Hyper Growth Stocks - This billionaire is now using one of our top strategies

Companies / Investing 2021 Sep 08, 2021 - 06:48 PM GMTBy: Stephen_McBride

By Justin Spittler :

Has billionaire Dan Loeb been reading the RiskHedge Report?

Loeb climbed to the top of Wall Street by achieving remarkable success as an “activist investor.”

In a nutshell, Loeb would buy large stakes in struggling companies… replace management… and make other adjustments (like cutting a dividend) to turn around the company.

That’s how Loeb amassed a $4 billion fortune.

Most people with that much success wouldn’t change their approach. If it isn’t broke, why fix it, right?

But Loeb recently made a huge change in how he invests…

- He started investing more money in “hypergrowth companies”…

Hypergrowth companies are exactly what they sound like. They’re companies that grow at an explosive rate.

As longtime readers know, not only do these companies turn entire industries on their heads…

In some cases, they create brand-new industries from scratch.

According to CNBC, Loeb wrote in his recent investor letter:

“[We have] moved decisively into building our capability to invest in ‘hyper-growth’ companies, focusing on early-stage ventures.”

Loeb largely avoided hypergrowth stocks for most of his career. Instead, he focused on “dirt cheap” value stocks with the potential to rebound.

So, why the change?

Well, it’s quite simple.

- Investing in hypergrowth companies can deliver massive returns…

For example, Loeb’s hedge fund Third Point invested in cybersecurity disruptor SentinelOne (S) in 2015. At the time, SentinelOne was a private company valued at just $98 million.

Today, SentinelOne is a publicly traded company worth $15.6 billion. In other words, SentinelOne’s market value has increased more than 150X since Loeb first invested in it!

Third Point also invested in artificial intelligence lending company Upstart Holdings (UPST) in 2015. Back then, Upstart was a private company valued at just $145 million.

But, like SentinelOne, Upstart went public earlier this year. It’s now worth $16.7 billion… or 112X more than the company was worth when Loeb originally invested in it!

More recently, Third Point invested in FTX.

FTX is one of the world’s biggest cryptocurrency exchanges, and one of the fastest-growing businesses on the planet.

The company was founded just three years ago. And it’s already worth $18 billion.

- This is a huge departure from how Loeb used to invest…

Loeb said so himself in his recent letter to Third Point investors. Per CNBC:

While valuation always matters, our analysis is more focused today on business quality, differentiation, innovation, disruption and market structure… This contrasts with our previous focus as an event-driven fund on using “events” (spinoffs, recaps, mergers, etc.) as opportunities to find “cheap” stocks.

In other words, Loeb is investing more heavily into innovative companies… even though it’s not cheap to invest in them.

In fact, investors will often pay steep premiums to own hypergrowth stocks. And that keeps many old-school investors from touching them.

They can’t justify buying a stock that trades at 20… 30… or even 40 times sales.

But that hesitation often leads to missing out on multi-bagger investments.

Of course, you don’t need to be a private investor or billionaire like Loeb to make a fortune off hypergrowth stocks.

- RiskHedge readers have also been reaping big returns on hypergrowth stocks…

In fact, I’m constantly recommending “expensive” hypergrowth stocks in my advisories, IPO Insider and Disruption Trader.

Most folks do the opposite. They buy whatever’s cheap.

By “cheap,” I mean stocks that have a low stock price in relation to their sales or earnings.

If a stock trades for $20/share and earns $4/share, it’s cheap.

If it trades for $200/share and earns $4/share, it’s not cheap.

People are drawn to “cheap” stocks for the same reason they flock to the Macy’s clearance rack. It feels good to get a deal. Americans love nothing more than getting lots of “bang for their buck.”

But when it comes to investing, this is usually the wrong approach.

- Expensive hypergrowth stocks are often the elite performers…

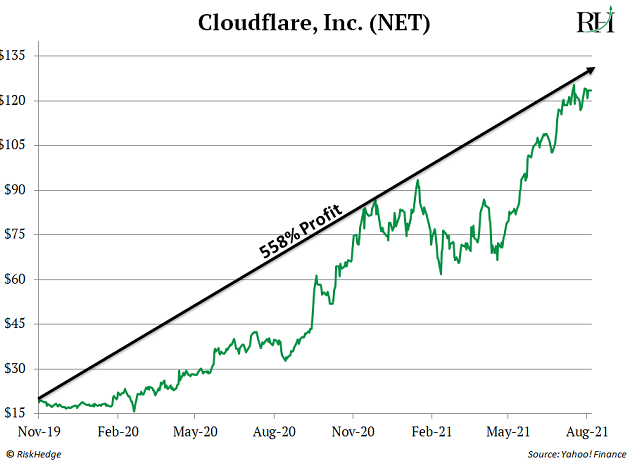

Edge computing pioneer Cloudflare (NET) is a perfect example.

When I recommended Cloudflare to IPO Insiders in November 2019, it was flying under the radar. Most people hadn’t heard of edge computing yet.

According to traditional valuation metrics, Cloudflare was expensive. But that didn’t stop it from becoming a monster stock.

As you can see below, NET has rallied 558% since I recommended it less than two years ago.

- Cloudflare is still an expensive stock today…

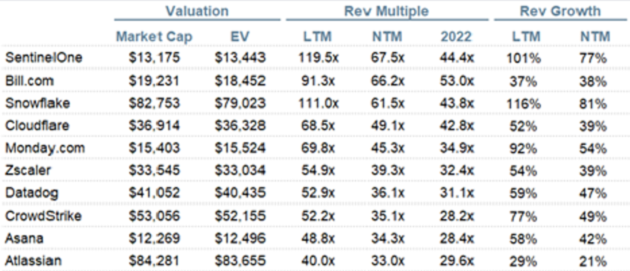

According to analyst Jamin Ball, Cloudflare is the fourth most expensive software stock—behind SentinelOne, Bill.com, and Snowflake.

Yet I have no intention of selling it anytime soon—it still has plenty of room to grow.

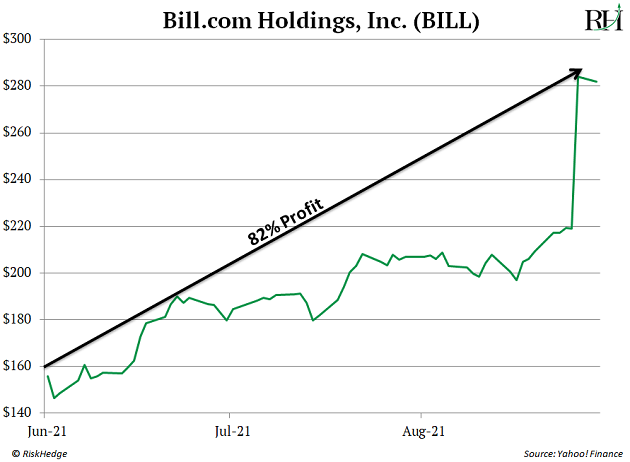

Bill.com (BILL) is another hypergrowth stock that I recently recommended. As you can see, it’s even more expensive than Cloudflare.

Bill.com is a software as a service (SaaS) company. In short, the company sells cloud-based software that helps simplify, digitize, and automate back-office financial processes.

Last Friday, BILL surged 30% after reporting that its sales surged 86% last quarter. It’s now rallied 82% since IPO Insider readers bought the stock less than two months ago.

And those are just two examples.

Other expensive software stocks include Zscaler (ZS), Asana (ASAN), and Atlassian (TEAM). If you had avoided these stocks due to their lofty valuations, you would have missed out on big gains.

Zscaler has soared more than 700% since it went public in 2018. Asana has climbed 188% since it went public last September, and Atlassian has surged more than 1,200% since it IPO’d in 2016.

That’s nearly 10X the S&P 500’s return over the same period.

- Clearly, avoiding hypergrowth stocks because they’re “expensive” is the WRONG move.

Investing in these types of opportunities can lead to explosive profits… in some cases, triple-digit gains in a matter of months.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.