The Best Stocks to Buy Now

Companies / Tech Stocks Jun 30, 2021 - 01:20 PM GMTBy: Russell_Fenton

US stocks have done relatively well during the coronavirus pandemic. The Dow Jones, Nasdaq 100, and S&P 500 indices have all risen to the highest level on record. In total, these indices have almost doubled from their lowest level in 2020. Let us look at some of the best stocks to buy now.

Tesla (TSLA)

Tesla has grown from a relatively small niche electric car company to becoming the biggest automaker in the world. It has a market capitalization of more than $592 billion, meaning that it is bigger than Toyota, Ford, and General Motors combined.

This performance has been helped by several things. First, Tesla is the best-known electric car company in the world. Second, it has advanced technology that beats all other companies. For example, its cars have the biggest battery range of all electric cars. Third, the firm has the biggest network of charging spots in the United States and other countries. Further, Tesla has a charismatic CEO and a strong brand recognition.

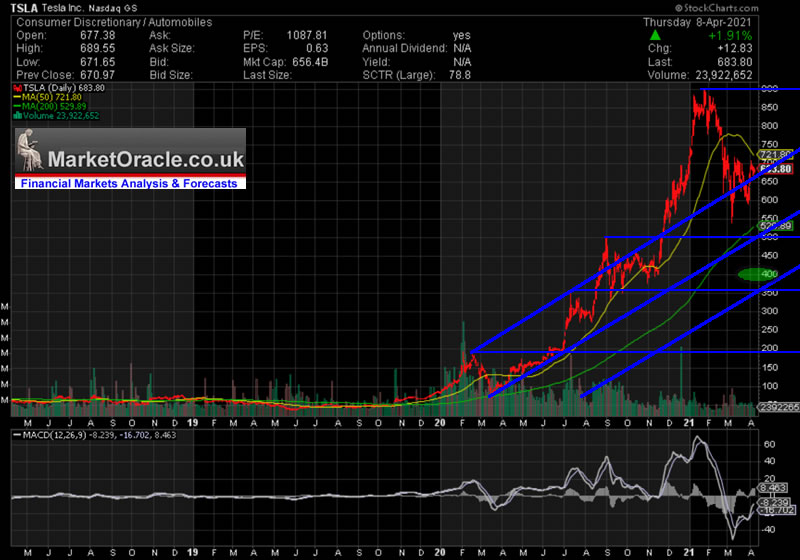

Tesla’s stock jumped to an all-time high of $902 in January. At the time of writing, it has declined by more than 30% as the rotation from growth to value has accelerated. The shares have also declined because of the overall decline of Bitcoin prices. Still, there is a possibility that the stock will bounce back as the transition to electric vehicles accelerates and as investors pile-in into companies that meet environmental, social and governance (ESG) criteria. As such, it makes sense to buy Tesla shares. Read more about how and where to buy the stock here.

Salesforce (CRM)

Salesforce has also evolved from a small software company to become one of the biggest firms in its industry. The company started out by offering Customer Relations Management (CRM) solutions to companies.

In the past few years, it has expanded its business substantially. It is now a leading player in business intelligence (BI) through its acquisition of Tableau. It is also aiming to become the leading corporate communication business through its acquisition of Slack. Also, it is a leading player in software integration through its acquisition of Mulesoft.

Salesforce competes with some of the leading companies in the world. For example, its CRM solutions compete with products like Microsoft Dynamics and Oracle CX CRM. Still, it has managed to maintain a strong market share with low churn.

Salesforce has a strong brand and revenue growth. It has a market capitalization of more than $225 billion and is a leading member of the Dow Jones.

Adobe (ADBE)

Adobe is a software company valued at more than $272 billion. In the past few years, the company has gone through major changes. In the past, the company was known for its software DVD. At the time, it used to make its money by selling these DVDs.

Recently, though, it has transformed its business to become one of the biggest SAAS companies in the world. Adobe sells most of its products using a subscription model. Over the years, it has added more than 22 million active cloud subscribers. It also has little churn.

Further, Adobe has expanded its business to become one of the biggest providers of cloud marketing solutions. Its marketing solutions are used by thousands of companies globally. The company is also a leading player in e-commerce through its Magento acquisition. Other leading acquisitions are Workfront and Marketo.

Some of the top reasons why Adobe is one of the top stocks to buy today are its strong growth, low churn, and its expanding market share in its industry.

Summary

There are many companies that make sense investing in today. In this article, we have mentioned some of the three top picks. Other companies in our radar are firms like Microsoft, AMD, Nvidia, and Boeing. These firms have a strong moat and are leading players in their industry.

By Russell Fenton

© 2021 Copyright Russell Fenton - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.