Stock Market Time to Buy the Dip?

Stock-Markets / Stock Market 2021 Sep 22, 2021 - 02:23 PM GMTBy: Monica_Kingsley

S&P 500 dived, yet the slide was bought before the closing bell. Does the long lower knot mean the selling is over? It‘s too early to say as following similar momentuous days, it takes 1-3 days for the dust to clear usually. The selling pressure might not be over, and the question is how far will it reach on a fresh attempt – 4,350s look attainable.

There, the fate of this correction would be decided, but we‘re on the verge of the historically more volatile part of Sep, and tomorrow‘s FOMC would up the ante. The dollar though was unable to rally, to keep intraday gains – on one hand a certain show of strength given the retreat in Treasury yields, on the other hand, proof of stiff headwinds as the world reserve currency isn‘t in a bull market. I‘m leaning towards the latter explanation.

As stocks rebound in what may still turn out to be a dead cat bounce, commodities got clobbered too – just as cryptos did. Gold attracted safe haven demand as money flew to Treasuries as well. Miners with silver holding ground, are a good sign for the sector – the overwhelmingly negative sentiment looks getting long in the tooth.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

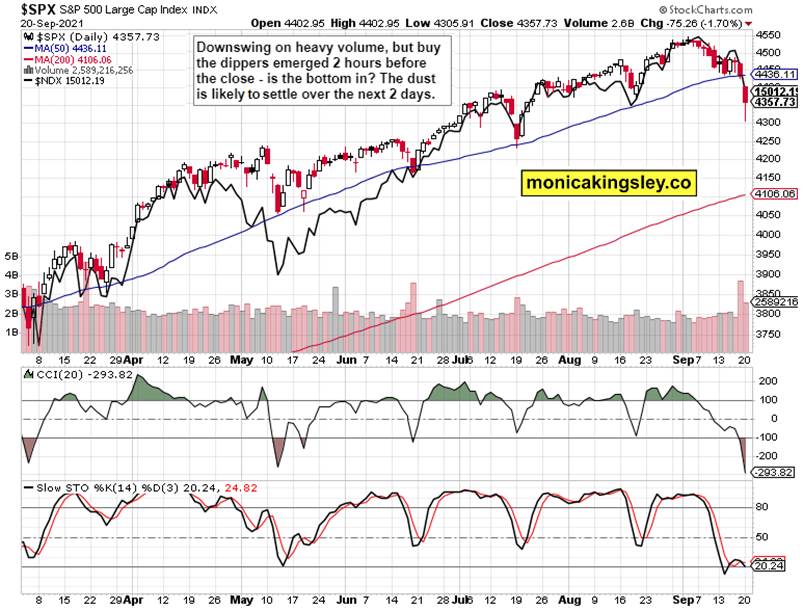

S&P 500 and Nasdaq Outlook

Half full body, half lower knot – such are the trickiest of candles. The fate of the downswing is being decided, and the bears need to break below 4,350s to regain initiative. I wouldn‘t be surprised to see stocks diverge from credit markets as buy the dip mentality hasn‘t spoken its last word.

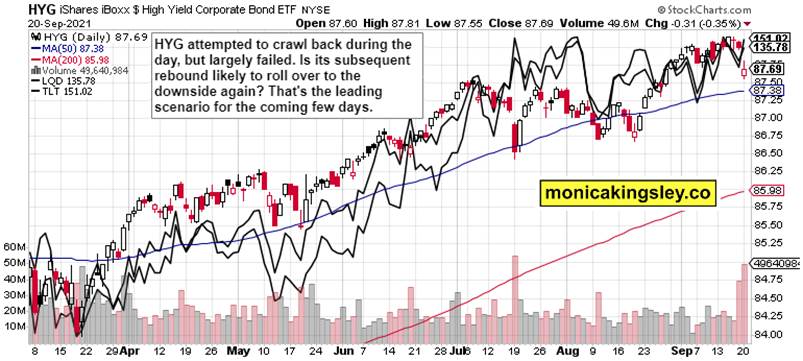

Credit Markets

High yield corporate bonds haven‘t made a strong enough comeback – their behavior through Wednesday, is of key importance now.

Gold, Silver and Miners

Gold has a chance to prove its local bottom is in, even if miners aren‘t yet confirming. Should the rebound in stocks hold, silver alongside commodities stands to benefit the most.

Crude Oil

Oil stocks and oil dived in sympathy, but black gold looks quite resilient to wild price swings. The bounce appears to have paused for the day.

Copper

Copper doesn‘t look as stabilized as oil does at the moment – prices haven‘t yet meaningfully decelerated, and the buying power isn‘t convincing.

Bitcoin and Ethereum

Bitcoin and Ethereum are joining the selloff, and the golden cross is in danger of being invalidated fast. Breaking below the early Aug lows would mean a fresh downleg is here. Let‘s see first the degree of liquidity returning to cryptos.

Summary

Is the selling over, is it not? Still inconclusive, but time for the bears is running short. The selling doesn‘t appear to be over, but I‘m not calling for a break of yesterday‘s lows before tomorrow is over. The degree of commodities outperformance today will be insightful as to the overall rebound strength.

Thank you for having read today‘s free analysis, which is available in full here at my homesite. There, you can subscribe to the free Monica‘s Insider Club , which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.