INVESTING IN HIGH RISK TECH STOCKS - ALL OR NOTHING

InvestorEducation / Tech Stocks May 16, 2021 - 07:09 PM GMTBy: Nadeem_Walayat

There is a reason why I don't like discussing investing in high risk stocks and it's nothing to do with the fact that I DO invest in high risk stocks to a limited degree. And that reason is because most of the people I converse with DO NOT UNDERSTAND HOW TO INVEST IN HIGH RISK STOCKS! So my preference is to avoid the subject altogether and stick to discussing that which has a high probability of success and low relative risk of loss. Though the stock market being what it is one never know when the likes of for instance a BP is going to EXPLODE! So stocks can never be risk free no matter what the stock is.

So the starting point before I fire off a list of high risk tech stocks is to explain how I invest in high risk stocks and hopefully my Patrons will be able to incorporate what I am saying into how they view high risk stocks for I have given up on trying to explain to people in the real world, including highly intelligent doctors, as there tends to be a mental block where high risk stocks are concerned i.e. people tend to look in the rear view mirror and see how x or y stock has soared into the stratosphere and thus think it is easy to be placed in for instance the next Tesla or TSM or AMD or whatever. Without understanding the fundamental fact that even if by chance they had invested in say AMD at $2, they would NOT be invested in AMD today at $80 because their short-term mindset would have likely ejected then from the stock at $3 or $4. That's why the starting point has to be to explain how I actually invest in high risk stocks which given exchanges with people tends to be the exact opposite of how many investors perceive high risk stocks and likely why they don't end of up capitalising fully on their investments.

Firstly investing in high risk stocks is taking an educated GAMBLE! The facts that we are able to glean about a business are usually mostly hype that barely scratches the surface of what's actually going on under the hood, so it is a GAMBLE!

And where gambles are concerned one should be prepared to lose every penny one has invested in the HIGH RISK STOCK which thus demands a DIFFERENT INVESTING STRATEGY AND MINDSET to that which one expects when investing in for instance a steady as she goes stock such as Microsoft.

Secondly, whilst I have invested in a good 20 high risk stocks over the past three decades, I DO NOT MONITOR THEM! Why because about a 1/3rd of them have gone kaput, and I think some were taken over and I got paid that way, another third are trading near peanuts, whilst the remaining third have soared into the stratosphere! Risen by thousands of percent! Which is why you should NOT MONITOR THEM!

I don't even remember most of those that have disappeared from my stocks portfolio for whatever reason. Though one that comes to mind is 32red, I bought the stock well over a decade ago because at the time I enjoyed playing online poker so I thought this is going to get BIG, but not long after buying SODS LAW happens! The US changed their gambling laws that blew a hole in 32reds business model, so the stock went bad, losing about 80% of its value, and that's where it sat for a good 10 or so, until out of the blue it got taken over and I ended up making a small profit! Imagine if I had monitored the stock and decided to cut my losses on any of the string of the short lived bounces that it experienced, none of which ever got the stock to where I had bought it.

In fact in my experience this is tends to be the ultimate fate of most good high risk stocks that they eventually tend to to get taken over or rather eaten by the big sharks in the corporate ocean.

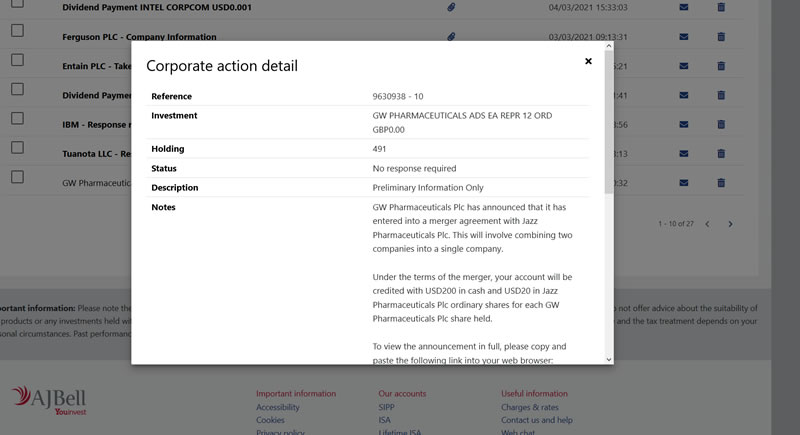

In another example I logged into my SIpp account recently and saw a message that one of my long-term high risk stocks that I bought for peanuts god knows when, well over 10 years ago, is now being taken over (merger) apparently I am going to get $200 CASH PLUS $20 in shares in the new company per share held, this is going to flood my account with cash when it happens later in 2021.

If it happens, it happens and I get my payout. If it does not, no big deal I'll leave it for another decade. This is what happens when you INVEST AND FORGET. You are getting a valuable lesson here which YOU should pay attention to! INVEST AND FORGET. Imagine if I had not followed this strategy and decided to take profits on GW Pharma when it was trading at say 1/5th it's current price!

THIS IS THE STRATEGY! Some stocks will go bust, some will just flounder forever, whilst a few will soar into the stratosphere. And the only way your going to get the payoff is by NOT MONITORING THE STOCKS! ELSE YOU WILL EXIT BEFORE THE BIG PAYOFF. And that is how I invest in high risk stocks which tends to be the complete opposite mindset to many investors who I brush up against who expect a small cap high risk stock to give them huge gains in the immediate future when that is not how it tends to work.

Do the work, select what one thinks should turn out to be good stocks, take a small stake and forget about it, maybe check on them once every few years, or if one needs the money.

But what one does not do is to SELL a good stock that is rising. That's not how to play this game. Well in my opinion and experience of investing in high risk stocks.

THE ONLY WAY TO GET THE BIG PAY OFFS IS TO INVEST AND FORGET!

DON'T LOOK AT THE CHARTS, THEY WILL MAKE YOU EXIT BEFORE THE BIG PAYOFF, WHY? BECAUSE HIGH RISK STOCKS ARE VOLATILE! THE CHARTS WILL BE STOMACH CHURNING SO DO NOT LOOK AT THEM! I DON'T. Until today the last time I looked at GW Pharma's stock chart was probably a good 5 years ago because it is not on my mind what the stock price is doing because I am not looking at it at ALL! And that's how one invests in high risk stocks!

Not to get obsessed by the day to day gyrations of for instance Tesla. That is a recipe for investing disaster!

ELSE stick to the regular portfolio of 'safe' AI stocks that trend.

INVEST AND FORGET BECAUSE TIME IS YOUR BEST FRIEND WHEN INVESTING IN HIGH RISK STOCKS WHILST THE PRICE CHART IS YOUR WORST ENEMY!

Which is the EXACT opposite to what inexperienced investors tend to do, they seek out news on penny stocks because they perceive them as being cheap and so imagine they could easily double or triple or more in price in a short space of time. Plowing ridiculously large percentage of their portfolio into what are usually professional pump and dump operations, and then sit there watching every minute by minute tick in value of their investment yo-yoing all over the place as the recent GAMESTOP saga illustrates which any fundamental analysis of which would reveal it to be a BAD stock to invest in.

So

1. No matter how much work one does, one does NOT know which stocks will be the winners and which will be the losers.

2. One is NOT to monitor the stocks, one does not want to look at them because that's going make one make mistakes! One NEVER SELLS STRONG STOCKS! Because it will be from these few that take off where your real profits will be made. So there won't be buying levels or regular updates, because that is not the strategy here, perhaps updates once a year or so.

INVEST AND FORGET!

You can set the time period beforehand, say I will invest in x stock and then forget about it for 5 years, 10 years, maybe more. Personally I just invest and forget until I discover it's been taken over or something.

So high risk stocks ARE a gamble, where individually one does not know if they will survive but collectively there should be some winners in ones select bunch.

The only way to cope with the volatility is to have a small opening stake where it won't effect one if it goes to ZERO, hence why HIGH RISK stocks should be a small percentage of ones STOCKS portfolio\, something in the order of less than 10% in terms of the opening investment.

So train oneself NOT to monitor high risk stocks because VOLAILITY WILL BE VERY HIGH. They will be yo-yoing all over the place for reasons one will likely never be able to unfold.

And then one must NOT SEL the stocks that take off, understand that is how one gets PAID. If you sell your good stocks after a few percent then you may as well not bother investing..

That's how I invest in HIGH RISK STOCKS! I basically invest and forget, because I am not looking for 100%, or 200%, I am leaving it for several thousands of percent or nothing!

Unless you have a similar mindset then it's not going to work, you are going to end up focusing on your losers and selling the good stocks way too early in their long-term trend trajectories.

What matters when looking at a high risk stock is not earnings or trend, because they tend to lack both, what matters is what is the VISION of the company. What is it that the company is trying to do? Where is it trying to go. AI? yep that IS THE mega-trend of our age!

Cure cancer? Cure ageing? Gene editing? High risk bio-tech stocks have delivered thousands of percent to date.

This article is an excerpt form recant extensive analysis : How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond

Topics covered Include:

- Covid Current State

- How to Get FREE Access to My Patreon Content for the Next 5 Years!

- Dow Stock Market Dow Trend Forecast Current State

- Stocks Bear Market / Crash Indicator (CI18)

- AI Stocks Lead the Bull Charge

- King Zuckerberg Tech Companies to Set up their own Governments!

- Best AI ETF ?

- INVESTING IN HIGH RISK TECH STOCKS

- THE ONLY WAY TO GET THE BIG PAY OFFs

- High Risk Tech Stocks Short List

- TESLA DISCOUNTING THE FUTURE

- 4 More High Risk Tech Stocks

- Who Wants to live Forever?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis - AI Stock Buying Levels, Ratings, Valuations and Trend Analysis into Market Correction

Contents:

- TESLA

- Cathy Wood ARK Funds CRASH!

- India Apocalypse Heralds Catastrophe for Pakistan and Bangladesh

- Covid-19 in Italy in August 2019!

- Stock Market Early Summer Correction Trend Forecast

- Stocks Expensive or Cheap Indicator (EC)

- AI Stock Buy % Rating Review

- 1. GOOGLE - $2398

- 2. AMAZON - $3312

- 3. MICROSOFT - $252.5

- 4. APPLE - $130

- 5. FACEBOOK - $320

- 6. NVIDIA - $592.5

- 7. AMD - $78.8

- 11. IBM - $145.5

- 12. INTEL - $57.7

- AI Stocks Buying Levels Update May 2021

- So what am I going to do

- GPU Mining FREE MONEY!

- CHIA Crypto Farming with Your Hard Drives Insanity!

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- More High Risk Tech Stocks - 30% done

- Bitcoin Trend Forecast - 40% done

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.