Will Powell Lull Gold Bulls to Sweet Sleep?

Commodities / Gold and Silver 2021 May 02, 2021 - 05:05 PM GMTBy: Arkadiusz_Sieron

The Fed left its monetary policy unchanged. However, the lack of any action amid economic recovery is dovish – good news for gold.

The Fed left its monetary policy unchanged. However, the lack of any action amid economic recovery is dovish – good news for gold.

On Wednesday (Apr. 28), the FOMC has published its newest statement on monetary policy . The statement wasn’t significantly altered. The main change is that the Fed has noticed the progress on vaccinations and strong policy support, and that, in consequence, the economic outlook has improved.

Previously, the US central bank said that indicators of economic activity and employment “have turned up recently, although the sectors most adversely affected by the pandemic remain weak”, while now these indicators “have strengthened”, while “the sectors most adversely affected by the pandemic remain weak but have shown improvement”. So, the Fed acknowledged the fact that the economy has significantly recovered .

Similarly, the US central bank is no longer considering the epidemic as posing “considerable” risks to the economic outlook. Instead, the pandemic “continues to weigh on the economy, and risks to the economic outlook remain”. It means that the Fed has become more optimistic and does not see risks as considerable any longer. This is bad for the price of gold although it’s not a very surprising modification, given the progress in vaccinations. However, no hawkish actions will follow, so any bearish impact for gold should be limited.

Another important alteration is that inflation no longer “continues to run below 2 percent”, but it “has risen, largely reflecting transitory factors”. This would be normally a hawkish change with bearish implications for gold. But the Fed doesn’t worry about inflation and is not going to hike the federal funds rate anytime soon, even when inflation remains above the target for some time. As Powell pointed out, “the economy is a long way from our goals, and it is likely to take some time for substantial further progress to be achieved.” Thus, gold bulls may sleep peacefully .

Implications for Gold

Indeed, they can relax with Mr. Powell on guard. The Fed Chair has reiterated during his press conference that the US central bank is not going to tighten its dovish stance and reduce the quantitative easing:

It’s not time to start talking about tapering. We'll let the public know well in advance. It will take some time before we see substantial further progress. We had one great jobs report. It is not enough to start talking about tapering. We'll need to see more data.

Uncle Jay and his bedtime stories… about inflation that is only “transitory”. Once upon a time,

the PCE inflation [is] expected to move above 2% in the near term. But these one-time increases in prices are likely to have only transitory effects on inflation.

Well, sure. Nonetheless, this is the favorite story of central bankers all over the world told to naive citizens. Just wait for the April inflation readings – they will be something! Of course, it is going to be too early to declare persistently higher inflation, but I’m afraid that the Fed may be too carefree about such a possibility.

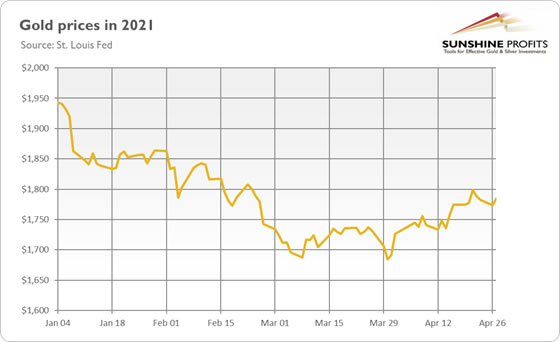

So, in the aftermath of the generally dovish FOMC meeting, the dollar slid yesterday, while the price of gold went up . Gold continued its recovery from the March bottom, as depicted in the chart below. This makes sense: after all, the Fed reiterated that it would maintain its current ultra easy stance for the foreseeable future, despite the fact of acknowledged improved economic outlook.

In other words, the Fed’s inaction made the US central bank more dovish given the better economic outlook and higher inflation. The statement’s language about the coronavirus and the economy was more optimistic, but inflation was considered to be transitory and no hawkish actions were signaled. So, the recent FOMC meeting should be positive for the gold prices from the fundamental point of view , although gold may continue its recent, generally lackluster performance for a while. Of course, the expansion of Fed’s accommodative monetary policy would be much better for the yellow metal, but the lack of any hawkish signals could still clean the room for gold for further upward moves.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.