Frank Holmes: When Inflation Erupts, Gold Will Take Off

Commodities / Gold & Silver Oct 21, 2008 - 07:28 PM GMTBy: The_Gold_Report

Expect short-term hesitancy in the upward movement of the gold price until liquidity returns to the markets, says Frank Holmes, CEO and chief investment officer at U. S. Global Investors and co-author of the new book “The Goldwatcher:Demystifying Gold Investing” (John Wiley & Sons). In this exclusive interview with the Gold Report, he predicts gold will go to $1,000, even $2,000, over the next two years. A growing money supply due to a change in government policies will help lift some juniors out of their misery, too. Holmes advises selective nibbling until conditions improve and names a few companies to consider.

Expect short-term hesitancy in the upward movement of the gold price until liquidity returns to the markets, says Frank Holmes, CEO and chief investment officer at U. S. Global Investors and co-author of the new book “The Goldwatcher:Demystifying Gold Investing” (John Wiley & Sons). In this exclusive interview with the Gold Report, he predicts gold will go to $1,000, even $2,000, over the next two years. A growing money supply due to a change in government policies will help lift some juniors out of their misery, too. Holmes advises selective nibbling until conditions improve and names a few companies to consider.

TGR: Can you start off by telling us what's going on?

FH: Based solely on global economic indicators, commodities should be in a cyclical bear market with no bottom in sight. But there's intense pressure on policymakers to fill the deflationary vacuum that's been created by both Main Street and Wall Street. Main Street's plummeting housing prices stretched the limits of the financial system, but lawmakers in an election year will find it easier to blame Wall Street than Main Street.

TGR: Both sides are at fault.

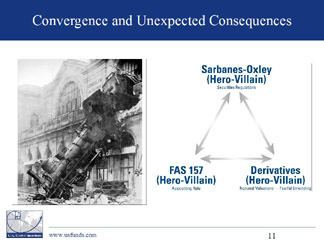

FH: The abuse of leveraging is the biggest culprit. Mike Milken spoke at a conference I attended last week in Hong Kong. He said that at the height of his career he was leveraged 4-to-1. Goldman Sachs now is leveraged 20 times, so a 5% mistake would wipe them out. The combined impact of Sarbanes-Oxley, FAS 157 (mark-to-market regulations) and leverage abuse has cost New York its position as the world's financial capital. No one expected this escalation of write-downs.

When Warren Buffett bought General Re Insurance in 2002 he warned about notional valuations because he tried to sell some of the derivatives, and lost billions of dollars. He called derivatives “weapons of mass financial destruction.” Everyone ignored him, and the derivative market increased 500% in five years.

TGR: Wow.

FH: If you make a 2% mistake in the $500 trillion derivative market, that's $10 trillion. What's $10 trillion? Well, the world's total GDP is $50 trillion. The total amount of U. S. dollars in circulation is roughly $15 trillion. A 2% mistake wipes out 20% of the world's GDP.

We're actually experiencing huge deflation—in housing and on Wall Street. It's not inflationary yet. The Paulson package is a stopgap measure that could lead to inflation. This meltdown is just like 1974 or the Depression of the 1930s, not the 1987 quick crash. It continues to destroy confidence. Another thing that propelled this meltdown to more disastrous proportions was the rule that removed the uptick rule for short-selling.

TGR: What will fix this situation?

FH: That's a good question. Adding untested regulations is dangerous, and the law of unexpected consequences is often negative. The combination of Sarbanes-Oxley, FAS 157 and the no uptick rule for shorting basically became toxic and led to the destruction of Lehman Brothers and Bear Stearns. Also, “ideas” like printing more money and the debasement of currency do not solve the credit crisis and are not good long-term solutions.

The dollar's not going to collapse due to loss of Asian support. All countries will support the dollar. The reason is that they can't afford for it to fall too far because then suddenly the U. S. would be exporting products and not importing. All the currencies will slowly debase themselves against gold and keep the dollar as the currency for global trade.

It appears we are now going through that inflection point moving from deflationary forces to an inflationary cycle. We had a little bit of run-up in inflation when oil ran to $150 a barrel, which was very excessive. What didn't make sense was the fact that gold didn't rise along with oil. On the historic 10-to-1 ratio, gold should have gone to $1400 to $1500. That leads to suspicions that a few people were manipulating the price of oil because gold failed at $1,000 per ounce. On another note, it is important to remember policymakers will do everything in their power to create liquidity and, historically, liquidity is bullish for commodities. However, our research suggests it'll take several quarters before this will affect commodity prices.

TGR: Will the market stagnate until this liquidity flows through and moves the commodities up?

FH: You'll have to be a very selective buyer for another couple of quarters. The price correction should lose downward momentum and create a “U” shaped bottom as the capital markets begin to reflect the policies being implemented.

TGR: When you say the price correction will lose its downward momentum, do you mean this wholesale sell-off of everything?

FH: Right.

TGR: We saw yesterday that Goldcorp (TSX:G) (NYSE:GG) was down 16%.

FH: That downward momentum will start to slow.

TGR: When you say commodities, do you mean gold?

FH: Asian economic activity has a big influence on the purchase of gold. At the London Gold Bullion Traders Conference in Kyoto, I was amazed to find the magnitude of the shortage of gold and silver coins. In Germany, they aren't having the crisis we're having here, but Germans were lining up to buy gold.

TGR: Do they have supplies?

FH: No, but they have gold in the kilo bars. Everything is sold as soon as they get it.

TGR: I tried to buy some Swiss 20 Francs today and couldn't find any.

FH: People are paying a large premium for small coins, and the purchase of safety deposit boxes is on the rise. People have been actually stuffing dollars in them, along with gold. It's not really a 1980-style mainstream panic. People are continuing to buy. The growth of gold ETFs attests to that. Now let me try to explain some of these huge price swings in commodities, equities and emerging markets.

Your readers might be interested to know that banks all have this software called VAR, or Value At Risk. It triggers an alarm indicating a need for more capital due to escalating debt defaults. You'd think that banks would go to their prime brokerage arm and rein in hedge funds trading mortgages and de-leverage them because that's where the risk is. Your business model says, “I have defaulting mortgages, so I need to be sure our hedge fund and prime brokers aren't having similar problems.”

TGR: Right.

FH: Well, the banks reacted by calling every hedge fund and de-leveraging all asset classes, equities, banks and commodities. So, starting August 12, 2007, some of the S&P stocks moved 15% in a day internally. This same margin call has now taken place about four times this past year. U.S. banks in Japan yanked loans to small cap companies, so those guys were scrambling to replace those loans. Situations like that are happening everywhere and they illustrate the long reach of this credit crisis.

A lot of emerging marketing investors got their noses bloodied when the U.S. called for its loans to be repaid. They will not be so quick to repeat that mistake. This ripple effect is hurting businesses. That is a concern that I heard over and over. Fortunately, the governments of emerging markets have huge surpluses and are better equipped to handle this crisis than they were in the 1990s.

All of this is good for commodities and gold rises in step with commodities. When inflation erupts everywhere, then gold will take off on its own with a bigger move.

TGR: When will that happen exactly?

FH: Over the next two years gold will be well over a $1,000, maybe running up to $2,000. The number-one Asian analyst, Chris Wood, is advocating a 30% gold exposure to institutions. Now, this is the number-one brokerage firm in Asia and their research is excellent.

TGR: What's the name of the firm?

FH: CLSA-Asia Pacific Markets. It recommends a portfolio allocation of 30% gold:15% gold bullion and 15% unhedged gold stocks. When an analyst of his stature advises putting 30% of your portfolio into gold, you have to take note. We tell our clients to put a maximum of 5% into bullion and no more than 5% toward gold equities.

TGR: Doug Casey's latest missive rounded it up to 30% too.

FH: The significance here is that the institutional side is getting on board with gold. That's a big deal.

TGR: Because the gold market is so small compared to the market caps these institutions deal with, even a small change in percentage would make a huge difference.

FH: All the brokers are getting their marching orders simultaneously. What happens is that non-correlated assets begin to correlate as people seek liquidity. So everyone's saying, “I have to get cash.” It's important to remember that brokers were leveraged 20 times and low-income house buyers were leveraged 99 times. This creates a chain reaction and knocks down the commodities. Several of these hedge funds have blown up, and if our holdings are similar to theirs, they've hurt us.

We went into this correction with a big cash position back in June, and we never expected such a huge correction, but our models were showing that it should be 20% to 25% cash. Then we start to nibble as things get clobbered, but they continue to get clobbered.

TGR: Yes.

FH: Last week the markets hammered every stock with liquidity. Many funds have been hit by this problem. Margin calls are driving this. It has nothing to do with the demand for gold or the supply and discoveries.

TGR: But that should work itself out fairly quickly by the end of the year.

FH: It was estimated that by the end of the year there would be $22 billion of resource stocks coming out.

TGR: Do you mean coming out of the hedge funds?

FH: Yes. Hedge funds have been forced to shut down. It's really interesting to look at the TSE Venture Index. When the asset-backed paper problems happened last summer, retail sponsorship dropped dramatically. The U. S. went through something similar in February when suddenly the small caps and mid-caps started losing liquidity. What we noticed was that the auction rate paper is exactly ten times the size of Canada's asset build paper crisis—$330 billion versus $33 billion. It was just before tax season, so a lot of American investors had to scramble for cash by redeeming their equity funds to pay their taxes.

TGR: Do you follow Richard Russell's Dow Theory Letters?

FH: You mean regarding the relationship between the Transports and the Dow Industrials?

TGR: Yesterday both were down so Dow Theory now confirms that we are in a bear market.

FH: Yes.

TGR: What happens to gold stocks in a bear market?

FH: Whether you have big deflation or big inflation driving the bear market, gold does well. If it's just a normal cyclical inventory recession or whenever interest rates are above the CPI rate, gold doesn't do well. Today, the Fed's funds are below the CPI rate and the printing presses are busy.

TGR: So, what are we in now?

FH: I think we're at the tipping point moving from deflation to inflation.

TGR: So, we've been on the negative side of that.

FH: We saw gold run to $1,000 twice because of deflation, not inflation. Massive liquidations are deflationary. Collapsing housing prices are deflationary. The price of oil running up was inflationary but it was triggered by the dollar deflation and gold moved with it. In the '30s, when you had a big deflationary cycle, gold was the best asset class. In the '70s, when you had a big inflationary cycle, gold was the best asset class.

TGR: Right.

FH: In the '90s when there was no big inflation or deflation, gold just meandered along.

TGR: So when do you think we will reach that tipping point from deflation to inflation?

FH: The money supply has basically been flat for the past three months. The correlation of commodity price action and emerging market money supply has an R-squared value over 80—highly correlative. We track the G-7 countries versus the E-7 (the seven most populated emerging countries in the world with available data) and track their money supply. The money supply has not been growing rapidly. We need to get the money supply up and this will happen with the $700 billion bailout. So, we're going through a transition over the next couple of months.

TGR: When will gold respond?

FH: There's been a six-week lag with the money supply, the same with NASDAQ. If the money supply spikes, there's a 70% probability that within six weeks the NASDAQ will start to rise.

TGR: Why would an increase in the money supply impact NASDAQ?

FH: People have more cash to spend.

TGR: So they're moving into the NASDAQ?

FH: Yes. The money supply has one of the highest correlations to the gold commodity as a whole. When you look at stocks individually, the number-one driver is the production per share growth. After that, it's cash flow, and then reserves. You can eliminate 80% to 90% of all the noise by calculating production and the cash flow.

TGR: What would you tell someone who has just inherited a million dollars?

FH: I'd put 5% into gold bullion and 5% into unhedged gold stocks.

TGR: Unhedged producers?

FH: Yes, and if you want to go down to the smaller caps like Jaguar (JAG. TO) , that's where you get your biggest potential returns.

TGR: Can you share a few names on your list of unhedged gold producers?

FH: We like companies that have a royalty business, such as Royal Gold (RGLD) . We also look at those with the strongest per-share-growth rates coming over the next 12 – 18 months. That list includes Agnico-Eagle Mines (TSX:AEM) , Kinross Gold (KGC-NYSE; K-TSX) , and Goldcorp—all of which have very healthy growth profiles relative to the Newmonts of the world. Goldcorp isn't a pure gold play, because it also produces a high percentage of base metals. But we expect that within two years those base metals will really start taking off.

TGR: Is that prediction based on anticipated growth in China?

FH: Yes. China has structurally gone through a quiet phase, but the government has policies in place that are designed to invigorate growth. As that growth starts to pick up steam over the next six months, you're going to see increased demand for the basic commodities. Of course, the economy is spending a lot of money for infrastructure right now, and that might put a temporary lag on commodities.

TGR: But you believe China's growth will drive the commodities market higher?

FH: Yes. The credit crunch created by the collapse of U. S. financial institutions will slow things down for a while, but ultimately, China will grow.

TGR: What other companies do you like?

FH: Unless they have two grams of gold (per ton) or a million ounces, junior explorers have been drifting lower and lower. Historically in situ reserves have traded at one-tenth of an ounce of gold. So, if gold is $600, then your reserves are worth $60 per ounce. When gold was $300, they were worth $30. That was the model for determining a fair market cap for junior explorers. With gold at $850, these companies should be worth $85 per ounce of reserves, but they're not. This amazes us. And when one of these companies is bought out, it's usually paid more than the ten times ratio. But valuations are now drifting down to $40 and $35 per ounce. So the market is basically valuing a company that has 8 million ounces as if it had only 4 million ounces.

TGR: This is a short-term phenomenon, right?

FH: Yes.

TGR: So, when this situation changes, how quickly will producers and majors start buying up the juniors?

FH: That's a different point. The seniors are going to buy only those juniors that have two grams of gold per ton or a million ounces. The other juniors will just work their way out of the system or go bankrupt.

TGR: What other criteria do you use to evaluate juniors?

FH: We ask some simple questions:Is the CEO technically competent? That is, is he a geologist? If not, that may be okay, but does he have a broad network to make up for that lack of technical knowledge? Does he know the newsletter writers, like Doug Casey, for instance? Does he know the investment bankers?

We've found that if the CEO does not know the Street, and doesn't know the newsletter writers, it doesn't matter if he's a geologist or an engineer. There's going to be no liquidity in the company's stock, unless there is a multimillion ounce discovery with a grade of greater than 2 grams per ton. But if you have a company whose CEO knows lots of newsletter writers, gets lots of coverage, knows the value in the Street and gets research for it, that company is going to have a higher price-to-book valuation, which makes it a much more attractive investment.

TGR: Anything else you look for?

FH: Financing is crucial. Companies that are rapidly spending money are going to run out of cash in about six months. The market undervalues them until they have financing in place.

TGR: Can you give us a few companies on your list that meet your criteria?

FH: Moto Goldmines (TSX:MGL) , which is in the Congo, is in that category, though they face geopolitical risks. The company has more than 10 million ounces and more than five grams per ton. Another one is Gabriel Resources (GBU:TO) , which has a large asset in Romania.

TGR: Both of these companies have some geopolitical risks associated with them.

FH: They do. But if they satisfy the criteria, these are the ones that the big mining companies will be acquiring.

To learn more about investing in natural resources, you might want to take a look at industry veteran Frank Holmes' new book, The Goldwatcher: Demystifying Gold Investing . Holmes is CEO and Chief Investment Officer of U.S. Global Investors, Inc., a registered investment adviser that managed more than $5 billion in 13 no-load mutual funds and for other advisory clients as of June 30, 2008. U.S. Global specializes in the natural resources, emerging markets and global infrastructure sectors. Its funds have received numerous awards and honors during Holmes' tenure, including more than two dozen Lipper Fund Awards and certificates. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC and Bloomberg, and has been profiled by Fortune, Barron's, The Financial Times and other publications. In addition, Holmes was selected as the 2006 mining fund manager of the year by Mining Journal, a leading publication for the global natural resources industry.

Visit The GOLD Report - a unique, free site featuring summaries of articles from major publications, specific recommendations from top worldwide analysts and portfolio managers covering gold stocks, and a directory, with samples, of precious metals newsletters. To subscribe, please complete our online form ( http://app.streamsend.com/public/ORh0/y92/subscribe )

The GOLD Report is Copyright © 2008 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

The Gold Report Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.