Why the Demand for US Real Estate Licenses May Soon Fall into a Sinkhole

Housing-Market / US Housing May 18, 2021 - 01:09 PM GMTBy: EWI

By this measure, the housing boom may be nearing an end

A lot of people who've lost jobs have turned to getting their real estate licenses as a path to prosperity.

Part of the mindset that selling houses is worth a try is the belief that prices go up most of the time.

As the Wall Street Journal noted on March 21:

[S]urging prices are persuading tens of thousands more Americans to try their hands at selling real estate.

There have been many other periods of time when home prices have trended higher. However, that's not always the case. As you know, home prices sank significantly following the subprime mortgage meltdown of nearly a decade-and-a-half ago.

But, after that bear market in real estate bottomed, the number of those getting their real estate licenses climbed to new heights.

Yet, the pace is now slowing.

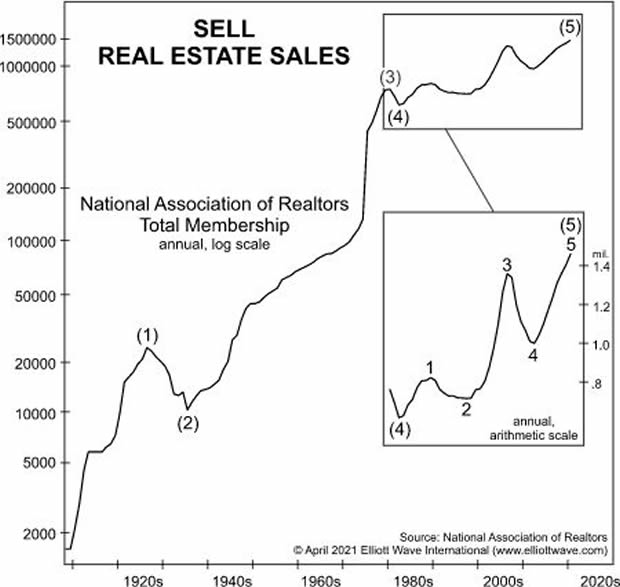

This chart and commentary from the May Elliott Wave Financial Forecast, a monthly publication which offers analysis of key U.S. financial markets, provide insight:

This chart shows the long rise of licensed [real estate] agents. By this measure, the rise of the great American dream can be traced all the way back to the beginning of the last century. The first two waves into the 1920s and the third wave through the inflationary 1970s were quite robust. In percentage terms, the fifth and final wave of the advance from 1983 is more muted, but the inset shows that in nominal terms, it traces out five waves.

Remember, when a fifth wave is complete, expect a turn in the opposite direction.

The question is: Is the trend in the demand for real estate licenses coinciding with the trend in the price of homes?

You are encouraged to read the May Elliott Wave Financial Forecast for insight into home sales and prices -- plus, get Elliott Wave International's analysis of stocks.

The stock market is relevant to real estate because financial history shows that stock prices and housing prices tend to be closely correlated.

If you'd like to learn how the Elliott wave model can help you analyze the stock market, you are encouraged to read the book, Elliott Wave Principle: Key to Market Behavior.

You can gain instant access to the online version of this Wall Street classic for free!

All that's required for free access is a Club EWI membership, which is also free. In case you haven't heard of Club EWI, it's the world's largest Elliott wave educational community (about 350,000 worldwide members.) Members enjoy complimentary access to a wealth of Elliott wave resources on financial markets and investing.

And, speaking of investing, here's a quote from Elliott Wave Principle: Key to Market Behavior:

Always invest with the preferred wave count. Not infrequently, the two or even three best counts comfortably dictate the same investment stance. Sometimes being continuously sensitive to alternatives can allow you to make money even when your preferred count is in error. For instance, after a minor low that you erroneously consider of major importance, you may recognize at a higher level that the market is vulnerable again to new lows. This recognition occurs after a clear-cut three-wave rally follows the minor low rather than the necessary five, since a three-wave rally is the sign of an upward correction. Thus, what happens after the turning point often helps confirm or refute the assumed status of the low or high, well in advance of danger.

Read the entire book to get a rich understanding of how the Wave Principle can help you navigate financial markets.

Just follow this link: Elliott Wave Principle: Key to Market Behavior -- instant and free access to the online version for Club EWI members.

This article was syndicated by Elliott Wave International and was originally published under the headline Why the Demand for Real Estate Licenses May Soon Fall into a Sinkhole. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.