What‘s Not to Love About Crypto Market Fireworks

Stock-Markets / Financial Markets 2021 Sep 06, 2021 - 10:09 PM GMTBy: Monica_Kingsley

Another weak selling attempt in stocks – are these setting up for tomorrow‘s NFPs volatility? It sure appears so, but buy the dip mentality looks likely to emerge victorious. The current period of low VIX will probably give way to a brief spike, which within bull markets is usually resolved with another upswing.

No matter the momentary hesitation in the credit markets, where we‘re moving two steps forward, one step backwards. Or rather two steps backwards, as can be seen this week. Risk off is still with us as key commodities aren‘t surging, leaving yesterday‘s silver upswing a little suspect on a daily basis. Copper and oil are struggling somewhat at the moment as well, taking (a bit too much) time as the dollar is only modestly declining and yields aren‘t rising.

The current trading environment favors still risk off, sectoral rotations are tame, and inflation expectations continue basing before money printing becomes an ever bigger problem for 2022 and the years ahead. Ethereum keeps doing wonders, and Bitcoin is joining in – finally, as expected. Hope you‘re riding open profitable positions too!

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

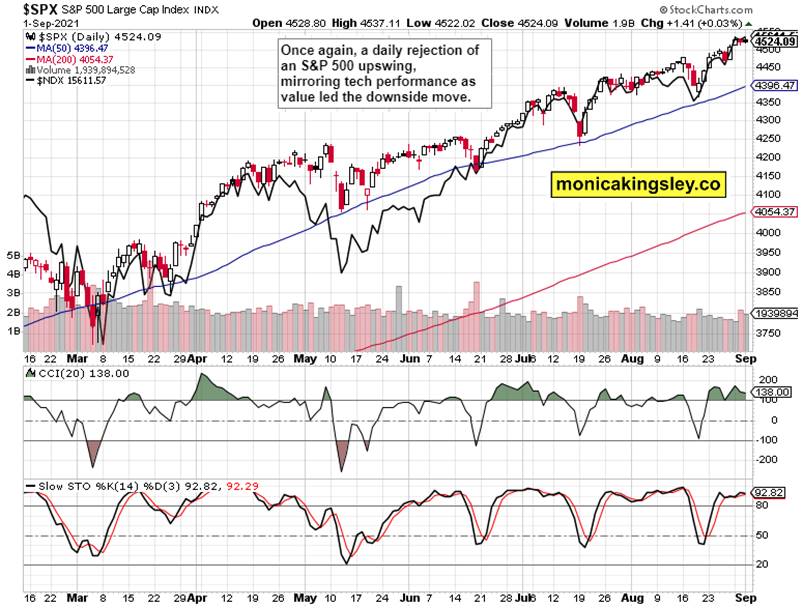

S&P 500 and Nasdaq Outlook

Two recent upswing rejections, that‘s the only thing standing out this week. The sideways to up grind goes on, and as tomorrow‘s NFPs aren‘t likely to throw a serious spanner in the works, it‘s set to continue.

Credit Markets

Credit markets are still facing crossroads – either HYG consolidates without meaningful downside breaking below yesterday‘s lows while quality debt instruments rebound, or the high yield corporate bonds would show daily weakness and join LQD and TLT. An outcome closer to the first scenario was more likely in my view yesterday, and did materialize. The issue is that it‘ll likely have to play out once again today. So, expect the risk-on parts of the market to do worse than tech.

Gold, Silver and Miners

Not a picture of daily strength in the precious metals – the bulls will have to wait for the real move tomorrow. Ìn spite of silver outperformance, the headline risk is still to the upside these weeks.

Crude Oil

Crude oil rose from the dead yesterday, and would better clear the $69 fast to the upside. The daily volume is indicative of accumulation, so the bulls still have a good chance.

Copper

CRB Index was little changed while copper dived. Steep downswing continuation is unlikely – the inflation trades aren‘t rolling over, and neither is the real economy. The current soft patch is likely to be resolved with another upswing in the red metal, bringing it back above the 50-day moving average.

Bitcoin and Ethereum

Cryptos are waking up again, and it‘s about the prolonged Bitcoin consolidation giving way to an upswing too. More gains were indeed ahead.

Summary

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.