How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond - Part1

Companies / Tech Stocks May 01, 2021 - 11:23 AM GMTBy: Nadeem_Walayat

Dear Reader

This article is part 1 of 2 of my recent extensive analysis : How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond

Topics covered Include:

- Covid Current State

- How to Get FREE Access to My Patreon Content for the Next 5 Years!

- Dow Stock Market Dow Trend Forecast Current State

- Stocks Bear Market / Crash Indicator (CI18)

- AI Stocks Lead the Bull Charge

- King Zuckerberg Tech Companies to Set up their own Governments!

- Best AI ETF ?

- INVESTING IN HIGH RISK TECH STOCKS

- THE ONLY WAY TO GET THE BIG PAY OFFs

- High Risk Tech Stocks Short List

- TESLA DISCOUNTING THE FUTURE

- 4 More High Risk Tech Stocks

- Who Wants to live Forever?

That was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my latest just published analysis most of which is exclusive to Patrons only -

LEARN TO INVEST - When to Buy and Sell AI Tech Stocks Such as GOOGLE

Topics covered Include:

- Stock Market Correction Time Window

- INDIA APOCALYPSE

- FREE ACCESS TO MY PATREON CONTENT FOR SEVERAL YEARS!

- GOOGLE Numero Uno

- Why I Don't Even think about Selling Stocks such as Google

- Google Opportunities in Stock Price Volatility

- What Happens When One Sells Stocks One Wants to Remain Invested in for the Long-run?

- RISK Of LOSS

- How long to Invest For?

- UNDERSTAND THE AI MEGA-TREND

- Investing in Chinese Stocks - Baidu, Tencent etc.

- INVESTING IN GOOGLE

- BITE THE BULLET

- The Inflation Mega-trend

- Why Buying the Dip Can be More Dangerous than Buying the High

Covid Current State

Firstly what's the current state of play in the deadly global pandemic game of vaccinate before the next Big variant wave hits.

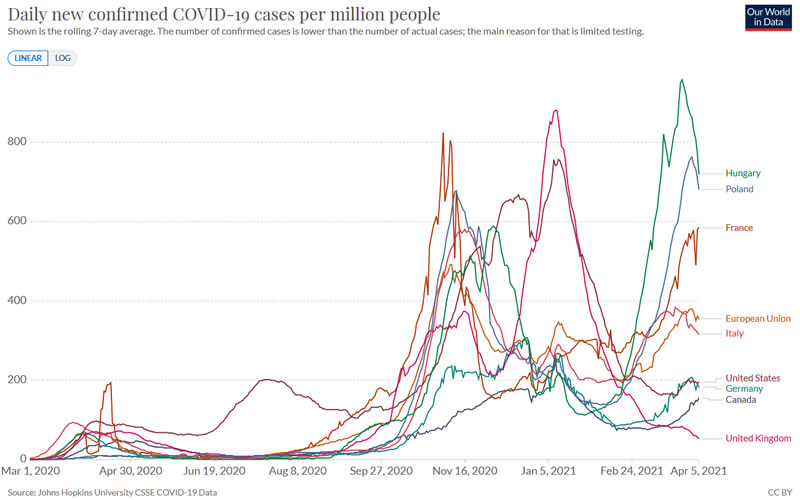

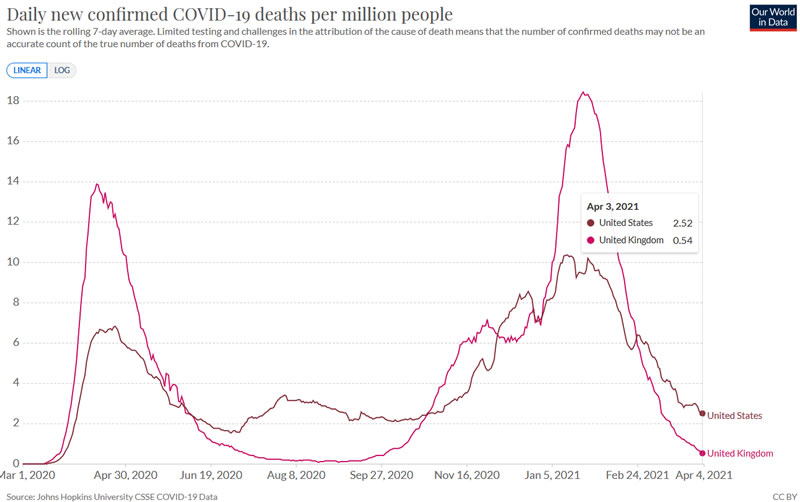

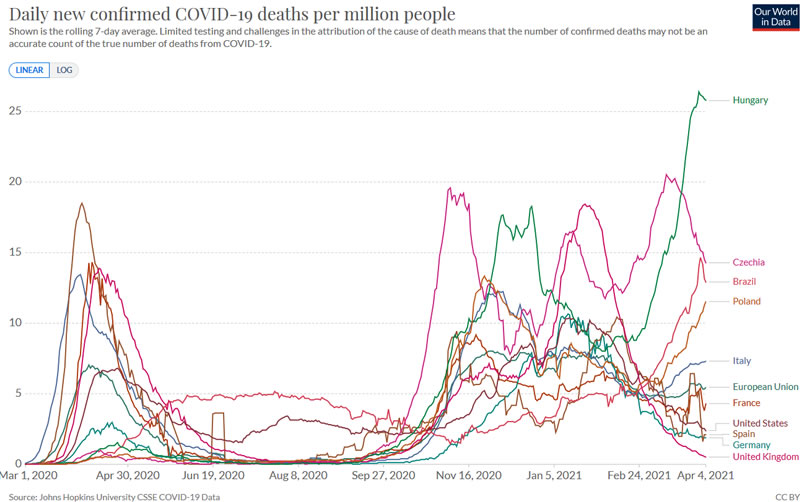

The UK and US are beating the Covid monster through the aid of their highly successful mass vaccinations programme, with so far the US being able to fend off the death consequences of the UK strain that is fast becoming the dominant strain across the states. meanwhile most of the European Union is suffering a third wave.

So whilst the number of cases WILL rise in the US, unlike the nightmare under the final year of the Trump Presidency, all the signs are pointing to a far less deadly outcome and thus both nations are converging towards the end of most of the major restrictions in day to day life that have crippled economic activity for many businesses. That and accelerated central bank money printing which has flooded the markets with asset price inflation.

And we only need to look at Europe to see what incompetent handling of the pandemic looks like, a European Union that is good at talking in endless meetings and conferences that has desperately sought to blame others for their own negligence in roll out of the vaccinations program with the villain being Astra Zeneca, despite the fact that they are in effect angels without whom many thousands more would have died in the UK alone.

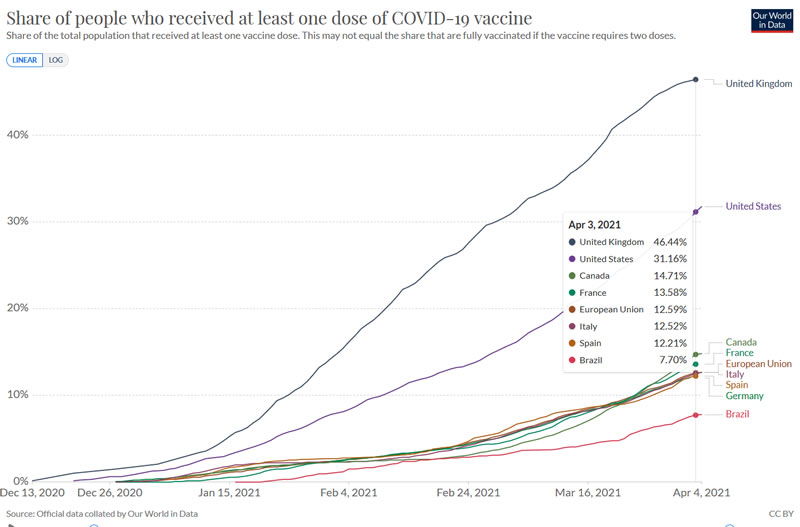

One only needs to look at the vaccinations graph for the reason why the UK and US are liberating themselves from covid restrictions just as many european nations are heading into new lockdown's.

I personally got my jab on the 19th of March (astrazeneca), was back to normal some 8 days later, with the first 12 to 24 being the worst in terms of side effects.

A centralised European Unions handling of the pandemic further illustrates why I and 52% of the British electorate were RIGHT to vote to escape from the event horizon of the EU black hole that is not fit for purpose, it just DOES NOT WORK! ESPECIALLY in a CRISIS! INCAPABLE OF ACTING SPEEDILY to meet the crisis be it a Pandemic or Financial or Economic Crisis! The EU JUST DOES NOT WORK!

How to Get FREE Access to My Patreon Content for the Next 5 Years!

The crypto mania is continuing to offer a short window of opportunity for likely only a few more months as Bitcoin continues to trade well above $50,000 which means virtually anyone with a decent GPU in their desktop PC can make easy money crypto mining in the background, and here's how my desktop PC is actually earning a net $6.50 per day crypto mining in the background, which within 3 weeks earned $136 net of UK electricity costs that resolves to $200 per month, more than enough to cover 5 years of Patreon fees at $3 per month ($180)!

Check out my video if you want FREE money, and yes my eyes rolled when I wrote that, sounds too good to be true. Though I do cover the risks in the video such as that the Bitcoin price WILL CRASH, and mining profits are GPU dependant. Nevertheless crypto mining in the background with Nicehash is generating $6.5 profit per day for me, so do look into crypto mining with your desktop PC whilst it lasts (referral link).

Video Contents:

00:20 Mining with NiceHash Intro

01:20 Limit GPU System Power Draw

02:58 3 Weeks Mining Earnings

03:38 Calculating Profitability

07:24 GPU settings for Mining in the background

08:46 Which GPU's are profitable

10:03 How long to crypto mine for

11:04 What to do with your bitcoin earnings

12.30 Spend Your Bitcoin when Price is High

13.30 Bitcoin Price Could CRASH

14:45 Mine whilst profitable to do so

16:33 What to do if Bitcoin Crashes

The bottom line is that the current free easy money crypto mining environment is time limited, how long will it persist for? Whilst I will do an analysis on the future prospects for the Bitcoin price in forthcoming piece. However, I don't see this crypto mania party extending much beyond 3 more months, especially as a major change is coming to Ethereum called EIP 1559 which will effectively halve the reward for miners. Note mining with NiceHash is actually done in Ethereum but the payout is in Bitcoin, more reason not to waste this time limited opportunity.

EIP 1559 and Raven Coin

And contemplating EIP 1559 and what it means for crypto mining then as Ethereum becomes more expensive to mine then that implies a shift in market hash power to the other crypto coins where likely a large beneficiary of which will be Ravencoin that could see a significant up lift in price. So, a strategy here could be to exchange ethereum mining today for Raven coin. Current price of Raven coin is $0.18. A large switch in market hash rate to raven coin could soon see it trade to over 50 cents, and likely a lot higher when the block rewards halve in January 2022 from 5000 raven coins to 2500 coins per block mined. So I will definitely be converting surplus bitcoins (about 15% of coins mined with NiceHash) into raven coin for the long-run, held with Nicehash until Coinbase decides to list RVN, maybe soon after their imminent IPO.

Fractional Reserve Bitcoining

And if you do mine don't hold onto your coins! SPEND THEM! And it's not just because the Bitcoin price could crash but that just as the banks only hold fractional reserves, so it is highly probable that the crypto exchanges, services such as Coinbase also only have fractional reserves. The only difference is the likes of the Fed will not bail them out if there is a run on the exchange. So be warned! These exchanges and digital wallet services likely don't have enough coins to honour all of their customer deposits where the best solution is to either SPEND or convert to fiat currency and send it to your bank account, whilst a hard wallet opens up a whole other can of worms, so keep it simple, mine it and then spend it! Else be prepared to be lose most of your holdings whenever they announce their "We've been hacked" fake stories to try and hide the fact that they have spent some of their customer holdings.

DISCLAIMER - The analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities

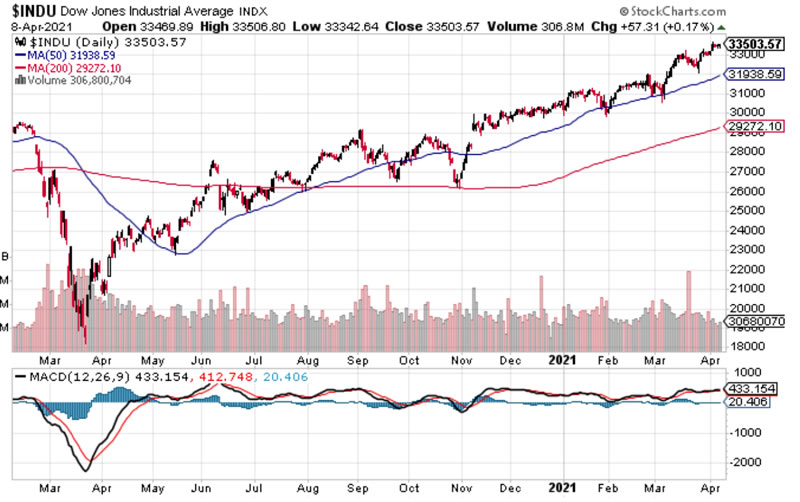

Dow Stock Market Dow Trend Forecast Current State

My trend forecast for 2021 as of the 8th of Feb analysis Dow Stock Market Trend Forecast 2021 is for a bull run to Dow 35k punctuated by a summer correction beginning early May as illustrated by the forecast graph for a gain of about 15% on the year.

The Dow currently stands at 33,503, a case of full steam ahead, literally climbing a wall of worry where a quick google on how this is being perceived by the blogosfear has the highly vocal doom merchants chasing their tails, tending to see every down day as a sign that the the TOP is IN! Which is why one should not pay attention to blogosfear!

(Charts courtesy of stockcharts.com)

So it's a case of full steam ahead into the window for a correction starting early May.

Stocks Bear Market / Crash Indicator (CI18)

Current Risk Remains VERY LOW at 5%, Recent lowest reading has been 15%. This Indicator is one of the neural nets I am working on as my AI takes baby steps into understanding how to interpret the stock market. It's task is to state the current risk of a bear market or crash being imminent i.e. within the next couple of weeks or so. So an independant technical indicator that acts as a warning to HEDGE stock portfolios ahead of further high probability drops in the market. Where my preferred hedging tool is to go short stock index futures so as to capitalise on any drop without selling any stock holdings, and delivering fresh funds to buy more AI stocks at deep discounts just as I did during March 2020. The last time this indicator triggered a warning was late February 2020, so it is NOT a trading indicator but instead advance warning that a correction already underway could turn into something worse so I need to hedge my stocks portfolio to some degree.

AI Stocks Lead the Bull Charge

let's see if the correction materialises so I can buy more stocks after the recent March dip in tech stocks that allowed me to pick up the likes of TSMC for $110, amongst several others on my target list including AMD and Nvidia, though Facebook failed to succumb to mainstream media hysteria instead took off like a rocket to currently stand at well above $300 which whether one likes it or not is precisely what one expects good stocks to do! Even the sleeping giant IBM broke out of it's year long trading range. Whilst Intel despite releasing a pile of garbage 11th Gen rocket lake processors, performing worse than their 10th Gen CPUs! That one would have thought would have resulted in weak hands selling out of their holdings and thus giving us a dip to below $50 to buy some more for the long-run, instead Intel has had a moon shot of its own trading towards 20 year highs! Hardly price action that one would expect from what I consider to be sleeping giants! Which is indicative of what's really going on under the hood that most still fail to grasp which is the exponential nature of the AI mega-trend and of course the rampant money printing inflation mega-trend. That and perhaps there aren't many weak hands left holding IBM and Intel stock.

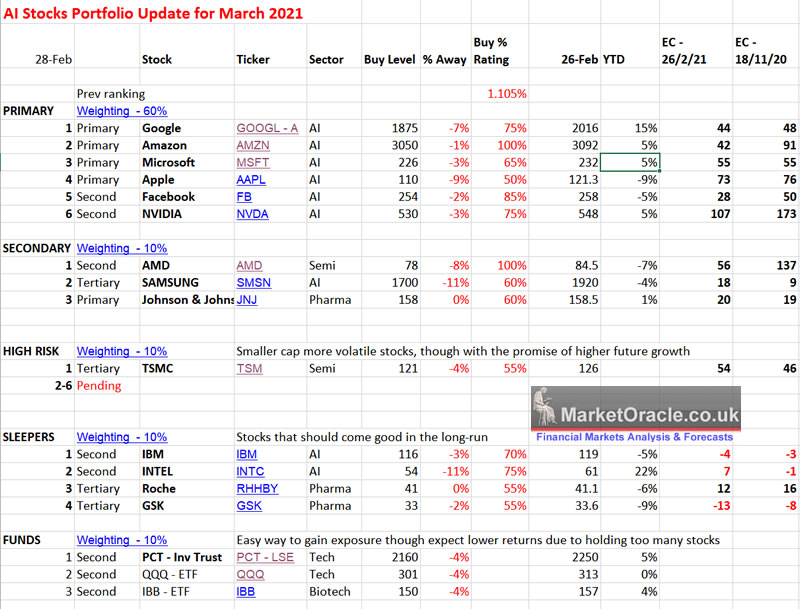

And here's a reminder of where the AI stocks stood at the time of my last extensive update - AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

King Zuckerberg Tech Companies to Set up their own Governments!

Aldus Huxley's Brave New world is taking another step towards becoming reality. What's the ultimate way tech companies can only be accountable to themselves? by making ALL of the rules, and I am not talking about congressmen and senators on their payrolls but companies becoming sovereign governments!

We'll that's what's happening in the United States right now! Nevada looks set to pass a bill that would allow companies to create governments, separate to the local government, and provide all the trappings that go along with being a government i.e. impose taxes, and maybe have their own AI powered militias, terminators patrolling the borders of the Republic of Google, whilst the workers go on their merry way oblivious to what lies beyond the Google frontier, much like the Hobbits in the Lord of the Rings blissfully living in their shires, whilst the Kings roamed the borders keeping the monsters out of their realms.

Best AI ETF ?

Before we jump head first into high risk tek stocks, lets take a collective intake of breath and consider an ETF that averages the risks. Normally I don't like etf's or any type of funds because they tend to sever the link to that which I seek to OWN. So one can imagine for instance that one is invested in Google, but your NOT, instead you are invested in the fund!

However, small cap tech stocks ARE high risk, and so if you have a shorter time horizon than you should have when investing in high risk stocks than a AI tech stock etf may prove useful.

Apart from the ETF's already mentioned in my AI portfolio

- QQQQ

- IBB

- PCT (own exposure)

ETF's on this short list are

- ROBO THNQ

- iShares U.S. Technology ETF - IYW

- iShares Exponential Technologies ETF - XT

Of the bunch I would go with ROBO, The ROBO Global Artificial Intelligence ETF, remember the goal of the ETF is to average the risk so with a mix of high risk stocks it also holds the usual tech giants such as Google and Microsoft but not in a big enough scale to dominate the portfolio, i.e. the tech giants probably account for less than 15% of the portfolio as the ETF adopts a AI sub sector exposure route, much as I have been focusing on for the past 5 years. Still it is wise not to put all of ones eggs into one basket so the ETF should form part of a portfolio in case something goes wrong with the ETF.

The ETF scales well with AI stocks, having more than doubled since the March low as much of the AI stocks had, though subsequently has under performed a somewhat which is the price one pays when investing in funds that tend to trade at discounts to their assets.

The rest of this extensive analysis : How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond has first been made available to Patrons.

- Covid Current State

- How to Get FREE Access to My Patreon Content for the Next 5 Years!

- Dow Stock Market Dow Trend Forecast Current State

- Stocks Bear Market / Crash Indicator (CI18)

- AI Stocks Lead the Bull Charge

- King Zuckerberg Tech Companies to Set up their own Governments!

- Best AI ETF ?

- INVESTING IN HIGH RISK TECH STOCKS

- THE ONLY WAY TO GET THE BIG PAY OFFs

- High Risk Tech Stocks Short List

- TESLA DISCOUNTING THE FUTURE

- 4 More High Risk Tech Stocks

- Who Wants to live Forever?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Latest analysis: LEARN TO INVEST - When to Buy and Sell AI Tech Stocks Such as GOOGLE

My analysis schedule includes:

- More High Risk Tech Stocks

- Bitcoin Price Trend Forecast

- AI Stocks Buying Levels Update

- UK House Prices Trend Analysis

- How to Get Rich!

- Learn How to Invest and Trade Reference Article

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

So again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst still profiting form crypto mining whilst the mania bubble lasts.

By Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.