Fresh Stock Market Highs to Meet Fresh Volatility

Stock-Markets / Stock Market 2021 Aug 17, 2021 - 11:59 AM GMTBy: Monica_Kingsley

Inflationary pressures building up aren‘t spooking the markets, there is no forcing the Fed‘s hand through rising yields. The bond vigilantes seem a distant memory as yields are trading well below their historical band, stunningly low given the hot inflation data. I‘m not saying red hot because the monthly CPI figure came in line with expectations, providing relief to the transitory camp. But last week‘s ISM services PMI and yesterday‘s PPI paint a very different story (to come).

My call about summer lull in bonds before these slowly but surely make their way higher (the 10-year to 1.80%), is turning out just as well as the inflation expectations‘ continued rebound. The cheap magic of Fed‘s June jawboning is losing its luster. Stocks steady and making marginally higher ATHs practically daily, uneven credit markets, gold holding up well following Monday‘s hit job, oil and copper trading in narrow ranges while the crypto uptrend goes on – fresh profits harvested across the markets yesterday, and new ones growing today.

The countdown to the Jackson Hole is on though, with the Fed practically having to do something – something in all likelihood face saving only as the record deficit spending gives it little to no maneuvering room.

Again, today’s report will be shorter than usual, and focus on select charts so as to drive position details of all the five publications.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

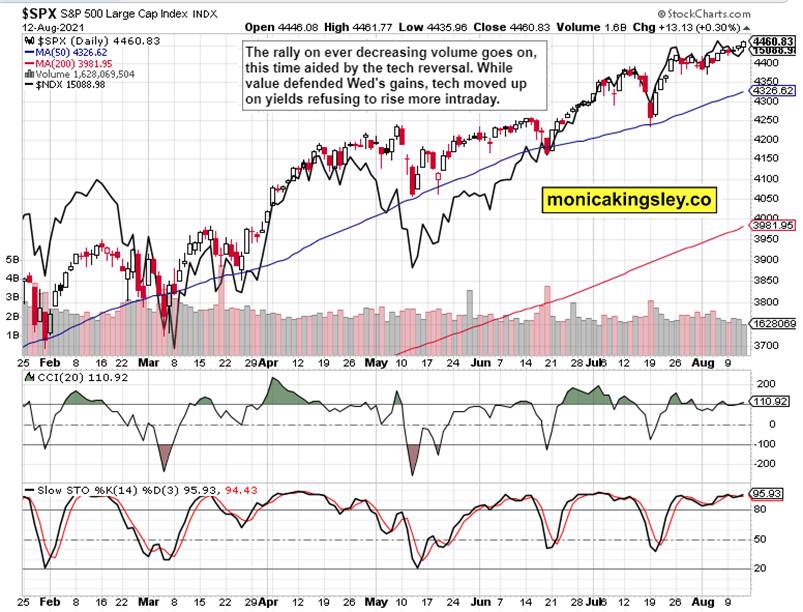

S&P 500 and Nasdaq Outlook

Broader base advance across the S&P 500 has lifted the 500-strong index, but the credit markets show short-term confirmation only. The air is getting thinner but bulls don‘t mind yet.

Credit Markets

- Credit markets‘ modest turn continues, and on even lower volume than was the case on Wednesday, which is a little suspicious but at least quality corporate debt is joining in this fragile rally.

Gold, Silver and Miners

Daily pause in gold, with the miners‘ weakness looking a bit too deceptive to me. The recovery from Friday and Monday‘s smackdowns is likely to go on as the inflation expectations and real yields provide fresh support again. Or does anyone expect high yields with such budget deficits? The market will wake up from giving the Fed the misguided benefit of the (inflation fighter) doubt.

Crude Oil

Oil has repelled intraday selling while the oil sector was more or less stable. The only question it seems is whether we would have to face another dip before the upswing slowly but surely resumes.

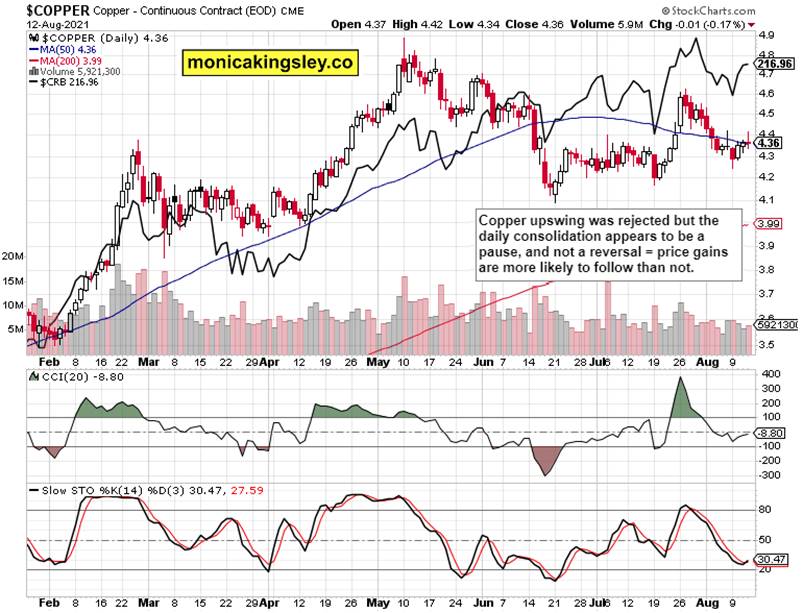

Copper

Copper was rejected, but only temporarily in my view – the commodity index is merely stalling, and that‘s a bullish sign given the PPI data increasing pressure on the Fed to act.

Bitcoin and Ethereum

Summary

In place of summary today, please see the above chart descriptions for my take.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.