Two Reasons Hyperinflation Is Unlikely

Economics / HyperInflation Jun 27, 2021 - 05:41 PM GMTBy: Kelsey_Williams

The correct definition of inflation is “the debasement of money by government and central banks“.

The effects of inflation show up in the form of higher prices for all goods and services.

Hyperinflation is defined as “out-of-control general price increases in an economy, …typically measuring more than 50% per month.” (source)

There are two specific reasons why hyperinflation re: out of control general price increases for all goods and services, possible US dollar collapse, etc., is unlikely.

REASON NO. 1) FED INFLATION IS LOSING ITS INTENDED EFFECT

For the past century, the Federal Reserve Bank of the United States has been debasing the US dollar by continually expanding the supply of money and credit.

The effects of that inflation are represented by a loss in purchasing power in the US dollar of ninety-nine percent.

The inflation that is created by governments and central banks is intentional and ongoing. The Federal Reserve and other central banks expand the supply of money and credit so that member banks can lend money perpetually.

Problems arise when governments and central banks cannot keep the effects of inflation in check. Historic examples of hyperinflation are France in 1790s and the Weimar Republic (Germany) in the 1920s.

A different (deflation rather than hyperinflation) example of a central bank being unable to manage the effects of its own inflation is the Great Depression in the United States during the 1930s.

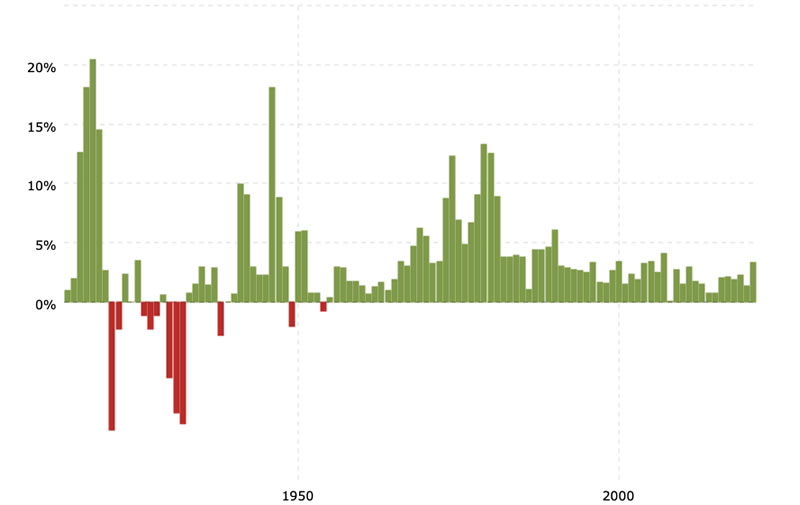

Here is a chart (source) that shows annual CPI rates dating back to 1914…

Note that the chart begins with the year 1914, one year after the inception of the Federal Reserve. A cluster of double digit increases (green bars) in consumer prices ends in 1919.

What history refers to as the Roaring Twenties was ushered in by a collapse in commodity prices and an economic depression so severe that it lasted for almost two decades. Only in the cities and for the wealthiest people were the effects seemingly non-existent.

The cluster of red bars reflects the extent of price deflation that occurred during the 1920s and 1930s.

In 1941, the year the United States entered World War II, the CPI rate shot up to 10% and stayed at relatively higher levels for another decade.

Then in the mid-1950s, the CPI began a 25-year run of increasingly higher rates, peaking in 1979-80 at 13.29% and 12.52%; at that time the highest rates in more than thirty years.

Since 1980, CPI rates have declined steadily. Recent upticks notwithstanding, the CPI rate been trending down for more than forty years.

The last double-digit rates of increase for the CPI occurred in 1979 and 1980. Also, the average annual rate of inflation as measured by the CPI has declined in every decade since the 1970s.

Furthermore, the actual annual CPI rate has been below 4% every year since 1990 except 2007, when it came in at 4.08%.

This seems somewhat incongruous in light of the fact that the biggest and most brazen money creation by the Federal Reserve has come in the past two decades.

It is not so much important as to why this is occurring. What is important is that it is occurring and that the effects are a century old in the making.

Now think back a few years to the attempts by Fed officials to “talk up” higher inflation rates post 2008-2010. (see The Fed’s 2% Inflation Target Is Pointless)

And, remember how more than just a few people expected hyperinflation and much higher gold prices after 2011?

Regardless of any reasoning, conjecture, and analysis to the contrary, the facts are clear that the effects of inflation are not meeting expectations.

REASON NO. 2) FED INFLATION IS FUELED BY CHEAP CREDIT

In late 18th century France and in early 1920s Germany, inflation was practiced the old fashioned way – they printed the money into existence.

That led to absurd levels in pricing for various goods and services. This was evidenced by the fact that the price of one loaf of bread in Germany went from 14 marks to 200,000,000,000 (200 billion) marks in just three short years.

Today, most of money supply expansion by the Fed is digital in nature and credit based. This accomplishes the inflation creation more conveniently. It has also allowed the Fed to respond to financial and economic crises in startling fashion.

As a result, the entire world economy is awash in cheap credit. Companies and entire industries function on cheap and easy credit. Most of them would not be able to stay in business otherwise.

Unfortunately, the dependence on cheap credit has increased the vulnerability of our financial system.

When you consider a fractional-reserve based banking system, and retail sectors such as housing, automobiles, student loans, small businesses that are all funded with credit, the numbers are mind-boggling.

The situation is much worse when factoring in derivative investments that are priced exponentially disproportionate to underlying investments of nominal or token value.

The use of leverage, i.e., borrowed money, dwarfs any underlying value, whether it be a house, a car, ETF, uncovered options writing, junk bonds, etc.

There is historic precedent for financial collapse following an abundance of easy credit by the Federal Reserve. The prominent example is the stock market crash in October 1929.

See the chart (source) below…

From its peak in August 1929 at 380 to its nadir in July 1932 at 44, the Dow Jones Industrial Average lost almost ninety percent. Most individual investors lost everything.

“Buying on margin became so popular that by the late 1920s, “ninety percent of the purchase price of the stock was being made with borrowed money.” Not only that … the U.S. economy had come to depend on that activity. Before the crash, nearly forty cents of every dollar loaned in America was used to buy stocks.” – www.awesomestories.com – Oct 24, 2015

CONCLUSION

Extensive use of credit for speculative ventures is considered normal today. Any lessons learned after the events of a century ago have been mostly forgotten. For those who care to know…

- The risk of a multi-asset price collapse is greater today than any risks associated with hyperinflation.

- Historically speaking, long periods of entrenched inflation always end in economic collapse.

- An economic collapse can happen either with (Germany 1918-23), or without (United States 1930s) experiencing hyperinflation.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2021 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.