Jumping the Fed Tightening Ship

Stock-Markets / Financial Markets 2021 Jun 29, 2021 - 03:38 PM GMTBy: Monica_Kingsley

S&P 500 powered higher after the daily pause, yet its solid gains don‘t have such a risk-on feel as the credit markets do. Depending on tech heavyweights for the lion‘s share of gains isn‘t though an immediate concern – the market breadth is slowly improving after value stocks were bombed out post-FOMC. Signs of life are returning, facilitated by the Fed‘s $8.1T and growing reasons to celebrate, so don‘t be spooked too many lower knots in VIX when there is no panic in the options arena either.

As tech-reliant as the S&P 500 is, the path of least resistance is still higher – and in the same way (tight trailing stop-loss) Nasdaq could be approached too, so as to protect our open profits while letting them grow.

PCE deflator readings often come below CPI thanks to the „weighted substitution effect“ at play, and it would come back to haunt the Fed. Taken to extremes, you downgrade from a steak to a hamburger, and then what? Cat or dog food? Obviously, this measure is favorable to the Fed as it defers the taper speculation further to the future.

Together with the redefinition of how long transitory used to last earlier, and what transitory (inflation) means now, the central bank wins in leaving the punch bowl available for longer (the job market offerrs plenty of excuses too). If last week gave us any lesson, it was that market players are all too quick to sell both the winners and losers. The spike in Treasuries was a clear warning sign of stress.

br> Gold and silver keep basing, for my taste a little bit too long. Not even silver is waking up – it isn‘t inspired by CRB. First stocks, then commodities, and finally precious metals would recover from the tightening speculation – it‘s thus far working this way. As I wrote yesterday, it‘s that the copper to 10-year yield ratio doesn‘t favor much precious metals downside (nominal yields aren‘t a risk here – only the dollar that appears consolidating before another push higher, seriously is).

The greenback though missed an opportunity to rise, and quelling the inflation fears through an „understated“ (different approach in accounting) figure, wouldn‘t be a bullish driver. USD/JPY also hasn‘t been trading favorably to the yellow metal lately, meaning the (gold) inflation trades may have to retrace a little more of their recent run before continuing higher. Again, gold is spending too much time at its recent support while silver isn‘t showing signs of life – miners to gold ratio isn‘t taking initiative either. Better clear off that zone...

Crude oil keeps trading with a bullish outlook, and oil stocks have a great future ahead – the intraday and upcoming volatility might not be always pleasant, but black gold is far from making a top..

Cryptos base building hypothesis hasn‘t been invalidated, but the current downswing better gets solidly retraced, otherwise we‘re in for another hot weekend.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 is going higher, reliably powered by tech stocks (heavyweights, precisely).

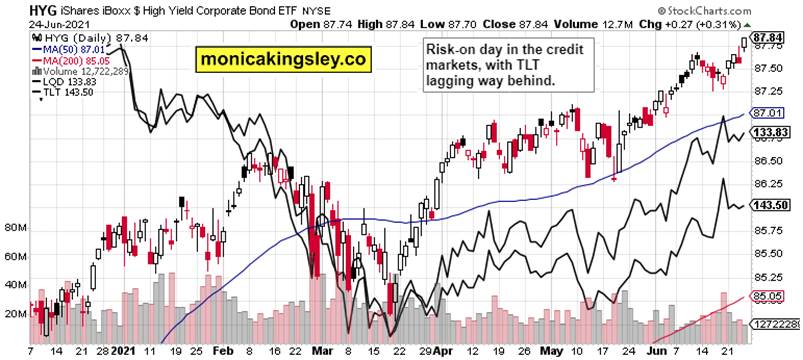

Credit Markets

- Risk-off Wednesday gave way to some animal spirits returning yesterday.

Technology and Value

The sectoral S&P 500 view isn‘t though a true picture of risk-on yesterday.

Gold, Silver and Miners

Gold and miners keep going nowhere – there is no momentary sign of strength, just temporary stability. Bigger move is coming.

Silver isn‘t yet leading gold, and the copper leadership is thus far being lost. Precious metals are obviously afraid of tightening, and had been hurt hardest in last week‘s liquidation.

Bitcoin and Ethereum

Prices are again approaching danger zone.

Summary

S&P 500 led by Nasdaq looks set to extend gains, and the leadership supporting the advance, will broaden.

Gold and silver still haven‘t regained short-term bullish momentum, and the longer they fail to do that, the more precarious their position in this long base building.

Crude oil seesaws in the short run, but the consolidation is likely to be resolved with higher prices, and oil equities rising again.

Bitcoin and Ethereum bulls better step in, and vigorously defend the 32,500 before the bears‘ appetite increases.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.