Capital and Liquidity Injections Results in Modest Credit Market Improvement

Economics / Credit Crisis 2008 Oct 21, 2008 - 04:27 PM GMTBy: Joseph_Brusuelas

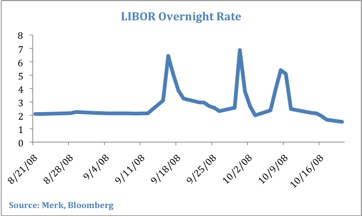

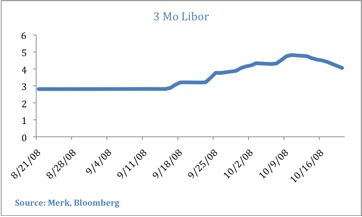

Credit and Money Supply Indicators: The injection of capital and elimination of caps on swap lines between foreign central banks and the Fed have engineered modest improvement in credit indictors over the past week.

Credit and Money Supply Indicators: The injection of capital and elimination of caps on swap lines between foreign central banks and the Fed have engineered modest improvement in credit indictors over the past week.

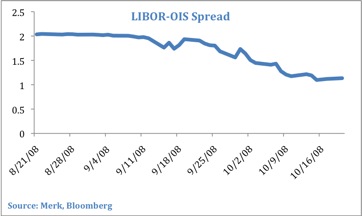

In addition, to our close observation of Libor fixings and the LIBOR-OIS spread, we also pay close attention to the TED spread as an indicator of financial health. The TED spread has narrowed by 169 points, but the elevated reading of the VIX indicates continued fears in market. However, the improvement in the TED spread is an indication of the market slowly beginning to function.

Unfortunately, the improvement has not been paralleled by the LIBOR-OIS spread. This spread has only compressed by 60 basis points and is another indicator of continued stress in credit markets.

Commercial Paper

There is a modest signal that lending has restarted on the back of the Fed program to purchase commercial paper. Through the end of the week, the major target appears to have been the commercial community, as the non-financial community continues to suffer.

Bank Assets

Commercial banks see an increase in assets and a modest restart to lending with consumer still drawing on home equity.

Fear still pervades among financials. Banks are holding excess reserves which is an indicaton that banks are horading cash in the aftermath of the Treasury's annoucement one week ago.

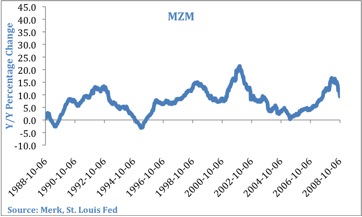

Monetary Aggregates

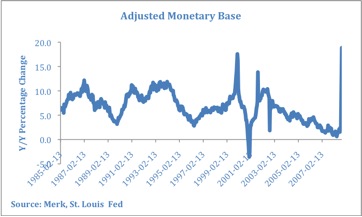

MZM declines while adjusted monetary base skyrockets. With velocity of money declining and Fed mopping up excess liquidity in the market, risk of inflation has substantially moderated in the near term. However, given the sharp increase in the adjusted base the market should closely observe continuing Fed action to sterilize those increases.

By Joseph Brusuelas

Chief Economist, VP Global Strategy of the Merk Hard Currency Fund

Bridging academic rigor and communications, Joe Brusuelas provides the Merk team with significant experience in advanced research and analysis of macro-economic factors, as well as in identifying how economic trends impact investors. As Chief Economist and Global Strategist, he is responsible for heading Merk research and analysis and communicating the Merk Perspective to the markets.

Mr. Brusuelas holds an M.A and a B.A. in Political Science from San Diego State and is a PhD candidate at the University of Southern California, Los Angeles.

Before joining Merk, Mr. Brusuelas was the chief US Economist at IDEAglobal in New York. Before that he spent 8 years in academia as a researcher and lecturer covering themes spanning macro- and microeconomics, money, banking and financial markets. In addition, he has worked at Citibank/Salomon Smith Barney, First Fidelity Bank and Great Western Investment Management.

© 2008 Merk Investments® LLC

The Merk Hard Currency Fund is managed by Merk Investments, an investment advisory firm that invests with discipline and long-term focus while adapting to changing environments. Axel Merk, president of Merk Investments, makes all investment decisions for the Merk Hard Currency Fund. Mr. Merk founded Merk Investments AG in Switzerland in 1994; in 2001, he relocated the business to the US where all investment advisory activities are conducted by Merk Investments LLC, a SEC-registered investment adviser.

Merk Investments has since pursued a macro-economic approach to investing, with substantial gold and hard currency exposure.

Merk Investments is making the Merk Hard Currency Fund available to retail investors to allow them to diversify their portfolios and, through the fund, invest in a basket of hard currencies.

Joseph Brusuelas Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.