocks Oct 04, 2021 - 10:03 PM GMTBy: Chris_Vermeulen

The unique technical setup in the NASDAQ over the past 30+ days is warning that the markets have lost momentum and may attempt to break below the $14,700, the Neck Line of the Head-n-Shoulders pattern. This unique price setup crept up over the past 20+ days as the US markets started to move away from upward price momentum as the Chinese and US market dynamics started to shift away from the continued reflation trade expectations. What does this Head-n-Shoulders pattern mean for traders and investors right now?

Head-n-Shoulders, or Three Mountains – A Critical Topping Pattern

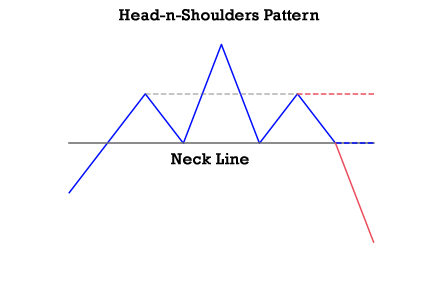

A Head-n-Shoulders pattern is similar to a Three Mountains Top pattern. It suggests a shift in momentum is taking place and the Neck Line, which is the support level between the left and right Shoulders, is critical in understanding how this pattern will likely play out in the future. The Head-n-Shoulders example, below, shows an idealistic pattern setup as well as the Neck Line that represents the critical support level for a price within this extended price pattern.

On real price charts, the importance of this pattern plays out around the Neck Line and the Left and Right Shoulder levels. The Neck Line represents the critical support level for the price. The Left and Right Shoulder levels represent critical resistance. If the Head-n-Shoulders pattern fails to prompt a breakdown below the Neck Line, then the price will rally above the Left and Right Shoulder levels and break the critical resistance level as it attempts to rally to, and eventually above, the Head peak. If the Head-n-Shoulders confirms a peak or top in the market, after the Right Shoulder has formed, the price will begin to weaken and attempt to test the Neck Line level. If this critical support level is breached, the price has confirmed a downward trend/momentum has taken control.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

The one reason I mention the Three Mountains pattern, which is a Japanese Candlestick pattern, is because of the psychological aspect rooted in all Japanese Candlestick theory and patterns – the battle between the buyers and sellers (or Bulls and Bears). The Three Mountains pattern is very similar to the Head-n-Shoulders pattern in structure and interpretation. Just as I described above, when the Neck Line is breached, Sellers (or Bears) have taken control of price action and confirmation of this breakdown would be seen as another new candlestick with a lower close, lower high, and lower low in price.

NASDAQ Head-n-Shoulders Pattern Testing $14,700 Support

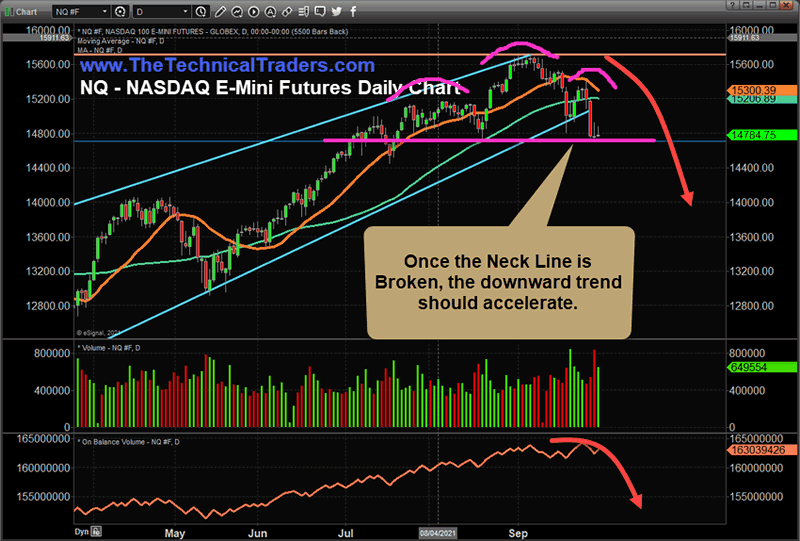

The Right Shoulder of this Head-n-Shoulders pattern formed over the past 15+ days and confirmed the Neck Line just recently. The $14,700 level, highlighted by the MAGENTA horizontal line, clearly shows the recent double bottom on the NASDAQ chart which represents the Neck Line.

Given how quickly the markets have shifted away from stronger bullish price trending and into this sideways price rotation, it is prudent to discuss the potential that a breakdown below $14,700 may happen and that price may attempt to move downward – trying to find new support.

If the NASDAQ is able to hold above the $14,700 over the next few days/weeks, then we would watch the $15,350 level as the shoulder resistance level. Once the price breaks above this level and confirms, we would expect a bigger price rally to start.

Traders Shift Expectations As Fear & Uncertainty Unsettle Trends

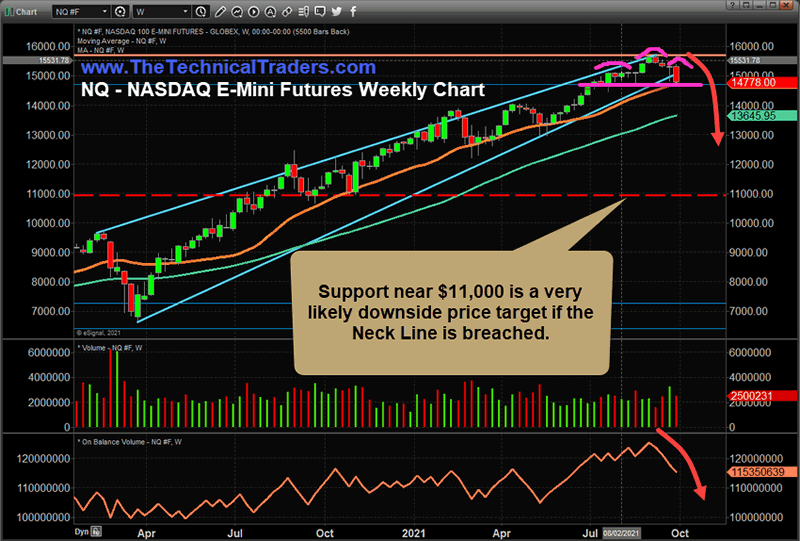

Even though we still believe the markets are within a moderately strong bullish price trend and we have yet to see any real confirmation of a downward price trend, we also have to acknowledge the Head-n-Shoulders setup on the NASDAQ that may prompt a moderate downside price correction. The reality of the global market environment has changed dramatically over the past 25+ days. Worries about a continued Chinese credit/debt collapse have taken center stage while the US deals with its own unique set of issues. This extreme level of uncertainty in the markets can, and often does, promptly extended volatility and moderate market corrections.

For example, the COVID-19 market collapse happened because of the uncertainty, and certainty, that was related to the sudden onset of the COVID virus. The late 2018 market correction took place because traders/investors believe the US Federal Reserve had pushed the Fed Funds Rate too high – which changed expectations related to market dynamics. All it takes, in reality, is for traders and investors to become “spooked” for a -15% to -20% correction to unload on the markets.

Either way, if the markets settle and begin another rally phase, or if the markets break down below the Neck Line, this type of price pattern sets up incredible opportunities for traders. A breakdown in price would represent a broader market reversion event that will find support, eventually, and set up another recovery rally phase. This process allows traders to pull capital away from risks and reinvest capital when the market dynamics are suitable for a new Bullish price rally. Of course, traders can attempt to capitalize on the breakdown price move as well with Options, Shorts, or Inverted ETFs. If the markets hold above the $14,700 level and begin another rally phase, then traders should expect another +7% to +12% rally in the markets – pushing the US stock market to new all-time highs again.

Instead of looking at this pattern in price as a concerning warning of a potential top, think of it as an opportunity for you to profit from price rotation if it happens. Traders want moderate volatility in the markets because it allows us to identify and profit from bigger trends. Now is the time to prepare for the huge opportunities the markets will present throughout the end of 2021 and into 2022.

Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

As something entirely new, check out my initiative URLYstart to learn more about the youth entrepreneurship program I am developing. This is an online program of gamified entrepreneurship designed to introduce and inspire youth to start their own businesses. Click-by-click, each student will be guided from their initial idea, through the startup process all the way to their first sale and beyond. Along the way, our students will learn life lessons such as communication, perseverance, goal setting, teamwork, and more. My team and I are passionate about this project and want to reach as many people as possible!

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.