Are US Inflation Fears Destabilising the Global Markets?

Economics / Inflation May 27, 2021 - 11:05 AM GMTBy: Sumeet_Manhas

The US dollar has enjoyed renewed highs of late, with this trend at least partially the result of forex positioning and a pronounced increase in net short positions as investors brace themselves for a depreciation in the value of the greenback.

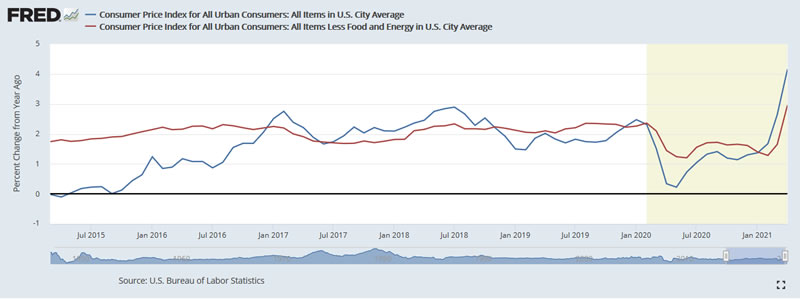

However, this also betrays rising rates of US inflation, which recently peaked at 2.6% and pushed the dollar even higher against both the pound and the Euro.

But are rising inflation fears beginning to destabilise the global markets, and what does this tell us about the influence of inflation on stocks and shares throughout the world?

How is Increased Inflation Impacting on the World’s Markets?

There have certainly been clear warning signs pertaining to increased inflation levels, with soaring commodity prices offering a relevant case in point.

More specifically, copper and iron ore have achieved brand new price highs in recent weeks, particularly as economies across the globe have begun to reopen and more than 355 million (or 4.6%) of the world’s population have now been vaccinated against the coronavirus.

While this is good news for some traders who may deal in commodities through the MT4 trading platform, it has also fuelled concerns that inflation is set to spike as products become more expensive (and quantitative easing measures are subsequently reversed).

Such uncertainty is definitely undermining the world’s markets, with the FTSE 100 shedding 2.5% last week as US inflation increased and precipitated a tech sell-off in North America and Asia.

US markets also slumped lower, declining by approximately 1% in early trading on Friday as leading tech stocks such as Tesla and Google’s parent company Alphabet were also the subject of a sudden selling frenzy.

Will Inflation Weigh Heavily on the Markets in Q3?

Of course, the US central bank has spent much of the last two weeks striving to reassure markets, reporting that any rise in inflation is likely to be transitory and not deserving of any immediate monetary policy or action.

This is an important assertion; as any widespread focus on curbing inflation could see a sudden hike in base interest rates, placing a potential squeeze on consumer spending and undermining market growth as the world’s economies continue to reopen.

However, this has done little so far to assuage risk-averse investors, particularly as commodity prices soar and customers begin to spend a little more as their personal fortunes improve.

The release of US inflation figures has also cast doubt over rising prices stateside, while the equity sell-off present amongst large tech stocks is helping to establish a cycle of uncertainty and risk aversion.

Another exacerbating factor is the recent rise of factory-gate inflation rates in China, which are now growing at their fastest pace since 2017.

Ultimately, there’s no doubt that rising inflation is creating uncertainty in the world’s stock markets, with the US once again at the epicentre of this trend.

By Sumeet Manhas

© 2021 Copyright Sumeet Manhas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.