You Don't Know How Big of a Bubble Your in until AFTER it BURSTS - Financial Crisis 2.0

Stock-Markets / Financial Crisis 2021 Jul 06, 2021 - 03:51 PM GMTBy: Nadeem_Walayat

I had planned on sending five more biotech stocks to invest and forget for a potential X10 as a continuation of my analysis of 25th May when I covered 5 small cap stocks (4 biotech) (Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond! . However, instead for the past few weeks I have been focused on adding meat to my decision of 17th June 2021 to disinvest from my AI stocks portfolio by reducing it by about 38% to date, having sold 50% of my Google shares, 70% Facebook, 100% Amazon, 100% Nvidia, 100% IBM, and I am contemplating some further selling given that the stocks are over valued and many divergences are taking place in the markets which were giving me flash backs to 2007 (Financial Crisis), 2000 (Dot Com Bubble) and even 1989 (Japanification) as we appear to be in a mix of all 3 bubbles to varying degree, though this does not mean a market top is imminent, it's just that we won't know a top is in until after the fact, anyway I had to de-risk to be able to sleep more comfortably at night and also let my Patrons know what I was doing that this article now seeks to illustrate why as stocks are rising into a high risk environment where complacency and high stakes gambling rules for which we only need to look at the likes of the Cathy Woods funds, Gamestop and the crypto mania bubble that topped in April but still over leveraged vested interests cling onto Bitcoin having bottomed with highly convincing commentary spewed to the masses such as stock to flow, halving's, institutional interest as I covered in my in-depth analysis of 15th June (Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels). Which to me despite the 50% drop to date, the crypto's are still in a BUBBLE with much further downside to come given the amount of leverage and further exaggerated by the likes Tether the $62 billion ponzi scheme that provides daily liquidity to the crypto markets.

You Don't Know How Big of a Bubble Your in until AFTER it BURSTS

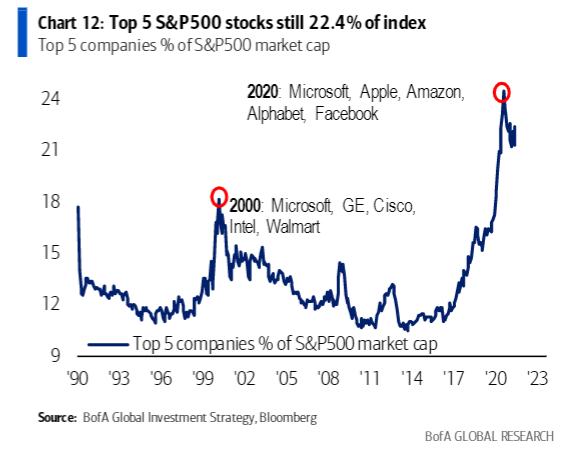

A handful of stocks are driving the indices higher, Apple worth $2.3 trillion, Microsoft $2 trillion, Amazon $1.8 trillion, Google 1.8 trillion, Facebook $1 trillion even that over priced pile of poop Tesla came close to being valued at $1 trillion, we are definitely in a bubble, you only need to go onto youtube and watch the to the moon videos of Cathy Wood, literally everything's going to go to the moon because her barely out of puberty Quants decree it to be so. This is clearly a major warning sign of a unsustainable trend when indices are ruled by such a small clique of tech stocks where the greatest similarity is with the dot come bubble in terms of the valuation of stocks that actually produce revenues unlike the largely worthless dot com's of that time.

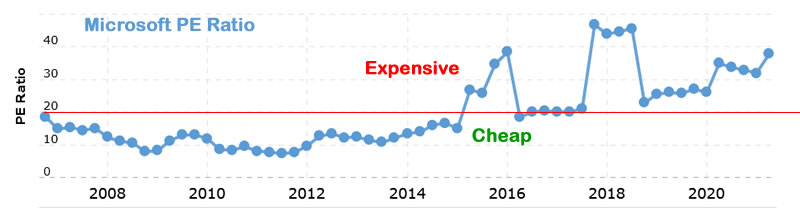

A good exercise to perform is to work out what would your portfolio be worth at 20 times earnings, then you get a hint of where stock prices could trade down to once we exit the bubble mania because 20 times earnings is still not exactly cheap, but in historic terms would be a fair price for large mature tech stocks.

So my thoughts have been focused on the the dot com bubble, then the bubble leading up to the financial crisis, and even further back to the 1989 Japan bubble, I bet most don't remember that bubble or are aware that it even existed! THAT was probably the mother of all bubbles when the market value of Tokyo was MORE than that of the whole of the United States! And hence in the lead up to which we got a string of movies appearing that painted a picture of the future belonging to Japan, much as today's movies paint an alternating picture between the future being owned by the Tech giants and CHINA!

We'll what happened to the mother of all bubbles? IT POPPED! Since which Japan ruling the economic world is just a mere footnote in dusty old economics books.

So you have to realise that towards the end of each bubble there exists a near certainty of outcome i.e. that JAPAN has WON the economic WAR. It's Game Over, JAPAN has WON! Much like we are building up to game over for the United States and so the 21st century will belong to China.

So I am sat here placing myself back into the 1980's when no one could see that rather than Japan wining and owning the future that this was it! The beginning of the end of Japan as an economic super power, no one could imagine Japan was about to enter into 4 DECADES of STAGNATION! If anyone suggested such at the time would ne seen as stupid! it was impossible for Japan to enter into 4 decades of stagnation and economic decline from there, but that is what happened!

CHINA! CHINA! CHINA! Maybe on the brink of becoming the NEXT Japan, so rather than owning the future this may be as good as it gets for China! You can see signs of this in the stock prices that trade at deep discounts to western stocks, why? It's because that is the real value of the Chinese economy, chinese stocks are NOT cheap, it's that the perception of what China actually is, perhaps overvalued by several orders of magnitude which will only become apparent with the benefit of hindsight and why I suggest don't follow the Cathy investing fool Woods into making the mistake of buying chinese stocks.

Which brings us to our own elephant in the room, AI tech stocks, which yes are overvalued but nowhere near to the extent of the dot com bubble. BUT I get the impression that I am missing something important that will only become apparent with the benefit of hindsight. That the real value of AI tech stocks is not $2 trillion for Apple, or $2 trillion for Amazon, , much as the value of Tokyo was not equivalent to the whole of the United States in 1989. The future IS foggy especially in the midst of bubble manias but my sixth sense due to having participated in many bubble manias over the past 30 - 40 years is telling me it that the value of AI tech stocks could reset to perhaps half where they typically trade today.

What pricked the Japanese bubble was rising interest rates which is what will probably prick today's bubble. The thing is that once the ball starts rolling it does not stop i.e. has unintended consequences, so whilst at the beginning mild rate hikes seem like the sensible thing to do it has unintended and unexpected effects that most are totally blind to until like the financial crisis had CDS and MBS start to blow up the whole banking sector.

And it appears that is the Achilles heel for this bubble, the banking sector as I will elaborate on shortly why we could be on the precipice of Financial Crisis 2.0, that at the least looks set to produce a reset in stock valuations which could go from a state of overvaluation to a state of under valuation i.e. all the AI stocks are good, but is Microsoft really worth 38 times earnings, or Amazon near 70 times? That's a lot of years of earnings growth priced in.

This article is an excerpt from my most recent extensive analysis evaluating the prospects for a Financial Crisis 2.0 - Investing in a Bubble Mania Stock Market Trending Towards Financial Crisis 2.0 CRASH! the whole of which has first been made available to Patrons who support my work.

- You Don't Know How Big of a Bubble Your in until AFTER it BURSTS

- Stock Market Summer Correction

- REPO Market Brewing Financial Crisis Black Swan Danger

- Margin Debt Bubble

- US Bond Market Long-term Trend

- Michael "Big Short" Burry CRASH and HYPERINFLATION WARNING!

- Michael Burry's Track Record

- Michael Burry's Portfolio

- Investing During Uncertainty

- AI Stocks Portfolio Buying July Levels Update

- HEDGING AI Stocks Portfolio

- Crypto Bear Market Accumulation State

- Bitcoin Bull / Bear Indicator

- Market Oracle AI Coin Thoughts

- Biotech Brief

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent comprehensive analysis of Bitcoin -

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

My analysis schedule includes:

- More X10 Biotech Tech Stocks - 60% done

- Stock Market Trend Analysis

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.\

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your biotech stocks investing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.