Cryptos: What the "Bizarre" World of Non-Fungible Tokens May Be Signaling

Currencies / cryptocurrency Jun 19, 2021 - 11:31 AM GMTBy: EWI

The world of cryptos includes something known as non-fungible tokens, which go by the acronym NFTs.

If you're unfamiliar with them, they're a bit bizarre but quite simple. Here's what the April Global Market Perspective, a monthly Elliott Wave International publication which covers 50+ worldwide financial markets, noted:

Investors' manic behavior has expanded to include non-fungible tokens, paying large sums of money for essentially a picture of something.

Getting more detailed, "a non-fungible token is a unique identification code that is affixed to a [digital] asset using blockchain to distinguish it from all other [digital] assets."

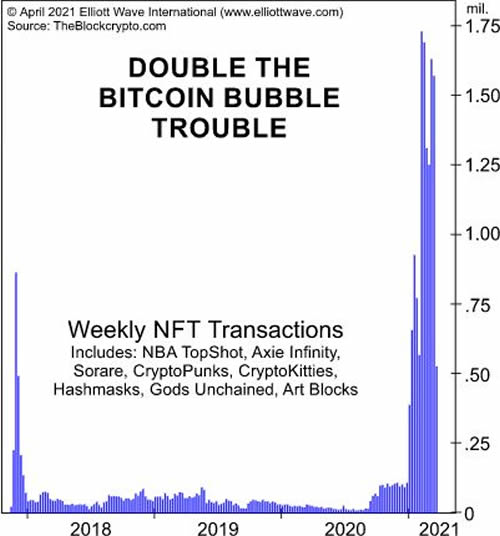

The April Global Market Perspective provided more insight with this chart and commentary:

The chart shows the performance of one of the most unseasoned of all collectibles, the non-fungible token (NFT), which first hit the market in December 2017. ... In addition to rocketing prices, NFTs surged into the culture at large with tokens tied to everything from basketball and football players to Passover and a Saturday Night Live skit. Capping the rage is a "digital collage" of bizarre, post-apocalyptic images called Everyday, which sold for $69.3 million through Christie's on March 10.

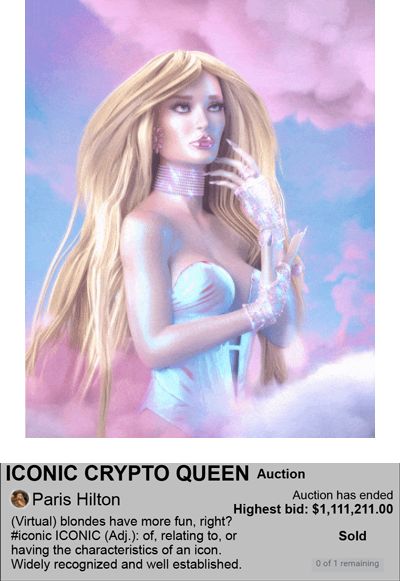

Well, the NFT craziness has persisted, as the May Global Market Perspective followed up by showing this NFT and saying:

Apparently, NFTs are still a thing. Paris Hilton, who is famous for being famous, garnered a bid of $1,111,211.00 for this Iconic Crypto Queen token on [April 25]. The absurdity of it all is not lost on everyone. "Each market frenzy seems crazier than the last," says MarketWatch.

As for one of the latest developments, on June 10, Barron's showed this image under the headline:

'Covid Alien' CryptoPunk Sells for $11.75 million in Sotheby's Sale

The reason for pointing out investors' interest in non-fungible tokens is to emphasize the level of financial mania that has been reached.

The monthly Global Market Perspective employs Elliott wave analysis to forecast what's next for cryptos, global stock markets, rates, metals, energy, forex and much more.

If you'd like to learn how the Wave Principle can help you analyze financial markets, you are encouraged to read Frost & Prechter's Wall Street classic book, Elliott Wave Principle: Key to Market Behavior. Here's a quote from the book:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or "waves," that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market's position within the behavioral continuum and therefore about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market's general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable.

Good news! You can read the entirety of the online version of the book for free!

All that's required for free access to Elliott Wave Principle: Key to Market Behavior is a free Club EWI membership. Club EWI members enjoy free access to a wealth of Elliott wave resources on investing and trading.

Just follow this link and you can have the online version of this Wall Street classic on your computer screen in moments: Elliott Wave Principle: Key to Market Behavior -- free and unlimited access.

This article was syndicated by Elliott Wave International and was originally published under the headline Cryptos: What the "Bizarre" World of Non-Fungible Tokens May Be Signaling. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.