How Options Are Fueling The Markets

Stock-Markets / Options & Warrants Aug 16, 2021 - 11:52 AM GMTBy: Chris_Vermeulen

In the past week, we have seen the Nasdaq and the S&P reach all-time highs. Since the covid crash, we have seen some massive movement to the upside. I believe there are several factors driving these markets up.

First, let’s look at the covid crisis and how it played a role. As a result of the shutdowns, the FED took a really aggressive stance with its quantitative easing measures. Lots of money printing to pay for massive stimulus payouts. The worse news we hear historically is that the markets will react sharply to the downside.

In this market, they did the opposite because many in the market viewed the bad news as a sign the FED will keep its foot on the gas with their aggressive quantitative easing. The markets love this as they see it as huge economic growth with less risk, even when things were shut down. Many people were at home and had nothing to do but spend their stimulus money. The markets loved this. That is why we saw massive growth in AMZN, FB, GOOGL, and MSFT. Other stocks favored from staying at home were ZM, NFLX, and TTD.

Now how do options fuel the markets? Well, when an underlying stock has options there is a secondary derivative market that has its own supply and demand outside of the stock. This can cause market makers to balance those demands. How do they do this?

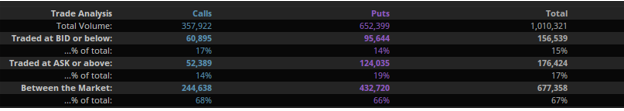

They do this by taking the difference of the total contracts bought and sold and adjust accordingly. So for example let’s look at SPX. In the below picture you can see Put volume is roughly half the call volume. In this case, the market maker would engage in an activity called delta hedging where they would buy shares of stock to offset the difference between the Put and Call contract volume. Since the market maker is only interested in the arbitrage between the bid and ask of these contracts, they want to stay delta neutral or, in other words, not be affected by stock price movement. When they buy to offset, this can drive the price of an underlying stock up. This is one reason why so many traders watch unusual options activity.

Every day on Options Trading Signals we do defined risk trades that protect us from black swan events 24/7. Many may think that is what stop losses are for. Well, remember the markets are only open about 1/3 of the hours in a day. Therefore, a stop loss only protects you for 1/3 of each day. Stocks can gap up or down. With options, you are always protected because we do defined risk in a spread. We cover with multiple legs which are always on once you own.

All my best,

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.