Stock Market Wishing Away Inflation

Stock-Markets / Financial Markets 2021 Sep 29, 2021 - 04:53 PM GMTBy: Monica_Kingsley

S&P 500 bears did indeed move, and the dip wasn‘t much bought. VIX with its prominent upper knot may not have said the last word yet, but a brief consolidation of the key volatility metrics is favored next. Even the overnight rebound (dead cat bounce, better said), is losing traction, prompting me to issue a stock market update to subscribers hours ago – fresh short profits can keep growing:

(…) Following yesterday’s slide, the S&P 500 upswing appears running into headwinds as credit markets keep putting pressure on the Fed. Rising dollar is thus far having little effect on commodities, and precious metals have retraced a sizable part of the intraday downswing. Tech remains more vulnerable than value, and this correction appears as not (at all) yet over.

While the dollar upswing hasn‘t been strongest over the prior week, higher yields are causing it to rise somewhat still. The commodity complex is remarkably resilient – the open long positions are likely to keep doing well – and I don‘t mean only energies. Copper is holding up in the mid 4.20s while precious metals are giving the bears a break – a tentative one, but nonetheless encouraging – as I have written yesterday:

(…) the metals would stop reacting to the bad news while ignoring negative real rates (yes, transitory inflation is another myth the market place believes in) at some point. All roads lead to gold – inflationary and deflationary ones alike.

What can the Fed do? Underestimate inflation, be behind the curve, carefully play expectations while real world inflation coupled with shattered supply chains wreck the stock market bull over the quarters ahead? Or throughtfully slam on the brakes (which is what the markets think it‘s doing now), which would force a long overdue S&P 500 correction that could reach even 10-15% from the ATHs? Remember that the debt ceiling hasn‘t been resolved yet, so an interesting entry to the month of October awaits.

Bonds are signalling that the Fed‘s image of inflation fighter (right or wrong, have your pick) is losing the benefit of the doubt it was given with the Jun FOMC – bond yields have abruptly ended their descent and subsequent trading range. This spells not only inflation (the risk of Fed‘s policy mistake – warnings it would take longer with us than originally anticipated coupled with the professed faith it would just naturally subside all by itself), but smacks of stagflation.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

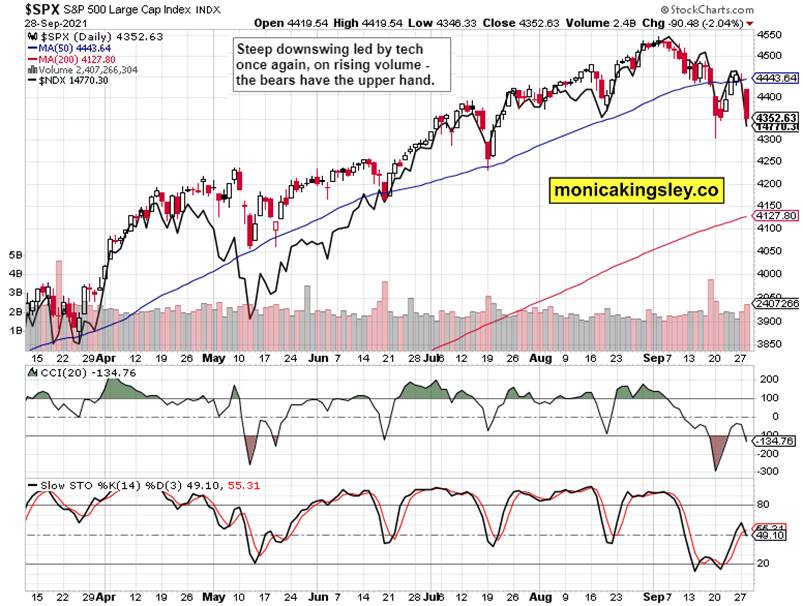

S&P 500 and Nasdaq Outlook

Rising volume and some lower knot hint at the possibility of overnight rebound, but the real question is whether that would stick. So far, it doesn‘t seem so.

Credit Markets

Credit markets haven‘t moderated their pace of decline, but TLT attempted to find bottom intraday, which would coincide with tech temporarily pausing as well. The dust hasn‘t yet settled.

Gold, Silver and Miners

Gold is having harder and harder time declining, and the miners pause makes yesterday‘s modest downswing suspect. When silver joins in showing some relative strength, we would know the focus is shifting to inflation again, in precious metals as much as in Treasuries – this hasn‘t happened thus far.

Crude Oil

Crude oil finally paused, and its candlestick favors consolidation – oil stocks have remained well performing, pointing out still more upside in the current black gold upleg.

Copper

Copper hesitation goes on, with the red metal once again trading at odds with the CRB Index, which makes further downside rather limited.

Bitcoin and Ethereum

Bitcoin and Ethereum bears haven‘t confirmed the initiative with a break below $40K in BTC (sorry for yesterday‘s typo stating $44K – corrected on my site). It‘s too early to declare the end of the trading range – similarly to gold, cryptos have a hard time falling, and that means something.

Summary

Stocks aren‘t out of the woods yet, and monetary policy has turned into a headwind. Damned if you do, damned if you don‘t – the Fed is having a hard time walking the fine taper line. Rising Treasury yields are a warning sign – commodities are likely to remain the most resilient, and precious metals would join just like cryptos. The question marks over the debt ceiling, the timing and actual pace of taper, keep persisting.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.