US Interest Rates: Making the Improbable Today’s Reality

Interest-Rates / US Bonds Jul 08, 2021 - 03:14 PM GMTBy: Paul_Rejczak

The US Federal Reserve has raised its interest rate guidance for 2023; and potentially late 2022. Oddly enough, interest rates have moved lower since the last Fed meeting.

I see an opportunity today.

You would think that the higher interest rate guidance would have created a bump higher in the $TNX (Ten-Year Note Yield). However, wouldn’t that make too much sense? The more trading experience I have gotten over the last two decades, the clearer it is, that logic doesn’t always work - unless you are early enough.

If you have been following along, you know that yesterday, I discussed the S&P Banking sector, namely KBE, as we wait for a pullback to some key technical levels.

It got me thinking: the Ten-Year Note yield should be very similar to that trade.

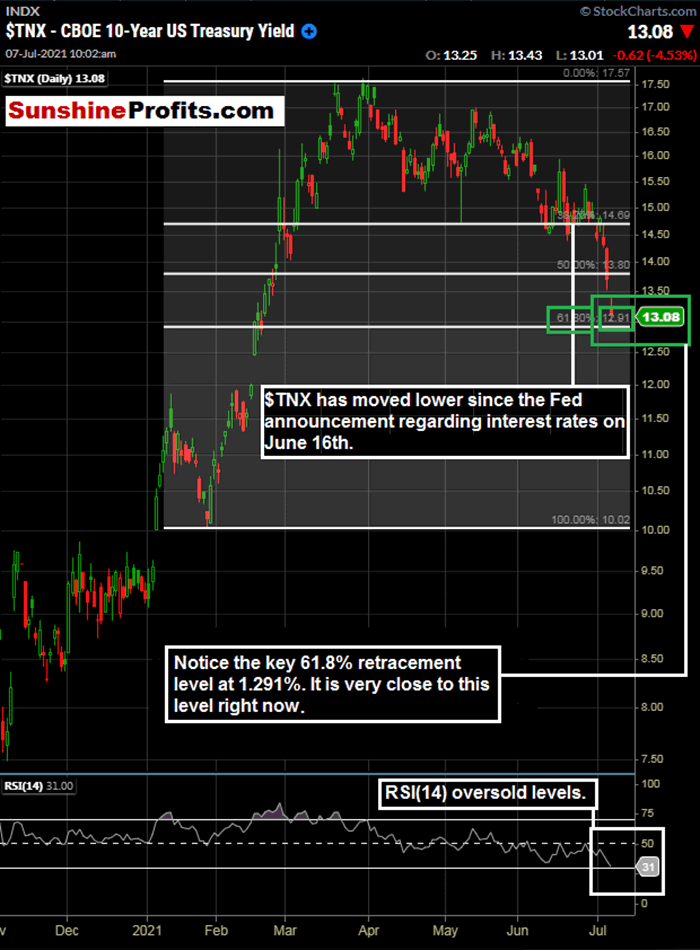

Figure 1 - Ten-Year Treasury Note Yield November 3, 2020 - July 7, 2021, 10:10 AM, Daily Candles Source stockcharts.com

We can see that the 10-year note yield has declined since June 16th’s Fed meeting. We are approaching daily oversold levels via the RSI(14). I think it is safe to say that many traders that took this trade (especially with leverage) have reached or are reaching their point of maximum pain. Notice how this chart looks very similar to the chart regarding KBE in yesterday’s publication.

Higher interest rates can create net interest margin expansion for banks and can boost the bottom line. Lower rates may have contributed to the fall in KBE over the last few weeks.

But Wait, There’s More

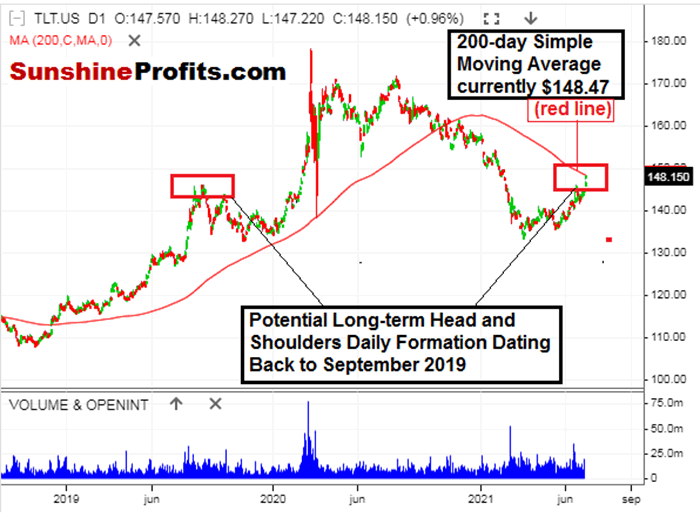

There were simply too many technical indicators to fit on one chart on this one. So, let’s take another look at interest rates, but this time in the form of TLT iShares 20+ Year Bond ETF. Let’s further out in time with daily candles here.

Figure 2- TLT iShares 20+ Year Bond ETF September 10, 2018 - July 7, 2021, DailyCandles Source stooq.com

I like the fact that numerous indicators are showing that interest rates may be due to head back in the “correct” direction. We have a long-term potential head and shoulders pattern, the 200-day moving average in TLT. We also have the key 61.8% Fibonacci retracement level in $TNX. Putting all of this together makes sense for a trade opportunity.

Perhaps since most traders that took the “logical” trade on the Fed announcement back on June 16th have had enough and reached a point of maximum pain, it can be our turn for a trade.

There are indeed numerous ways that a trader can trade interest rates. There are different products, durations, and instruments. Many traders are not familiar with interest rate futures; they are quoted differently and have margin requirements that may not be suitable for many traders.

I happen to like the TLT as the preferred instrument here. It is the longer end of the curve (20+ years) and is extremely liquid. The longer end of the yield curve can provide more price volatility versus the shorter end, and I strongly like the longer-term head and shoulders pattern that could be forming in the TLT.

Putting all of this together makes me consider Selling TLT when $TNX trades between 1.291% - 1.310% or at the 200-day near moving average of TLT ($148.47). Let's call it $148.47 - $148.00.

It looks like this TLT trade could be triggered at any time today.

Now, since we are covering so many markets, let’s cover the rest of them and see where the nine covered markets are trading for Premium Subscribers.

Not a Premium subscriber yet? Go Premium and receive my Stock Trading Alerts that include the full analysis and key price levels.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts.Sign up for the free newsletter today!

Enjoy your day! And remember to be patient with your entries.

Rafael Zorabedian

Contributor

* * * * *

This content is for informational and analytical purposes only. All essays, research, and information found above represent analyses and opinions of Rafael Zorabedian, and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. You should not construe any such information or other material as investment, financial, or other advice. Nothing contained in this article constitutes a recommendation, endorsement to buy or sell any security or futures contract. Any references to any particular securities or futures contracts are for example and informational purposes only. Seek a licensed professional for investment advice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Information is from sources believed to be reliable; but its accuracy, completeness, and interpretation are not guaranteed. Although the information provided above is based on careful research and sources that are believed to be accurate, Rafael Zorabedian, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. Mr. Zorabedian is not a Registered Investment Advisor. By reading Rafael Zorabedian’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Trading, including technical trading, is speculative and high-risk. There is a substantial risk of loss involved in trading, and it is not suitable for everyone. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment when trading futures, foreign currencies, margined securities, shorting securities, and trading options. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Rafael Zorabedian, Sunshine Profits' employees, affiliates, as well as members of their families may have a short or long position in any securities, futures contracts, options or other financial instruments including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. Past performance is not indicative of future results. There is a risk of loss in trading.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.