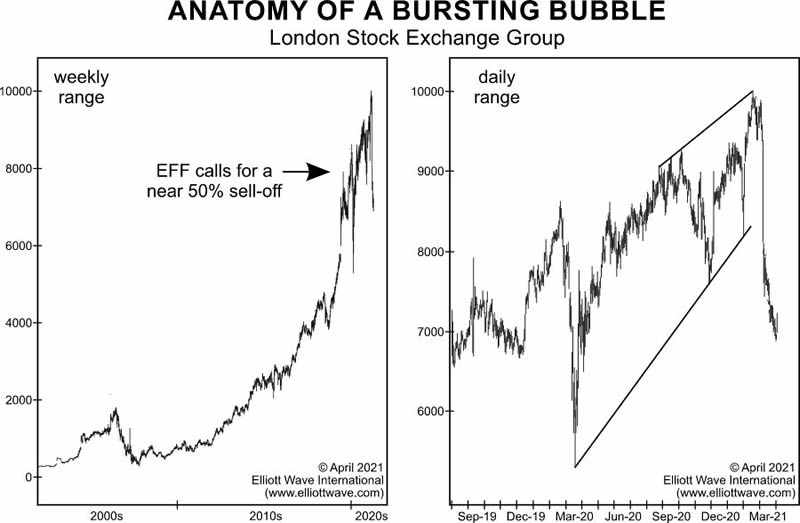

See what Anatomy of a Bursting Market Bubble looks like

Stock-Markets / Liquidity Bubble Apr 16, 2021 - 10:58 AM GMTBy: EWI

Those who are familiar with the Elliott wave model for analyzing and forecasting financial markets know that a main trend takes the form of five waves.

Thus, when the fifth wave is complete, a trend in the opposite direction is set to begin.

Another insight into the Wave Principle that's relevant to the present discussion is that corrections often end at the terminus of the previous fourth wave of one lesser degree of trend.

If that sounds like a mouthful, hold on, you're about to see a market example that'll make it plain as day.

Almost two years ago, the September 2019 Global Market Perspective, an Elliott Wave International monthly publication which provides analysis of 50+ worldwide markets, made this forecast:

The London Stock Exchange Group has been riding along an upward parabolic curve that has generated a 20-fold increase in the stock price since the late 2000s. Parabolic advances are inherently unsustainable, and this one is even more precarious given that we can count five waves up since the LSE's public debut. Once the rally breaks, an initial decline should pull prices back to a previous fourth wave ... implying a near 50% sell-off from today's levels.

Fast forward to this update from the just-published April 2021 Global Market Perspective (keep in mind that wave labels are only available to subscribers):

These two updated graphs show exactly how this forecast played out. The cited advance was the end of [a fifth-wave rally], which topped at 7922 on September 11, 2019. Prices [then] plummeted 39% in [a corrective wave] and bottomed above the previous-fourth wave price target.

The near-term chart on the right illustrates [another upward Elliott wave pattern], which began at the March 2020 low. After rising within two converging trendlines, LSE Group peaked on February 16, 2021. In March, the stock price tumbled 39% again.

This is just one example of many. Elliott wave analysis works for any widely traded financial market around the world.

As the Wall Street classic book, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter, says:

Without Elliott, there appear to be an infinite number of possibilities for market action. What the Wave Principle provides is a means of first limiting the possibilities and then ordering the relative probabilities of possible future market paths. Elliott's highly specific rules reduce the number of valid alternatives to a minimum.

If you would like to learn about "Elliott's highly specific rules," you can read the online version of Elliott Wave Principle: Key to Market Behavior, 100% free.

All that's required for free access to the book is a Club EWI membership. Club EWI is the world's largest Elliott wave educational community and is free to join. Members enjoy instant access to a wealth of Elliott wave resources on financial markets, investing and trading.

Get started by following this link: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline See This "Anatomy of a Bursting Bubble". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.