Stock Market FOMO Hits September Brick Wall - Evergrande China's Lehman's Moment

Stock-Markets / Stock Market 2021 Sep 22, 2021 - 03:42 PM GMTBy: Nadeem_Walayat

Dear Reader

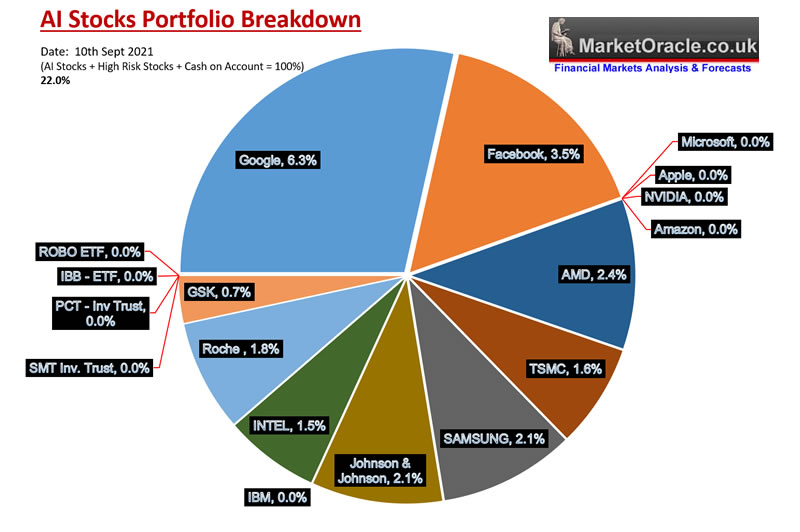

My last analysis posted on the 1st of September proved to be a timely reminder that an historically overbought stock market on virtually every measure was entering into the seasonally worst trading month of the year that at the very least suggests to prepare for a significant correction with each passing day and there was even a possibility of market panic event, a CRASH for which there are countless indicators that I have been covering since Mid June such as what is taking place in the Reverse Repo market of a defacto brewing Financial Crisis 2.0, the magnitude of which we will only realise with the benefit of hindsight, hence why I sold out of 80% of my Top AI stocks during the summer months with the last being to exit IBM leaving my AI stocks portfolio in it's current state, devoid for the first time in many years of the likes of Microsoft Apple, Nvidia and Amazon, with holdings of Google and Facebook greatly reduced.

Though at the time and since I have iterated my intentions to buy back some of the less over valued stocks during the second half of October as the probable conclusion of a market correction, which remains my objective regardless of whether the correction materialises or not that this analysis seeks to clarify the magnitude of as the stock market tumbles from near it's all time high the deeper we move into September with my primary focus being on mapping out a trend into the end of this year, that is now accompanied by a secondary projection deep into 2022.

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

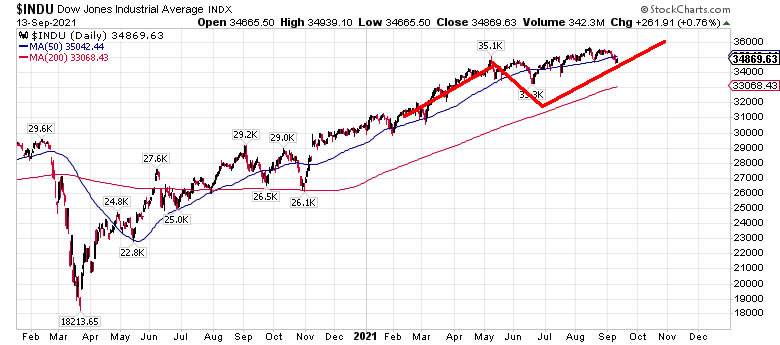

Stock Market Forecast 2021 Review - Firstly a review of my forecast for 2021 as of the 9th of Feb.

9th Feb 2021 - Dow Stock Market Trend Forecast 2021

Dow Stock Market 2021 Outlook Forecast Conclusion

Therefore my forecast conclusion is for the Dow to target a trend to between 34,500 and 35,000 by the end of 2021 for a gain of 13.5% to 15.2% on the year that should be punctuated by at least one significant correction starting early May 2021.

The updated graph shows that whilst the stock market did begin a correction early May and continued into Mid June, however in terms of price was nowhere to the expected extent and thus was one of the primary reasons why I took it as an opportunity to SELL into the highs. So whilst we are likely to get another run higher into the end of the year, that run higher should be coming off a significant correction during Sept / Oct.

Stock Market AI mega-trend Big Picture

Just pause for a moment and take in the chart below, the message one should be receiving loud and clear is that I expect this bull market to run for many more years, whilst my best guess a year ago was that it would top in early 2027, as long as run away valuations moderate during 2022 then I don't see why this should still not remain as the big picture, thus the bull market could extend to 18 years from it's March 2009 low!

12th June 2020 - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

Therefore the following graph illustrates my road map forecast conclusion of how I expect the AI mega-trend to play out over the next 15 years and why I will continue the mantra of buy the dips and panics all the way towards liquidating holdings during the next mania peak when valuations go out the window and when I will likely heavily short these same stocks all the way down towards the buying opportunity of the 2030's.

I continue to see an inevitable War with China being the primary driver for turning a Quantum AI stocks bubble mania crash into a true multi year bear market. So I will be including the current state of that key megatrend and in part it has me regretting my recent purchases of chinese stocks, not because I don't think they will be profitable but that making such investments is in part financing the CCP, which is a bit like investing in the third reich during 1931, profitable to do yes, but......

For more on the War with China Mega-trend see my in-depth analysis that mapped out the trend trajectory for the next 10 years-

- 27 Dec 2016 - The Trump Reset - Regime Change, Russia the Over Hyped Fake News SuperPower (Part1)

- 28 Dec 2016 - US Empire's Coming Economic, Cyber and Military War With China (Part 2)

Thus my primary strategy remains to buy deviations form the high in good / fairly valued AI stocks i.e. presently most stocks are running well ahead of schedule in terms of the mega-trend for on average X6 by early 2027. For instance Google at it's current mania pace will X26 by early 2027 and trade on a market cap of $50 trillion dollars! There's going to be a significant pause in this bull market sooner rather or later to check this runaway train else it will end in a train wreck.

Evergrande China's Lehman's Moment

Meanwhile Financial Crisis 2.0 continues to unfold where China's giant property developer Evergrande is the canary in the coal mine, tip of the ice-berg, China's Lehman's moment that looks set to default on $300 billion of debts. Here's what the giant property developers stock price looks like.

I don't have the time to go deep into china's debt crisis right now, just that it illustrates the fraud that is China's corporate accounting, why one should NOT get carried away with investing in Chinese stocks as I often repeat and hopefully people are taking notice of! Look at the chart, all those poor fools who bought at presumably a 50% discount during the Summer months when many fools where touting the stock as 'cheap' have now all been wiped out! There is no coming back from a 92% loss!

The facts are this that they are a lot worse than that which is known hence we will only know the true magnitude of China's financial crisis / property crash with the benefit of hindsight so start by discounting the worst possible case which is a Lehman's style collapse as the chinese dominos start to fall.

Given China's immature society i.e. lack of accountability then this could be the trigger for much civil unrest across China as the facts become known that the China Clown Party's dictats were the trigger for the collapse.

And here's a video version I posted on this topic -

This article is an excerpt from my most recent extensive analysis that maps out the stock markets trend into Mid 2022 which was first made available to Patrons who support my work - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent extensive analysis updating AI stocks buying levels as we head towards the window for a significant correction even a possible stock market crash.

Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

My analysis schedule includes:

- Silver Price Trend Analysis, AI Stocks Portfolio Update - 30% Done

- China House Prices CRASH! War with China Mega-trend Defence Stocks

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Your de-risked along the highs analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.