Nonfarm Payrolls Crushed Gold Like a Sandcastle

Commodities / Gold and Silver 2021 Aug 14, 2021 - 10:25 PM GMTBy: Arkadiusz_Sieron

The US economy added almost 1 million jobs in July, building solid ground for tapering. Meanwhile, the PMs’ sandy foundations crumbled spectacularly.

The US economy added almost 1 million jobs in July, building solid ground for tapering. Meanwhile, the PMs’ sandy foundations crumbled spectacularly.

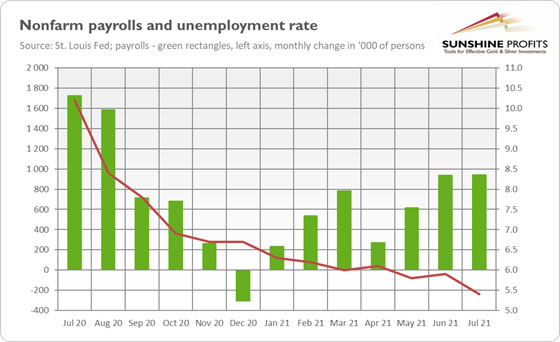

Another blow to gold! July’s nonfarm payrolls came in strong. As the chart below shows, the US labor market added 943,000 jobs last month, following 938,000 additions in June (after an upward revision). More than one-third of all gains occurred in leisure and hospitality, reflecting the economy’s reopening after the Great Lockdown.

What’s more, the nonfarm payrolls surprised the markets on the positive side. The economists surveyed by MarketWatch forecasted “only” 845,000 gains. Additionally, the employment in May and June combined was 119,000 higher than previously predicted. Another positive revelation was the decline in the unemployment rate from 5.9% to 5.4% – a much lower level than it was expected (5.7%), as the chart above shows.

Although the number of employed people is still down by 5.7 million from its pre-pandemic level in February 2020, it’s much higher than in April 2020 (by 16.7 million) – a clear sign that the US labor market is recovering from the last year’s recession and heading into full employment.

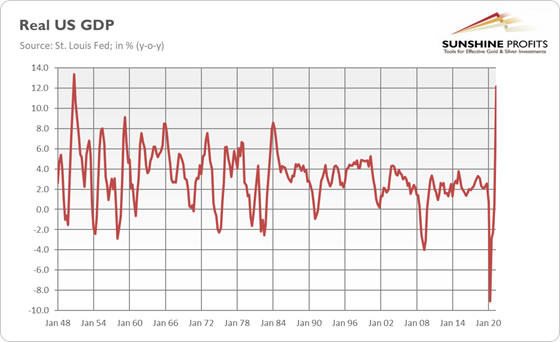

Importantly, the July nonfarm payrolls came in one week after the strong advance estimate of the US GDP in Q2 2021. According to the Bureau of Economic Analysis, the real GDP increased 12.2% year-over-year (or 1.59% quarter-to-quarter or 6.5% at an annual rate). As the chart below shows, it was the quickest pace of economic growth since the fourth quarter of 1950. Of course, the number results from a very low base last year, but it doesn’t change the fact that the economy has strengthened recently.

Implications for Gold

What does the recent employment report imply for the gold market? Well, in the last Fundamental Gold Report, I pointed out that the Fed started the countdown to the tapering of its quantitative easing and would announce it later this year:

The tapering clock is ticking. In June, the Fed started talking about tapering, while last month it noted that some progress has been made towards its goals. It’s likely that within a few months mere progress will transform into substantial progress, especially given that the job gains in July were strong and above the forecasts. With further improvements in the labor market, the expectations of a more hawkish Fed should strengthen, exerting downward pressure on the gold prices.

The latest surprisingly strong nonfarm payrolls bring us closer to the beginning of the Fed’s tightening cycle. You see, the thing the Fed lacked to recognize “substantial progress” towards its goal of maximum employment was a few strong employment reports. Last month, the US economy added almost 1 million jobs, which significantly reduced the slack in the labor market.

If August turns out to be similarly strong, the FOMC could announce the start of the tapering of its asset purchases in September. Actually, some analysts believe that Powell could signal it in his speech in Jackson Hole at the end of August.

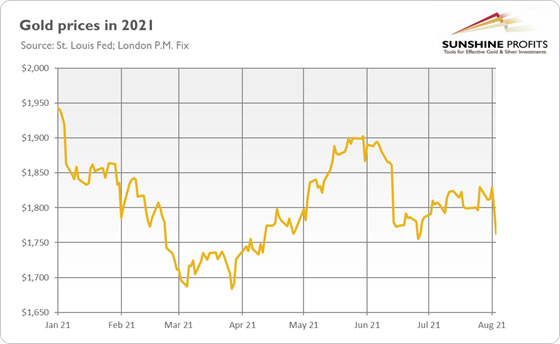

So, in line with my previous commentary, the strong nonfarm payrolls lifted the expected path of the federal funds rate, sending gold prices much lower. According to the CME FedWatch Tool, the odds of an interest rate hike in December 2022 increased after the publication of the employment report from 58.8% to 66.2%. As a result, the price of gold plunged from around $1,800 to $1,760, as the chart below shows.

Unfortunately, gold has further room to continue its slide. Each positive economic news or any hawkish signal from the Fed (e.g., Richard Clarida, Fed Vice Chair, expressed his belief last week that “necessary conditions for raising the target range for the federal funds rate will have been met by year-end 2022”) could add to the expectations of higher interest rates and to the downward pressure on the yellow metal.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.