How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond - Part 2 of 2

Companies / Investing 2021 May 18, 2021 - 06:56 PM GMTBy: Nadeem_Walayat

Dear Reader

This is part 2 of 2 (part1) of my investing high risk tech stocks analysis that was first made available to Patrons who support my work: How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond

- Covid Current State

- How to Get FREE Access to My Patreon Content for the Next 5 Years!

- Dow Stock Market Dow Trend Forecast Current State

- Stocks Bear Market / Crash Indicator (CI18)

- AI Stocks Lead the Bull Charge

- King Zuckerberg Tech Companies to Set up their own Governments!

- Best AI ETF ?

- INVESTING IN HIGH RISK TECH STOCKS

- THE ONLY WAY TO GET THE BIG PAY OFFs

- High Risk Tech Stocks Short List

- TESLA DISCOUNTING THE FUTURE

- 4 More High Risk Tech Stocks

- Who Wants to live Forever?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my most recent analysis - AI Stock Buying Levels, Ratings, Valuations and Trend Analysis into Market Correction

Contents:

- TESLA

- Cathy Wood ARK Funds CRASH!

- India Apocalypse Heralds Catastrophe for Pakistan and Bangladesh

- Covid-19 in Italy in August 2019!

- Stock Market Early Summer Correction Trend Forecast

- Stocks Expensive or Cheap Indicator (EC)

- AI Stock Buy % Rating Review

- 1. GOOGLE - $2398

- 2. AMAZON - $3312

- 3. MICROSOFT - $252.5

- 4. APPLE - $130

- 5. FACEBOOK - $320

- 6. NVIDIA - $592.5

- 7. AMD - $78.8

- 11. IBM - $145.5

- 12. INTEL - $57.7

- AI Stocks Buying Levels Update May 2021

- So what am I going to do

- GPU Mining FREE MONEY!

- CHIA Crypto Farming with Your Hard Drives Insanity!

As well as access to my recent exclusive to Patrons analysis

LEARN TO INVEST - When to Buy and Sell AI Tech Stocks Such as GOOGLE

Topics covered Include:

- Stock Market Correction Time Window

- INDIA APOCALYPSE

- FREE ACCESS TO MY PATREON CONTENT FOR SEVERAL YEARS!

- GOOGLE Numero Uno

- Why I Don't Even think about Selling Stocks such as Google

- Google Opportunities in Stock Price Volatility

- What Happens When One Sells Stocks One Wants to Remain Invested in for the Long-run?

- RISK Of LOSS

- How long to Invest For?

- UNDERSTAND THE AI MEGA-TREND

- Investing in Chinese Stocks - Baidu, Tencent etc.

- INVESTING IN GOOGLE

- BITE THE BULLET

- The Inflation Mega-trend

- Why Buying the Dip Can be More Dangerous than Buying the High

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- More High Risk Tech Stocks - 30% done

- Bitcoin Trend Forecast - 40% done

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

DISCLAIMER - The analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities

INVESTING IN HIGH RISK TECH STOCKS - ALL OR NOTHING

There is a reason why I don't like discussing investing in high risk stocks and it's nothing to do with the fact that I DO invest in high risk stocks to a limited degree. And that reason is because most of the people I converse with DO NOT UNDERSTAND HOW TO INVEST IN HIGH RISK STOCKS! So my preference is to avoid the subject altogether and stick to discussing that which has a high probability of success and low relative risk of loss. Though the stock market being what it is one never know when the likes of for instance a BP is going to EXPLODE! So stocks can never be risk free no matter what the stock is.

So the starting point before I fire off a list of high risk tech stocks is to explain how I invest in high risk stocks and hopefully my Patrons will be able to incorporate what I am saying into how they view high risk stocks for I have given up on trying to explain to people in the real world, including highly intelligent doctors, as there tends to be a mental block where high risk stocks are concerned i.e. people tend to look in the rear view mirror and see how x or y stock has soared into the stratosphere and thus think it is easy to be placed in for instance the next Tesla or TSM or AMD or whatever. Without understanding the fundamental fact that even if by chance they had invested in say AMD at $2, they would NOT be invested in AMD today at $80 because their short-term mindset would have likely ejected then from the stock at $3 or $4. That's why the starting point has to be to explain how I actually invest in high risk stocks which given exchanges with people tends to be the exact opposite of how many investors perceive high risk stocks and likely why they don't end of up capitalising fully on their investments.

Firstly investing in high risk stocks is taking an educated GAMBLE! The facts that we are able to glean about a business are usually mostly hype that barely scratches the surface of what's actually going on under the hood, so it is a GAMBLE!

And where gambles are concerned one should be prepared to lose every penny one has invested in the HIGH RISK STOCK which thus demands a DIFFERENT INVESTING STRATEGY AND MINDSET to that which one expects when investing in for instance a steady as she goes stock such as Microsoft.

Secondly, whilst I have invested in a good 20 high risk stocks over the past three decades, I DO NOT MONITOR THEM! Why because about a 1/3rd of them have gone kaput, and I think some were taken over and I got paid that way, another third are trading near peanuts, whilst the remaining third have soared into the stratosphere! Risen by thousands of percent! Which is why you should NOT MONITOR THEM!

I don't even remember most of those that have disappeared from my stocks portfolio for whatever reason. Though one that comes to mind is 32red, I bought the stock well over a decade ago because at the time I enjoyed playing online poker so I thought this is going to get BIG, but not long after buying SODS LAW happens! The US changed their gambling laws that blew a hole in 32reds business model, so the stock went bad, losing about 80% of its value, and that's where it sat for a good 10 or so, until out of the blue it got taken over and I ended up making a small profit! Imagine if I had monitored the stock and decided to cut my losses on any of the string of the short lived bounces that it experienced, none of which ever got the stock to where I had bought it.

In fact in my experience this is tends to be the ultimate fate of most good high risk stocks that they eventually tend to to get taken over or rather eaten by the big sharks in the corporate ocean.

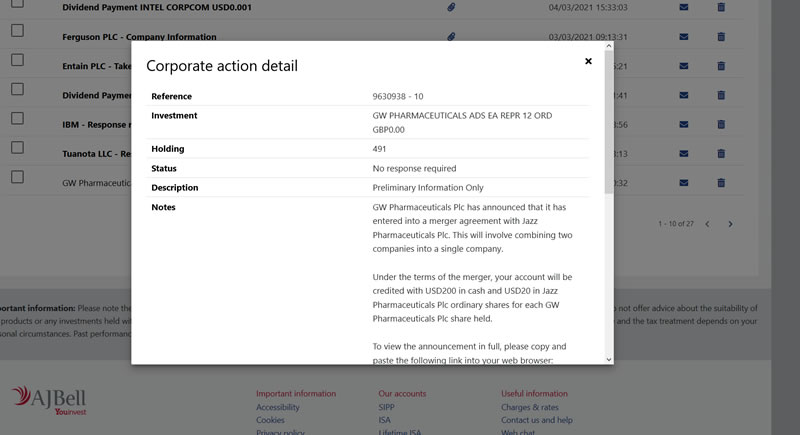

In another example I logged into my SIpp account recently and saw a message that one of my long-term high risk stocks that I bought for peanuts god knows when, well over 10 years ago, is now being taken over (merger) apparently I am going to get $200 CASH PLUS $20 in shares in the new company per share held, this is going to flood my account with cash when it happens later in 2021.

If it happens, it happens and I get my payout. If it does not, no big deal I'll leave it for another decade. This is what happens when you INVEST AND FORGET. You are getting a valuable lesson here which YOU should pay attention to! INVEST AND FORGET. Imagine if I had not followed this strategy and decided to take profits on GW Pharma when it was trading at say 1/5th it's current price!

THIS IS THE STRATEGY! Some stocks will go bust, some will just flounder forever, whilst a few will soar into the stratosphere. And the only way your going to get the payoff is by NOT MONITORING THE STOCKS! ELSE YOU WILL EXIT BEFORE THE BIG PAYOFF. And that is how I invest in high risk stocks which tends to be the complete opposite mindset to many investors who I brush up against who expect a small cap high risk stock to give them huge gains in the immediate future when that is not how it tends to work.

Do the work, select what one thinks should turn out to be good stocks, take a small stake and forget about it, maybe check on them once every few years, or if one needs the money.

But what one does not do is to SELL a good stock that is rising. That's not how to play this game. Well in my opinion and experience of investing in high risk stocks.

THE ONLY WAY TO GET THE BIG PAY OFFS IS TO INVEST AND FORGET!

DON'T LOOK AT THE CHARTS, THEY WILL MAKE YOU EXIT BEFORE THE BIG PAYOFF, WHY? BECAUSE HIGH RISK STOCKS ARE VOLATILE! THE CHARTS WILL BE STOMACH CHURNING SO DO NOT LOOK AT THEM! I DON'T. Until today the last time I looked at GW Pharma's stock chart was probably a good 5 years ago because it is not on my mind what the stock price is doing because I am not looking at it at ALL! And that's how one invests in high risk stocks!

Not to get obsessed by the day to day gyrations of for instance Tesla. That is a recipe for investing disaster!

ELSE stick to the regular portfolio of 'safe' AI stocks that trend.

INVEST AND FORGET BECAUSE TIME IS YOUR BEST FRIEND WHEN INVESTING IN HIGH RISK STOCKS WHILST THE PRICE CHART IS YOUR WORST ENEMY!

Which is the EXACT opposite to what inexperienced investors tend to do, they seek out news on penny stocks because they perceive them as being cheap and so imagine they could easily double or triple or more in price in a short space of time. Plowing ridiculously large percentage of their portfolio into what are usually professional pump and dump operations, and then sit there watching every minute by minute tick in value of their investment yo-yoing all over the place as the recent GAMESTOP saga illustrates which any fundamental analysis of which would reveal it to be a BAD stock to invest in.

So

1. No matter how much work one does, one does NOT know which stocks will be the winners and which will be the losers.

2. One is NOT to monitor the stocks, one does not want to look at them because that's going make one make mistakes! One NEVER SELLS STRONG STOCKS! Because it will be from these few that take off where your real profits will be made. So there won't be buying levels or regular updates, because that is not the strategy here, perhaps updates once a year or so.

INVEST AND FORGET!

You can set the time period beforehand, say I will invest in x stock and then forget about it for 5 years, 10 years, maybe more. Personally I just invest and forget until I discover it's been taken over or something.

So high risk stocks ARE a gamble, where individually one does not know if they will survive but collectively there should be some winners in ones select bunch.

The only way to cope with the volatility is to have a small opening stake where it won't effect one if it goes to ZERO, hence why HIGH RISK stocks should be a small percentage of ones STOCKS portfolio\, something in the order of less than 10% in terms of the opening investment.

So train oneself NOT to monitor high risk stocks because VOLAILITY WILL BE VERY HIGH. They will be yo-yoing all over the place for reasons one will likely never be able to unfold.

And then one must NOT SEL the stocks that take off, understand that is how one gets PAID. If you sell your good stocks after a few percent then you may as well not bother investing..

That's how I invest in HIGH RISK STOCKS! I basically invest and forget, because I am not looking for 100%, or 200%, I am leaving it for several thousands of percent or nothing!

Unless you have a similar mindset then it's not going to work, you are going to end up focusing on your losers and selling the good stocks way too early in their long-term trend trajectories.

What matters when looking at a high risk stock is not earnings or trend, because they tend to lack both, what matters is what is the VISION of the company. What is it that the company is trying to do? Where is it trying to go. AI? yep that IS THE mega-trend of our age!

Cure cancer? Cure ageing? Gene editing? High risk bio-tech stocks have delivered thousands of percent to date.

How I Invest in High Risk Stocks

I either buy at the market or if not comfortable in doing use a a buy limit or set price alert to prompt me to act if the price trades down to a level where I am in fine to take the risk.

Again these are high risk stocks, and one does not know if they will come good or not, which only TIME will tell, so there is no rush in gaining exposure, so do not get bullied or panicked into investing especially in the light of media hysteria for instance that which surrounds the likes of Tesla. Take your time, and invest when one is okay with the risk vs reward.

High Risk Tech Stocks Short List

So from the shortlist of 19 stocks I am adding 5 stocks to TSM, and more in due course as the vision of where the corps are heading becomes clearer.

Adyen N.V. (ADYEY)

Afterpay Limited (AFTPY)

Corsair (CRSR)

CrowdStrike Holdings, Inc. (CRWD)

CuriosityStream Inc. (CURI)

DraftKings Inc. (DKNG)

DocuSign, Inc. (DOCU)

Green Dot Corporation (GDOT)

MercadoLibre, Inc. (MELI)

Opendoor Technologies Inc. (OPEN)

Pinterest, Inc. (PINS)

QuantumScape Corporation (QS)

Roblox RBLX

Sea Limited (SE)

Shopify Inc. (SHOP)

Square, Inc. (SQ)

StoneCo Ltd. (STNE)

Tesla, Inc. (TSLA)

Unity Software Inc. (U)

TESLA (TSLA) $684 - DISCOUNTING THE FUTURE

Unfortunately whilst Nikola Tesla invented our electric future he never capitalised upon it. Tesla stock has market cap of over $650 billion so it is hardly a small cap stock, but it is still what I consider to be very high risk which is born out by the volatility we see in it's stock price.

What's Tesla all about? Electric Cars! Which only scratch the surface when one looks at it's trend trajectory. What is Tesla trending towards?

1. Self Driving Cars

2. Batteries

3. Electricity Generation and Transport

And innovations in those key sectors are likely to drive Tesla's future profits, likely more than from EV's. AI systems in self driving cars, batteries for the storage of electricity and then generation and transportation of electricity to charge vehicles, generation in terms of solar power where households with electric cars use Tesla own solar power to charge their Tesla vehicles which many buyers will lap up, why because SELF DRIVING cars will be sold as INCOME generators just as Tesla SOLAR power is an INCOME generator for households, the sales pitch being your car will pay for itself and your solar will pay for itself whilst powering your home and changing your car for FREE! Think of the cars battery as part of your homes power bank, thus instead of having say a 10 kwh power bank you have say 80kwh which means your home has 80 kwh of stored energy to profit from by selling energy back to the grid at times of high demand and high prices. Your home car combo becomes a money generating power station for the national grid! I bet many of reading this are already starting to be sold on the idea even before being bombarded with the Tesla marketing hype! It's going to be like a chain reaction, most home owners are going to want a money generating self driving car solar powered home combo.

So Tesla could eventually come to be seen as an energy storage and generation company rather than an EV car company as Tesla continues to innovate in their solar generation materials space i.e. already Tesla is marketing the first generation of solar roof tiles. I for one would seriously contemplate installing Tesla solar roof tiles given that they are invisible installs even though North England is hardly suitable for solar power generation.

One things for sure for Tesla under Elon Musk has a lot of vision, maybe too much when one considers many of his moon shot or rather mars shot ideas, but as long as he stays grounded on earth with Tesla, I don't see why Tesla cannot increase it's market cap many multiples of it's current valuation.

To invest in Tesla or not. The forward PE Ratio is 170! And its 12 month high is $900 against it's 12 month low of $111 so very volatile!

Price to Book is 28.41 which is not too bad. Price to cash flow is 203 which is pretty bad, PEG ratio 4.8 which is pretty bad, I could go on but you get drift., Tesla is high risk no matter what Tesla's sales pitch and fan boys suggest.

What we would be investing in is the VISION of the Future which is for AUTONAMOUS SELF DRIVING CARS!

If one believes this to be the future than that is what one needs to discount the value of today!

The problem is it is not guaranteed that TESLA will deliver the FUTURE! Yes it might innovate the future into being BUT it could just as well end up being the likes of Toyota, Nissan, BMW, Volkswagen and General Motors who end up MAKING the future become manifest.

So the vision is highly probable, but it is not certain that it will be delivered by TESLA!

So an investment in Tesla is high risk, which means a small all or nothing stake, seeking to ride this roller coaster no matter what happens between today and 10 years from now.

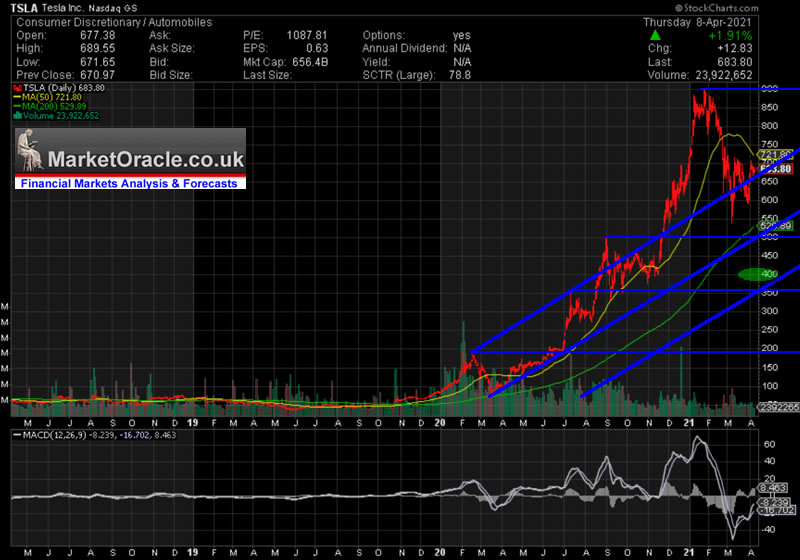

Tesla Chart Analysis

Tesla's bubble recently popped which saw the price plunge from $900 down to $540, currently trading at $683. The stock currently appears to be marking time before the next leg to new all time highs which on this chart it has already done 3 times before! That is what I bet most are expecting Tesla stock to do.

However, I suspect Tesla is in for a another leg lower that could see the stock trade down to as low as $400. Why? Because when a chart becomes too easy to read in a particular direction it implies that is not what it is going to be the most probable outcome. Repeating the same pattern for the fourth time would be too easy a market move.

What will I do?

I will put an alert on Tesla stock to take a look at it if or rather when it trades down to $400, and then consider buying the stock, but I am definitely not a buyer at $683 on a market cap of $650bn.

CORSAIR (CRSR) - $34

Invest in what you buy. The latest addition to my compute power is a 5950x RTX 3080 system that has Corsair 360mm radiator, a pair of Corsair MP600 NVME2 drives and a Corsair 1000 watt power supply. And that is why corsair is on this list, just as Nvidia makes the best GPU's, AMD best CPUs, ASUS the best mother boards, Corsair makes one of the best PSU's and cooling solutions and is trying hard to take the SSD drive crown from Samsung. I have been buying corsair components for a good 20 years! Especially cases, which is probably where they started out in the PC components world.

So Corsair has been around for a long-time but only very recently listed on the stock market in September 2020, so will be unknown to most retail and wall street investors. That and it is a small cap stock. But if you are into building PC's with quality components then you will know Corsair! So that is the starting point for my look at Corsair being placed on this list, because what they sell are good quality products and the market that it is feeding is growing exponentially - GAMING, GAMERs want the BEST components, the BEST GPU's, the BEST coolers, the BEST cases, the BEST CPUs, so Corsair is in a long-term AI Gaming driven growth industry, and Corsair is busy branching out of its core products that now includes NVME2 drives and it won't be long before we start seeing Corsair motherboards and maybe one day Corsair being an Nvidia board partner producing GPU's.

Furthermore it's not just the self building PC enthusiasts that corsair caters towards but has carved out a brand name for itself which means many of its key components, especially PSU's and cases are listed by most custom system builders.

Corsair at a $3bn market cap is a true small cap stock, even so it's financials are better than that of Tesla, Forward PE is just 23, Price to Cash flow is 17.

Corsair Chart Analysis

Corsair's IPO in September 2020 was at $15, following which it soared to $50 before correcting to $30 and currently has the stock trading at $34. The most probable pattern to expect to trade in its range of between $32 and $45 as I don't think it's going to be on most investors radar for some time given it's small size. Perhaps subject to speculative whims without understanding what Corsair truly is, it's not a gaming stock as it appears to be listed under it is more akin to a baby Samsung, Asus and such like so plenty of scope for growth.

The stock is in a trading range, sellers at the top and buyers at the bottom pending a breakout either on good news or speculators trying to drive a trend for short-term profit as they did with GAMESTOP, which is good because it will bring it to retail investors attention many of whom might realise it is a hidden gem. Though the stock may stay in it's trading range for some time.

What will I do?

I am DEFINETLY going to buy Corsair stock! I love the products it produces, and it is not over priced, the recent IPO means its flying under the radar of most investors though of course being newly listed means it lacks price history so higher risk. Anyway I will be buying a stake in this company at around its current price of $34.

DocuSign (DOCU) $212

DocuSign charges users recurring subscription fees for it's cloud e-signature service, sounds like a straight forward e-service company but for some reason it continues to remain darnn expensive on a forward PE of 155 and market cap of $40bn, similarly Price / Book is a hefty 122. I think it all boils down to the companies rate of increasing it's customer user base which is roughly increasing by 50% per year. Investors like to see rapid growth of an online companies user base. Digging deeper into why the stock is so expensive I see ARK has a invested $700 million in the stock, what do they see that I don't? Is Docusign becoming THE go to Brand for e-signatures like Google is the search engine?

DocuSign Chart Analysis

The stock took off like a rocket courtesy of the pandemic where everything with an e in it's business plan got heavily bid up, peaking at $290 and trading down to recent support at $190. On face value Docu should mark time in this trading range before the next big leg higher. However, I am not comfortable with the valuation. Especially as the next support below the $190 is all the way down to $100.

What will I Do?

I'm not going to pay a daft price, even if it does eventually breakout higher given brand dynamics. I'm only going to be interested in investing if the stock falls to about $120. So I am setting an alert on the stock at $122.

COINBASE (COIN)

This stock is not on my short list because it's not been listed on an exchange yet, it's IPO is on 14th of April 2021 so there is no trading chart. What is coinbase? You already know what coinbase is for I mentioned it earlier in this article. Coinbase is the primary US crypto currency exchange that profits from crypto transactions. According to it's prospectus Coinbase made $553mln in profit on revenue of $1.28bn for 2020, with projected revenues of $2 billion for 2021. So Coinbase should be off to a good start and are definitely doing something right.

And of course the stock price will be volatile as it will follow the booms and busts of the crypto currencies as transaction volumes ebb and flow. Still as long as it continues to grow it's user base then that 'should' act to leverage the stock to the bitcoin price because the more users it gains the more transaction revenues will be generated regardless of what the crypto prices do.

What Will I do?

I will have to wait and see what the valuation of the company is when it starts trading but I am definitely interested in gaining early exposure to this profit making crypto stock at something like 30 to 40 times earnings ($533mln) with 115 millions shares being listed that would put the target stock price at between $144 to $192. If it is trading beyond that range then I will probably wait until the next inevitable crypto bust materialises before consider investing at a better valuation. In fact the IPO could trigger a crypto sell off as investors sell bitcoin to buy Coinbase stock!

ROBLOX - RBLX $71

A true gaming stock, come on everyone knows what Roblox is? the online gaming social media platform. It had it's IPO in March and currently trades at $71 on a market cap of $35bn, forward PE is 110, and on a Peg ratio of 96 and made a loss of $1.2bn (hopefully that's due to investing in the platform). So not exactly cheap! However, no matter how bad the financials are and how expensive it appears, it reminds of once upon a time a company called Facebook that too was over priced at its IPO and look where that has risen to. Roblox IS a high risk stock that has exposure to one of the key mega-trends - GAMING.

Roblox Chart analysis

The stock started trading at $45, hit a high of $76 and has been in a trading range since of between $75 and $62.

What will I do

I want exposure but again don't want to pay a daft price, instead of $71 I would be willing to pay something like $40. I don't see how the stock is going to rally given its high valuation, especially in a post pandemic world where I am assuming growth in online gaming will slow following the 2020 surge. For now I am going to watch it's quarterly earnings to see if it is able to grow into it's market cap, or takes a tumble towards $40 and then decide to invest or not.

So in summary, the only new high risk stock I am going to invest in right now is Corsair. Coinbase remains pending it's first trading day price, and the others are pending better valuations.

I will continue to investigate high risk tech stocks to see what stand out as good long-term plays and let patrons know. And once more remember folks, investing in high risk stocks is VERY HIGH RISK! So expect price volatility else DO NOT Invest!

Who Wants to live forever?

A reminder of the balancing act that is the combating of the ageing process as we wait on AI Pharma to deliver the end to ageing magic pills - .July 2019 - Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies

1. EAT HEALTHY - Something I need to do more of.

2. EXCERCISE - Aerobic (weightlifting) and Aerobic (boxing), to keep young you want to emulate a young body by having a high lean mass body percentage. Easier during summer than the cold winter months when I personally tend to accumulate a pounds of flab that now needs shedding.

Here VR headsets such as the Oculus Quest 2 can be utilised to help shed the flab and build stamina.

3. Avoid Stress, meditation such as yoga helps reduce stress.

4. Supplementation - Metformin, Acetylcholine, Vitamin D (helps immune system combat covid-19) amongst others..

In fact a new study by the government of Ireland confirms what we have know for the duration of the pandemic that Vitamin D helps prevent respiratory infections which now recommends 1000 ui per day for ALL adults. Also recommends handing out vitamin D supplements at Covid-19 testing centres. A case of better late than never - Ireland Report. I have personally been taking 4000 ui most days since February 2020 as suggested to Patrons at the time, and a lesser dose less frequently before hand. And it's not just to combat covid but also ageing and mood disorders such as depression.

5. Boost NAD+ through supplementation with Nictotinamide Ribosome (NR) which is cheap! and NOT NMN which is over-hyped and over priced and probably does more harm than good.

6. Fasting from time to time to clear out senescent cells.

And as always do your own research before you start popping any pills!

Again this analysis was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my most recent analysis - AI Stock Buying Levels, Ratings, Valuations and Trend Analysis into Market Correction

Contents:

- TESLA

- Cathy Wood ARK Funds CRASH!

- India Apocalypse Heralds Catastrophe for Pakistan and Bangladesh

- Covid-19 in Italy in August 2019!

- Stock Market Early Summer Correction Trend Forecast

- Stocks Expensive or Cheap Indicator (EC)

- AI Stock Buy % Rating Review

- 1. GOOGLE - $2398

- 2. AMAZON - $3312

- 3. MICROSOFT - $252.5

- 4. APPLE - $130

- 5. FACEBOOK - $320

- 6. NVIDIA - $592.5

- 7. AMD - $78.8

- 11. IBM - $145.5

- 12. INTEL - $57.7

- AI Stocks Buying Levels Update May 2021

- So what am I going to do

- GPU Mining FREE MONEY!

- CHIA Crypto Farming with Your Hard Drives Insanity!

As well as access to my recent exclusive to Patrons analysis

LEARN TO INVEST - When to Buy and Sell AI Tech Stocks Such as GOOGLE

Topics covered Include:

- Stock Market Correction Time Window

- INDIA APOCALYPSE

- FREE ACCESS TO MY PATREON CONTENT FOR SEVERAL YEARS!

- GOOGLE Numero Uno

- Why I Don't Even think about Selling Stocks such as Google

- Google Opportunities in Stock Price Volatility

- What Happens When One Sells Stocks One Wants to Remain Invested in for the Long-run?

- RISK Of LOSS

- How long to Invest For?

- UNDERSTAND THE AI MEGA-TREND

- Investing in Chinese Stocks - Baidu, Tencent etc.

- INVESTING IN GOOGLE

- BITE THE BULLET

- The Inflation Mega-trend

- Why Buying the Dip Can be More Dangerous than Buying the High

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- More High Risk Tech Stocks - 30% done

- Bitcoin Trend Forecast - 40% done

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your vaccinated analyst

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.