Global Stock Market Investing: Here's the Message of Consumer "Overconfidence"

Stock-Markets / Stock Market 2021 Jul 25, 2021 - 06:38 PM GMTBy: EWI

Bear markets tend to follow this particular sentiment

In many global regions, economies are flourishing.

For example, here are two headlines about the U.S.:

What America's Startup Boom Could Mean For The Economy (npr.com, June 29)

Inflation Rose in June as Economic Recovery Continues (WSJ, July 13)

The goings-on in the United Kingdom provide another example. Employers in the UK are hiring people at the highest rate in more than six years. Plus, business and consumer spending are climbing swiftly -- at the fastest clip in a quarter of a century.

So, it wasn't surprising to see this June 18 CNBC headline:

Morgan Stanley picks the global stocks set to ride Europe's expected boom

However, here's what investors need to know: An economic boom follows an uptrend in the stock market, not the other way around. In other words, history shows that a booming economy may serve as a contrarian indicator.

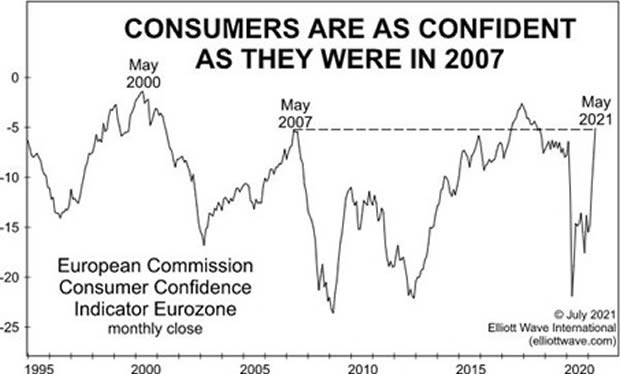

Indeed, here's a chart and commentary from our July Global Market Perspective, a monthly Elliott Wave International publication which provides forecasts for 50+ worldwide financial markets:

The chart shows that consumer confidence in the European Union two months ago eclipsed the survey's pre-pandemic optimism from February 2020. Financial markets have traveled this territory before. In May 2020, GMP discussed two prior outbreaks of consumer overconfidence and noted that bear markets followed such sentiment. In the case of this survey, the all-time high came in May 2000.

The Stoxx 600 peaked in March of that year and fell 60% over the next 24 months. Consumer confidence peaked two months before the stock market's top in July 2007, and the Stoxx 600 declined 61% to March 2009.

Yes, consumer and business confidence might climb even higher. However, the point is: The "boom part of the cycle" appears to be in the "mature" zone. Another key takeaway is that many in the investment community see the economic upturn as a sign that the bull market in stocks will persist when history suggests just the opposite.

The best way to get a handle on the world's stock markets is to use the Elliott wave model, which reflects the repetitive patterns of investor psychology.

After all, as Frost & Prechter's Elliott Wave Principle: Key to Market Behavior notes, "The Wave Principle is governed by man's social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value."

Want to see (FREE) what the waves are predicting next for

50+ of the biggest global markets?

Stocks in the U.S., Asia and Europe; bitcoin + other cryptos, bonds, FX, gold, oil... now through August 6, join us at Elliott Wave International for a free investor event, "Around the World in 19 Days."

It's our main event of 2021 -- this journey takes you around the world's 50+ most active markets in 19 enlightening days.

FREE, join in now to see new forecasts instantly ($245 value).

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.