Financial Stocks Sector Appears Ready To Run Higher

Stock-Markets / Banking Stocks Apr 29, 2021 - 03:02 PM GMTBy: Chris_Vermeulen

As we transition into the early Summer months, we are watching how different market sectors are reacting to the continued shifting of capital over the past 60+ days. One this is very clear, certain market sectors are strengthening while others have run into resistance and are consolidating. We believe the next few weeks and months will continue this type of trend where capital continues to shift away from risks and into sectors that show tremendous strength and opportunity.

We wrote about how Precious Metals are likely starting a new bullish price trend on April 18, 2021. You can read that research article here: https://www.thetechnicaltraders.com/metals-miners-may-have-started-a-new-longer-term-bullish-trend-part-ii/.

We wrote about how the recent bullish price trend was based on a “wall of worry” and how the markets love to climb higher within this environment on April 14, 2021. You can read that research article here: https://www.thetechnicaltraders.com/us-equities-climb-a-wall-of-worry-to-new-highs/.

We also published an article on April 11, 2021 suggesting the Cannabis Sector had reached a Pennant Apex and would likely begin a new bullish price trend after some “shakeout” price volatility near the Pennant Apex. You can read that research article here: https://www.thetechnicaltraders.com/is-the-cannabis-alternative-sector-rally-ready-to-breakout-again/.

XLF May Rally Another 8% – 10% Or More

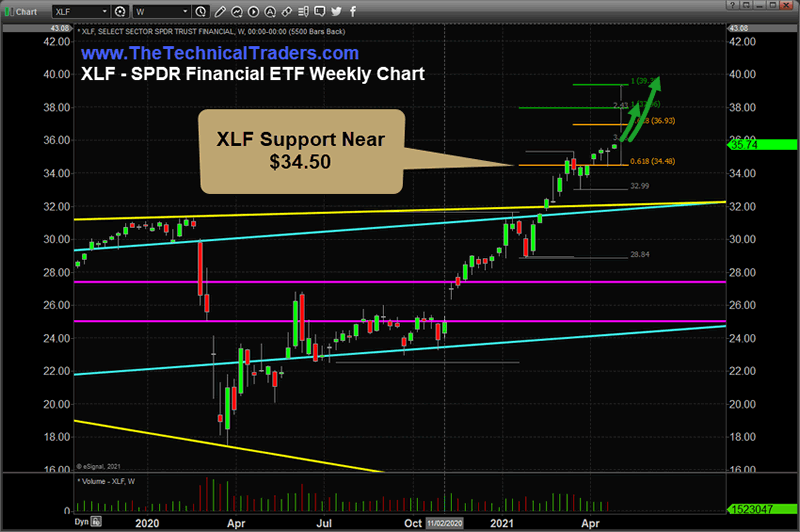

Today, we are revisiting a recent research article suggesting the Financial Sector may be poised for another rally trend targeting the $38.00 level first, then the $39.40 level based on our research. The financial sector continues to trend higher after the COVID-19 market collapse. Global central banks and government policies are very accommodating to stronger earnings and growth in the Financial sector. Recently, the US Government passed a new COVID stimulus bill that allocates money for at-risk borrowers to help elevate foreclosure actions.

It is very likely that these continued actions to support a stronger US and global recovery will translate into higher price trending in the Financial sector as we move into the Summer months – where weather and Summer activities push people back outside and into more active lifestyles.

Using our Fibonacci Measured Move technique, we have identified a support level in XLF near $34.50. Therefore, as long as price stays above this level, we believe a continued bullish price trend will push future prices towards the target levels near $38.00, then $39.40. We are watching for the next 0.61% Fibonacci level, near $36.93, to be breached as a sign the bullish price trend is accelerating.

Although the market may appear to be very extended and overbought, we still believe there is room to run for certain market sectors. XLF, MJ, GDXJ, SILJ, and many others have recently moved into our watchlist for new bullish trends. Are you ready for profit from these moves?

Our research team believes traders and investors need to be prepared for quickly shifting sector trends over the next 6+ months as this highly leveraged global market event plays out. Our research suggests a price rotation event is near and the global markets are still trending in a moderately strongly bullish trend. The strongest sectors are going to continue to be the best performers over time. Being able to identify and trade these sectors is key to being able to efficiently target profits. You can learn more about how I identify and trade these sectors by registering for my FREE course here.

For those who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you with daily market reports, research, and trade alerts. More frequent or experienced traders have been killing it trading options, ETFs, and stocks using my BAN Hotlist ranking the hottest ETFs, which is updated daily for my premium subscribers.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.