Bitcoin Price Enters Stage #4 Excess Phase Peak Breakdown – Where To Next?

Currencies / Bitcoin Jul 22, 2021 - 02:35 PM GMTBy: Chris_Vermeulen

Over the past few months, I’ve been interviewed in podcasts and on Kitco where I’ve discussed the US and global market setups and trends based on my unique understanding of Technical Analysis and price patterns. Even though I’ve heard/read some comments from viewers sharing their own opinions which may not always agree with my interpretation of the market setups, I like to let the market trends do their thing and ultimately someone will be proven correct at the end of the day. Today, we’ll revisit some research I completed back in November 2020 and see how that research played out to today with Bitcoin.

Attempting to predict any future trend in any market is a difficult task, to say the least. The markets do what they do and part of my experience is to understand technical analysis setups and the underlying psychological aspect to the market cycles. I’m never 100% accurate in my predictions or expectations either – no one is 100% accurate in predicting any future event. All we can do is try our best at identifying these setups and take trades when the opportunity strikes for profits.

Our November 27 Bitcoin Predictions Prove To Be Incredibly Accurate

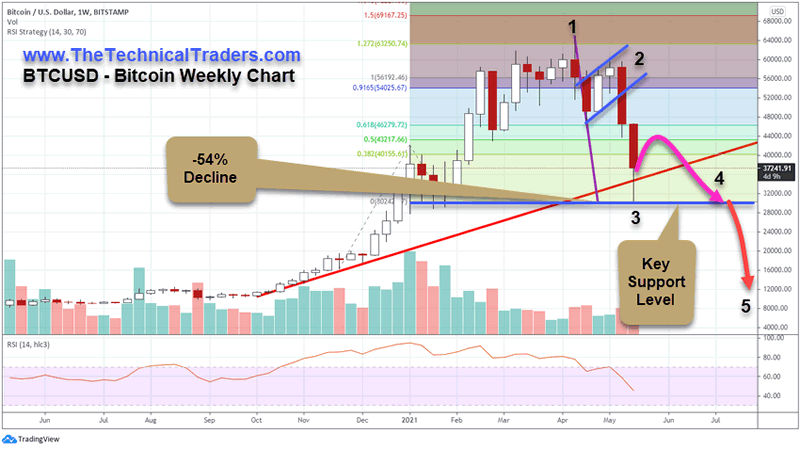

On November 27, 2020, I published a research article that highlighted a fairly common pattern which I call the “Excess Phase Peak” and I highlighted a number of charts/setups at that time while warning readers that the current US/global market trends were entering a “blow-off” topping phase that would likely end in this type of Excess Phase Peak type of pattern. I also highlighted past Excess Phase Peak setups to provide clear examples.

Over the course of the last 6+ months, I’ve continued to share updates to the Bitcoin setup as it continued to progress through the different stages of the Excess Phase Peak setup. Most importantly, the breakdown at Stage #3 where the initial sideways flagging price trend breaks down – setting up the final support/floor in the markets before the last phase of selling takes place (Phase #5). You can read these published research articles (below):

- November 27, 2020: HOW TO SPOT THE END OF AN EXCESS PHASE – PART II

- May 20, 2021: BITCOIN COMPLETES PHASE #3 OF EXCESS PHASE TOP PATTERN – WHAT NEXT?

- June 22, 2021: BITCOIN IS NEAR THE BRINK OF BREAKING DOWN TO $30K – WILL IT STOP THERE OR WILL A ‘HERD MENTALITY’ SELL OFF DRAG IT TO $10K?

Excess Phase Peak Pattern Repeats – Creating Price Cycle Waves

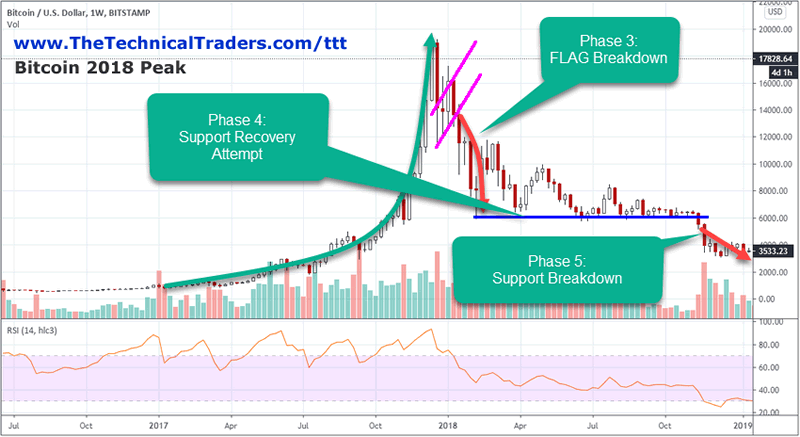

Let’s go back to the original chart from that November 27 article that started all of this. This chart highlighted the 2018 Bitcoin peak and how the Excess Phase Peak patter setup and progressed to an ultimate bottom in price.

I defined the structure/process of an Excess Phase Peak breakdown months ago as :

- The Excess Phase Rally must push price levels to new highs.

- A breakdown in price from the Excess Phase Peak sets up a FLAG/Pennant recovery phase. This represents the first attempt at a recovery that eventually fails.

- A breakdown in price from the FLAG/Pennant price recovery phase creates the real first opportunity for short traders or those that executed timely Put options. This represents the first real downward price trend after the FLAG setup.

- Phase 3 sets up the Intermediate-term support level. This becomes the last line of defense for price – an intermediate-term price floor. This phase can take quite a while to complete as traders often still believe a new rally will resume. Thus, this support level often has quite a bit of momentum to breakdown before it eventually fails.

- The final breakdown of price below the Phase 4 support level usually begins a much deeper sell-off. This is usually when other factors in the markets have finally resulted in the realization that the excess phase is over.

Initially, Phase #1 and Phase #2 are common setups within a price rally. What I feel is critical in confirming this Excess Phase Peak setup is the Phase #3 breakdown of the sideways price flagging pattern (#2), which will ultimately setup the lower intermediate support level. Once this Phase #2 breakdown takes place, that is enough confirmation for me to continue to believe that the Excess Phase Peak pattern will play out completely to ultimately establish some lower bottom in price.

Current Bitcoin Breakdown Sets Up A Rush To The Final Bottom In Price

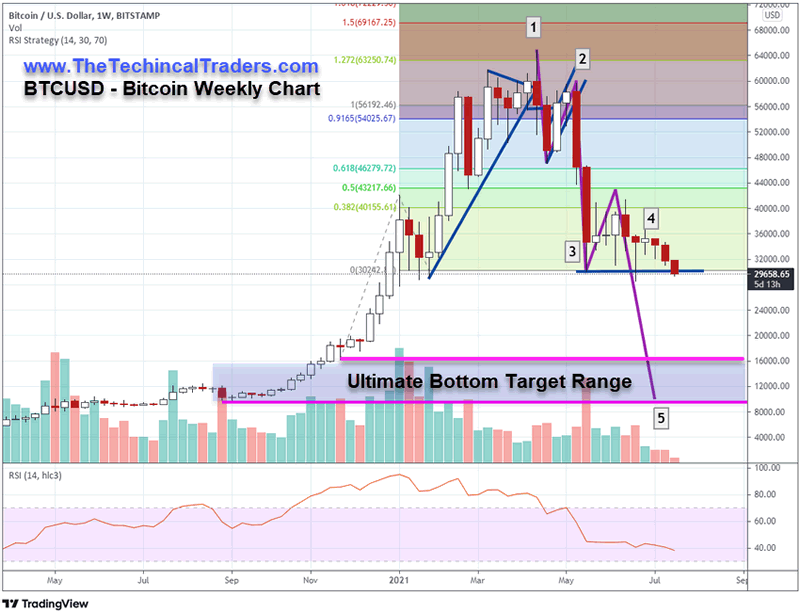

In this BTCUSD Weekly chart, we move to current price levels which highlight the breakdown of the Stage #4 Intermediate Support level (near $30,000). As continued price weakness pressures price to move below this critical $30,000 level, Bitcoin traders will start to shift their expectations once recent lows are breached near $28,600. Crypto traders are very strong believers in the ultimate upside targets of $100k or more and are often unable to see the downside risks associated with Technical Analysis setups and patterns.

Therefore, my team and I believe a flood of new selling pressure will initiate once the $28,000 level is breached to the downside. This is where Bitcoin traders suddenly shift away from the buy/hold position and start to reduce holdings because of downside risks. Those traders that purchased above $40k and are still holding, waiting for the rally, may want to reconsider their plans as the Excess Phase Peak pattern suggests. Phase #4 breakdown suggests an ultimate bottom level exists somewhere near between $9500 and $16,000 – a full -50% to -68% below the Stage #4 support level (near $30,000).

Eventually, price and selling pressure will dictate where the Ultimate Bottom will setup for Bitcoin. Our estimate of a $9500 to $16,000 bottom target range is based on the initial support level setup in September/October 2020. If this level is breached as selling pressure may continue to drive price levels much lower, then we would fall back to the next key low in price from March 2020, near $3,850.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

While a collapse to $3,850 would certainly burst a lot of enthusiasm for Bitcoin and the $100k expected bullish price target level everyone believes will eventually happen, we, as Technical Analysts, believe the current Phase #4 breakdown is just starting and any of these ultimate downside targets are very valid levels for price to attempt to find some future support.

In closing, I want to urge Bitcoin and Crypto traders to understand these setups and trends because you will see them in the future. Be aware of the setups, phases, and trends that are likely to develop within this pattern and learn to use them to your advantage. I’m excited to get back onto the recent podcasts, interviews, and get invited back to Kitco again to discuss this current breakdown in Bitcoin. In most cases, you just have to identify the setups/phases of market trends let the market trend tell you what to expect – instead of trying to “hope” for an unrealistic outcome.

Want to know how our BAN strategy is identifying and ranking various sectors and ETFs for the best possible opportunities for future profits? Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

From all my decades of experience, I can tell you that unless you have a solid foundation related to knowing when and where opportunities exist in market trends, you are likely churning your money in and out of failed trades. I will be presenting my two favorite strategies at the July Wealth365 Summit on July 13th at 4 pm and July 16th at 12 pm. The Summit is free to attend and offers unparalleled opportunities for learning…plus a potential prize or two!

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.