SPX Stock Market Short Squeeze – Here Or Not?

Stock-Markets / Stock Market 2021 Apr 25, 2021 - 02:52 PM GMTBy: Monica_Kingsley

S&P 500 turned around at the open, and didn‘t look back. Is the selling over, have the markets turned the corner? Buy the dip looks to have won the day, VIX has been beaten back, and corporate credit markets scored strong gains. The benefit of the doubt would go with the bulls as the Russell 2000 and emerging markets joined in the buying spree. Heck, even the option traders turned more complacent again.

The table looks set for brighter days, but it‘s the odd performance in value (the reopening fireworks don‘t seem to go stale ever really) ignoring retreating yields, which the tech heavyweights strangely neither rejoiced. That reminds me of the dog that didn‘t bark story. I‘m thus looking for a daily consolidation of surprisingly easily gained ground without ruling out a weak downswing attempt – but it‘s the upside potential that‘s looking short-term limited here. The daily SPX chart doesn‘t give me confidence yet to declare this correction as not returning next week.

Nominal yields have again retreated a little, and inflation expectations are sending inconclusive messages – but don‘t forget that inflation is what the Fed ultimately wants. It just has to balance that with the Treasuries market not going into a tailspin – for now, mission accomplished, inflation expectations have peaked, move along, nothing to see here.

But the higher commodity prices are sending a clear message to the contrary – look for the PPI readings to be affecting CPI increasingly more. Markets aren‘t waiting for the Fed, and have been transitioning to a higher inflation environment already, even though the Fed sold the transitory talking points quite well – it would indeed be a 2022-3 story when inflation supported by the overheating job market would kick in. That‘s the context decreasing nominal yields should be interpreted in.

Gold welcomes this reflation period with nominal yields becoming a tailwind, as reflation is also a time when commodities do great, not just the stock market. And we‘re in the decade of precious metals and commodities super bull runs – and these are well underway. The debasement of fiat currencies against real assets is set to continue, and will accelerate given the unprecedented fiscal and monetary support already and ahead – sorry dollar bulls, the greenback declines are resuming – just look at the yen and yields nodding to the metals upswing.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

The dip was bought right at the open yesterday, in a tentative sign of strength. A superficial one, precisely, for the correction might not be over.

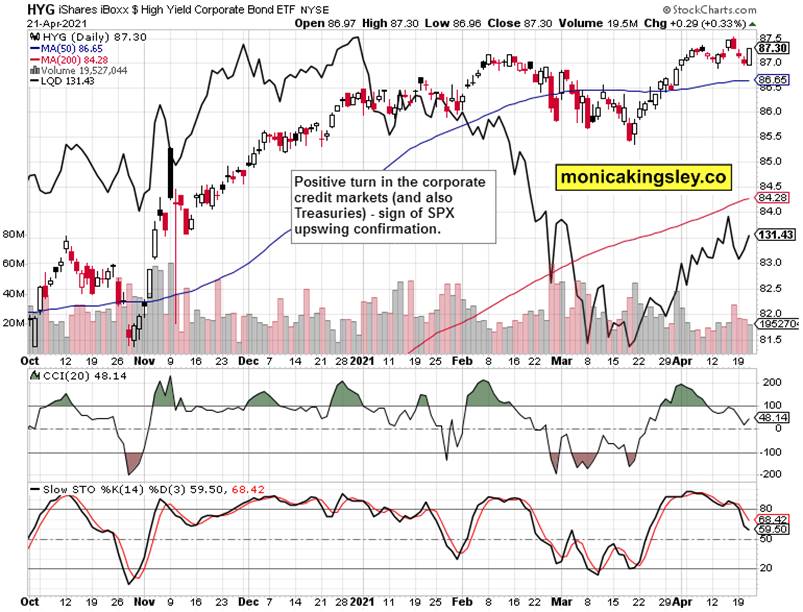

Credit Markets

Both the high yield corporate bonds (HYG ETF) and investment grade ones (LQD ETF) rose in tandem, but the volume wasn‘t entirely there – similar to stocks. Regardless of the sectoral imbalances discussed below, it‘s a strong argument for why any resumption of selling won‘t likely get too far.

Technology and Value

Value keeps pulling the 500-strong index ahead while the leadership in tech remains outside the woefully underperforming heavyweights. I‘m looking at that to change over time, though.

Gold and Silver

Gold upswing is still in a healthy shape, with miners outperforming. The retreating nominal yields have turned into a tailwind as gold gathers strength to break the $1,800 level shortly.

Yesterday was characterized by silver‘s strength, and that means an issue of varying proportions usually ahead. But I am interpreting the chart as a weak setback only, a very temporary one – this isn‘t any kind of turnaround.

Gold‘s Big Picture

This is the key chart proving that the precious metals upleg has started weeks ago – the caption says it all. Look for much higher prices ahead as weeks and months roll by.

Summary

The shallow S&P 500 consolidation won‘t likely continue today as another good unemployment figure came in, and I look for the sectoral imbalances to improve later today and tomorrow.

Gold and miners are taking a little breather, together with silver. Nothing unexpected or groundbreaking, the precious metals upleg is well established already, and $1,800 will be history as early as next week, when the rip your face off rally continues.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.