ABBVIE - ABBV 116 - Cheap Low Risk Pharma Stock Investing - Risk 1

Companies / BioTech Jul 01, 2021 - 07:26 PM GMTBy: Nadeem_Walayat

Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

Why has my focus shifted to biotech stocks and not more tech stocks?

Firstly, I have been investing in biotech stocks for DECADES, it's just that since 2015 my focus shifted to the emerging AI mega-trend to make sure I was invested to capitalise on a trend that was clear to me would span DECADES, at the time I thought I was probably getting in late on the AI Mega-trend but clearly that is always the case! WE ALWAYS THINK we're late to the party but this trend is going to run right into the end of the 2030's

This also explains why I hold the likes of GSK and JNJ amongst a string of smaller cap biotech stocks many of which have been disappearing from my portfolio over the years usually due to being taken over as it looks likely to be the case for GW Pharma later this year. So I need to replenish this once much loved and now neglected stock sector with a string of new smaller cap high risk stocks for the next 5 to 10 years.

Secondly, our beloved AI stocks have been BID UP to high valuations, yes including Google, so they are not CHEAP, even after a 10% to 15% correction i.e. the likes of Microsoft and Amazon are discounting a lot of future earnings growth! Of course that does not necessarily mean that they are about to fall to what I would consider to be fair value let lone cheap levels as they did during March 2020 because at the end of the day they are GOOD stocks so usually command a healthy premium to invest in.

However, during the course of this exercise I am repeatedly finding that the biotech stocks are tending to be greatly unloved! Especially when one compares them to the barmy valuations that many of the smaller cap tech stocks that populate the likes of ARK INVEST have been lifted to such as TESLA and SQAURE and most of the rest.

So this does appear to be an opportune time to go on the hunt for smaller cap higher risk biotech stocks.

RISK RATINGS

I am also adding a risk rating to the high risk stocks where 1 is lowest risk and 10 highest risk in terms of something going wrong and the stock effectively crashing into becoming a penny stock or even going bust within the next 5 years. This is based on the sum of all my analysis of each stock and given my risk averse nature then most of the stocks will have a low probability of actually going bust within the next 5 years. Still this rating will give an extra measure of risk vs reward when entertaining potential position sizes.

ABBVIE - ABBV $116 - Cheap Low Risk Pharma - Risk 1

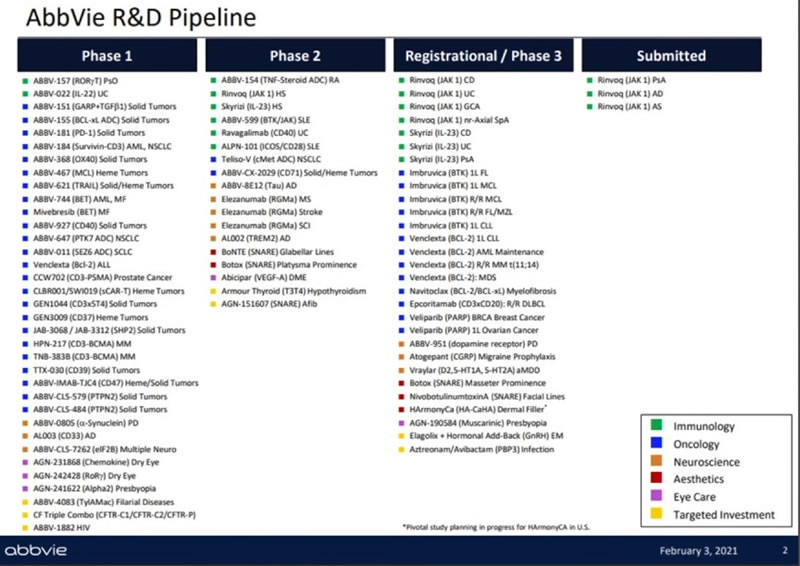

This pharma was only founded in 2013 as a spin off from Abbott Labs and is based in North Chicago, the stock has already grown to a market cap of $206 billion. The play here as is the case with most of the biotech's is to capitalise on FDA approval of drugs and treatments under development. The fundamentals are one of strong revenue and earnings growth with Q1 sales jumping by 51% and earnings up 22%. The company trades on a very low PE of 9.1 and pays a HUGE dividend of 4.5%, so definitely not much of a high risk stock. I expect the stock will soon migrate it's way upwards in my stocks portfolio to join the likes of JNJ. Why is the stock so cheap trading only on a PE of 9? We'll the market is discounting the loss of patents over the next couple of years on it's primary earners such as Humira that accounts for about 1/3rd of the companies revenues. Though the company has a huge number of drugs in the pipeline any one of which could be as big an earner as Humira. The company has strong cash flow of $17 billion, plenty of coverage to continue to pay it's annual dividend and scope to acquire smaller biotech corporations as well as cover interest payments on it's $78 billion of debt.

The stock charts long-term performance to date is hardly exciting, only recently surpassing it's previous high of $105, however which will now act as strong support. So downside looks very limited which means this breakout to new highs could see the stock accelerate much higher over the coming year. Therefore the 1st Buying level is $ 110 and then $104, as downside looks very limited in technical terms, unless a general market slump delivers us a deeper buying opportunity.

So Abbvie is definitely an example of the Pharma sector being unloved and hence a good safe stock that is selling very cheaply. Despite the trend to date, I would not be surprised if the stock doubled in price a year from now. So what I am wondering is do I buy the stock right now are risk waiting for just a 5% drop to $110 as the current general stock market correction so far has not had any negative effect on this stock which is a sign of relative strength i.e. one buys strength and sells weakness.

This article is an excerpt from my recent extensive analysis that concludes in my latest biotech stocks with the potential to X10 over the coming years Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond! has first been made available to Patrons who support my work.

Topics Include:

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Inlcuding access to my latest analysis -

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

My analysis schedule includes:

- More X10 Biotech Tech Stocks - 50% done

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.\

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst investing in biotech stocks.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.