So... This Happened! One Crypto Goes From "Little-Known" -to- "Top 10" in 6 Weeks

Currencies / cryptocurrency Sep 18, 2021 - 04:53 PM GMTBy: EWI

SOL surges 10x in six weeks, outshining crypto kings like Bitcoin and Ethereum. See how you could have seen the rally coming.

The world's financial authorities continue toggling back and forth between banning digital currency transactions one day, and predicting hyperbitcoinization -- i.e., bitcoin becoming fiat currency -- the other.

All the while high-profile gazillionaires like Elon Musk stir the pot with metaphorical nursing tweets about "pumping not dumping" bitcoin.

Thus, it's hard to remember bitcoin is NOT the only sheriff in town. There are hundreds of listed tokens quietly making huge waves in their much smaller pools. One such name is Solana, a lower altcoin who, between July 20 and September 9, actually outperformed the leading crypto kings.

While Solana stood at a much more accessible $22 at its July 20 low, Bitcoin stood just under $30,000. And yet, only one of these two currencies surged tenfold from that low to all-time highs in the ensuing month.

That would've been Solana!

In fact, Solana's incredible run catapulted it into the elite list of "Top 10" cryptos, for the 10th ranking. And everyone from the August 16 Forbes -- "Solana Hits New All-Time High" -- to the August 16 Public UK -- "Solana Price on a Roar!" -- stood up and paid attention to the action.

An August 24 Coin Telegraph had this stunning testament to the new-found fervor for Solana:

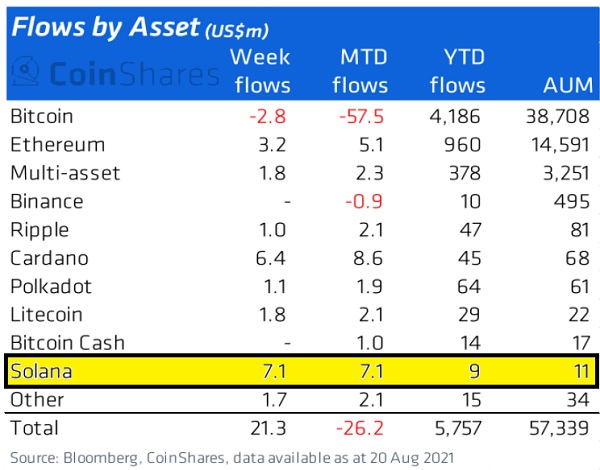

"Institutional investors bet big on Solana... with one-third of inflows to crypto investment products being invested in instruments tracking Solana this past week.

"According to CoinShares' Monday 'Digital Asset Fund Flows Weekly' report, $7.1 million flowed into Solana investment products between Aug. 15 and Friday."

The problem is, according to mainstream wisdom, nobody could've foreseen Solana going from back-of-the-line lagger to leader of the race. Said one August 17 news source:

"Its native SOL token has been the stand-out performer during the recent cryptocurrency surge of the last few days.

"The reason for the sudden and dramatic interest in Solana's open infrastructure blockchain has left many analysts scratching their heads."

Many, but not all.

On July 11, our Crypto Pro Service analyst Tony Carrion set the stage for a very bullish scenario. Tony showed the following SOLUSD chart, which pegged prices at the end of a fourth-wave Elliott wave correction.

The next move due was a fifth wave rally -- to new highs:

"We have structural support at 26.73, and hopefully the market won't need to go below that. The bottom line is that we'd want to see 38.08 exceeded, and ultimately a move above 44.10 to bolster the bullish scenario that is unfolding."

And this is what followed: SOL soared four-fold to record highs!

Then, as SOL penetrated $90 mark, the August 29 Crypto Pro Service revisited the crypto with a new, updated forecast; one that called for still higher prices even as the mainstream experts continued to scratch their heads as to why the crypto was rallying in the first place. In Tony's words:

"Apparently, a number of fundamental guys are still trying to figure out why Solana is doing this. As I've said many times, fundamental analysis is basically useless in trying to calculate price moves.

"Elliott wave analysis is far superior; it allowed us to use the .618 multiple of wave 1 to calculate where 5 might move, when it was trading way back in the 20's.

"Wave 5 isn't finished. We're not inclined to stand in the way of this move and will see what the market does. There are still higher projections using Fibonacci ratios. Heck, we could get all the way above $200."

And, a move to above $200 on September 9 is what followed!

It's commonly said that crypto markets are loose cannons with unpredictable trends.

We believe that's true -- IF you don't have the right tools to analyze price action.

We don't claim that Elliott waves are a crystal ball, of course. But patterns of investor and trader psychology are at play in cryptos, too -- making this "unpredictable" market quite the opposite.

Right now, our friends at EWI are hosting a Crypto-trader event (FREE): Now thru Sept. 23 Elliott Wave International opens the doors to their trader-focused Crypto Pro Service. FREE for 7 days, you get objective intraday + daily forecasts for Bitcoin, Ethereum + 6 more cryptos. PLUS, get up-to-speed at the free "kick-off" webinar with EWI's Crypto Pro Service editor Tony Carrion. Discover details and join in at elliottwave.com now.

This article was syndicated by Elliott Wave International and was originally published under the headline So... This Happened! One Crypto Goes From "Little-Known" -to- "Top 10" in 6 Weeks. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.