US Dollar Upswing, S&P 500 and Nasdaq Outlook

Stock-Markets / Financial Markets 2021 Sep 07, 2021 - 07:41 PM GMTBy: Monica_Kingsley

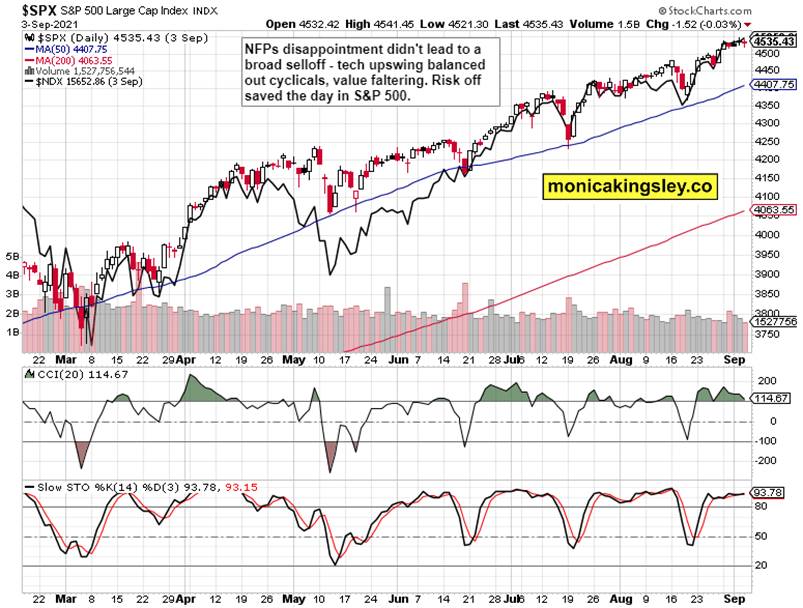

S&P 500 didn‘t get hammered on the NFPs miss – stocks did reasonably well, saved by the daily rush into tech. Volatility didn‘t spike throughout the week at all, and credit markets maintain their risk-on posture. Still, the real economy deceleration made itself heard, pushing back Fed taper speculations even further from September. Jerome Powell wanted to see more jobs data, and would want even more so now. I wouldn‘t be really surprised if no taper was announced in November.

Markets are thus far unconcerned about a policy mistake in letting inflation get entrenched even more – Treasury yields moved up, but don‘t expect to see them gallop just yet. Slow and steady, orderly grind higher is the most likely trajectory ahead, and even that won‘t propel the dollar higher, or keep it really afloat. Greenback‘s support is at 91.70, and I‘m looking for it to give in over the nearest weeks, which carries tremendous implications for commodity and precious metals trades. And for risk assets in general.

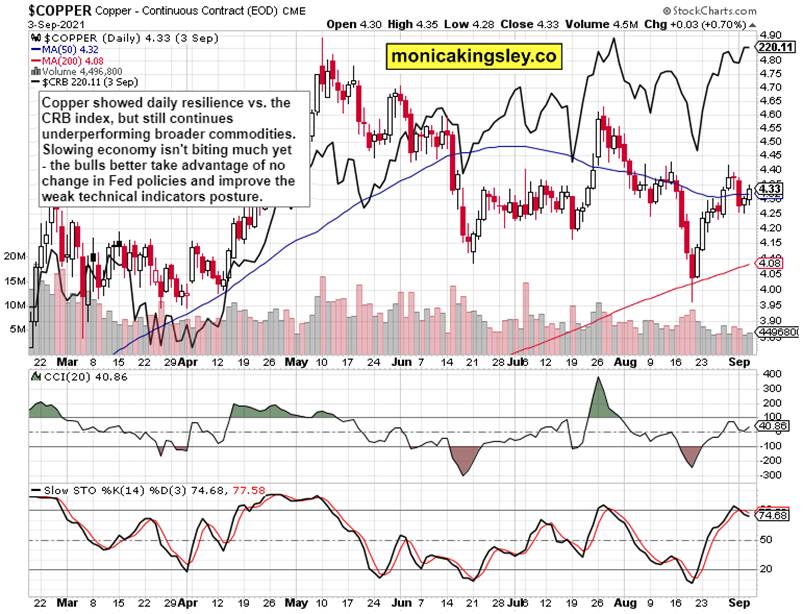

Precious metals thus far remain tame, and should continue chugging along just fine. Commodities such as copper and oil won‘t be derailed, but might panic temporarily in case of really bad incoming data. Copper‘s continued underperformance of the commodity index highlights the growth woes of the day, and even if the red metal might look to some as ready to roll over, the positive stockpile situation should cushion potential downside. In short, I‘m not looking for a meaningful disturbance to the commodities bull, as the inventory replenishment cycle has far from run its course, and inflation is bound to get hotter this year still.

As written on Friday:

(…) In short, forget about tapering into a weakening economy that doesn‘t see labor participation or hours worked rising. The Fed won‘t take that gamble soon, and we know what that means for real assets (and stocks too as inflation and yields aren‘t yet breaking the bull) – fresh money finding its way into financial markets, lifting prices.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

Friday‘s result could have been worse, way worse – and shows stocks still remain focused on money printing more than anything else.

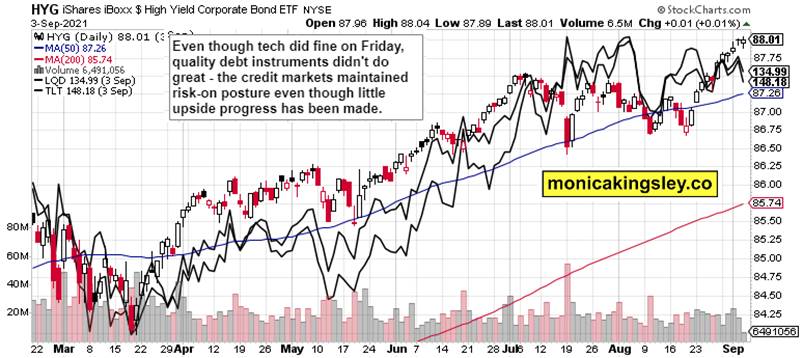

Credit Markets

Credit markets posture remains risk-on, and the inflation worries are reflected in the quality instruments. High yield corporate bonds remain in an uptrend, supportive of risk taking.

Gold, Silver and Miners

Precious metals benefited strongly on the assumption of Fed erring on the side of tardiness in announcing taper – inflation expectations are remaining tame thus far. Gold and silver ascent is though getting increasingly more confirmed by the miners turning higher too.

Crude Oil

Crude oil ran into a setback, but didn‘t roll over decisively – some more sideways trading before higher prices emerge, is likely. Look to the dollar for direction.

Copper

CRB Index continues its strong recovery, and copper is taking a brief rest at the 50-day moving average. While weakening real economy would hurt it, the red metal‘s supply/demand situation would cushion temporarily lower prices. Technically, the bulls better step in fast and take prices solidly above 4.40 in order to steer clear of the danger zone.

Bitcoin and Ethereum

Following long weekend gains, cryptos are under pressure today – it looks like a daily setback and not a reversal. Golden cross is approaching.

Summary

NFPs disappointment isn‘t likely to derail the risk-on trades, and would actually work in pushing the taper timing further into the future, which would likely result in further stock market and other asset gains. The alternative to taper earlier would force a correction, for which I am afraid there‘s no appetite.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.