The Curious Stock Market Staircase Rally

Stock-Markets / Stock Market 2021 Apr 14, 2021 - 10:34 AM GMTBy: Monica_Kingsley

Another day of tiny S&P 500 gains defying gravity, boosted by overnight price action. Well, liquidity overpowering junk corporate bonds opening with a bullish gap only to partially close it. With some credit market hints at deterioration present, the yen carry trade is getting a new lease on life today, and that‘s generally bullish for risk-on assets such as stocks – but not really for precious metals.

With all the Fed support, the Powell bid is in, affecting „traditional“ sectoral dynamics of rotation. Value is probably about to feel the heat if you look at the very long lower knot in financials (XLF ETF) yesterday. Yes, this interest rate sensitive sector still rose in the face of long-dated Treasuries‘ gains. Needless to say, technology loved that, and its heavyweights ($NYFANG) keep driving the sector up. It looks to be a question of time before Tesla (TSLA) joins – Square (SQ) already did.

The key question is the rotation‘s degree – now that the yields appear ready to retreat still a little more (the 10-year yield appears targeting the low 1.50% figure if not declining further), which is what technology anticipates even though utilities and consumer staples have been dragging their feet a little lately. But value stocks aren‘t selling off in the least (yet?). Is the TINA still strongly in effect when those stock market segments that could have been expected under more stringent monetary policy to be sold, aren‘t no more? Rising tide lifting really all boats – in stocks.

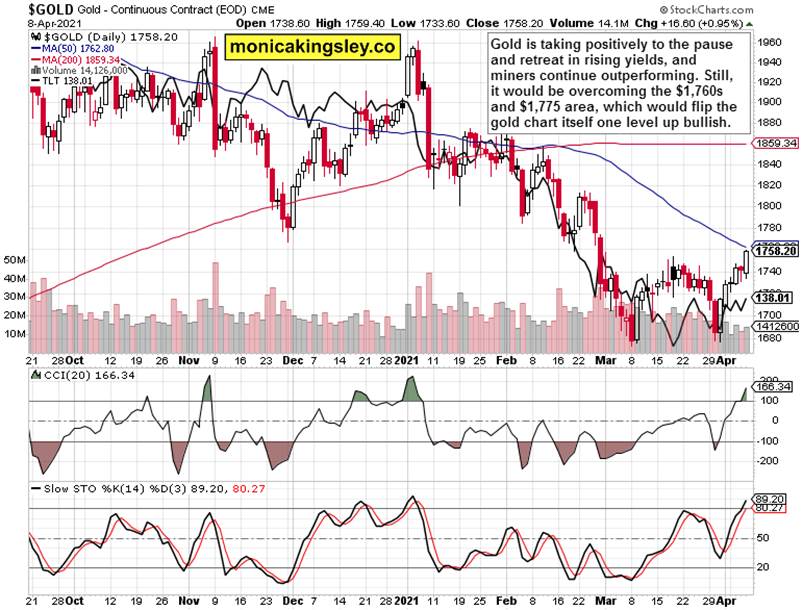

Gold has retreated from yesterday‘s almost $1,760 highs accompanied by continued miners‘ outperformance. That‘s likely on account of the yen getting under pressure today, even though gold defended the Mar 08 bottom in spite of $USDJPY peaking in the closing days of Mar. The yellow metal is still sensitively reacting to the nominal yield moves, which are serving as a tailwind – both in the short run and when you zoom out and add copper into the picture (final chart of yesterday‘s analysis).

One of the key things that I am still waiting for before declaring the gold bottom to be absolutely in, is its run above the key $1,760s or even better above $1,775 level. Let‘s though first watch for the miners not running out of steam.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

S&P 500 keeps hugging the upper border of Bollinger Bands, yet the willingness to trade at these extended levels has slightly returned yesterday. Hard to time any bear raid in these circumstances really.

Credit Markets

Very tight correlation indeed as the high yield corporate bonds to short-dated Treasuries (HYG:SHY) ratio keeps tracking the stock market moves. Not even the HYG volume picked up yesterday, making it impossible to call for a turnaround as investment grade corporate bonds (LQD ETF) keep rising in sympathy with TLT.

Technology and Value

Tech (XLK ETF) sprang to new highs on TLT erasing its Wednesday‘s losses while value again kept gained ground. Broad-based advance not pointing to much downside really unless $NYFANG turns in earnest.

Gold and Silver

Gold turned strongly higher on the retreat in rising nominal yields (even as inflation expectations ticked lower yesterday) and the yen tailwind, but the volume behind the rally off the second imperfect bottom, is quite weak overall (concerning).

Silver joined in yesterday‘s party, and both copper and platinum moved higher as well. Seeing the white metal not spiking yesterday is actually a positive sign of the precious metals upswing health, daily woes notwithstanding.

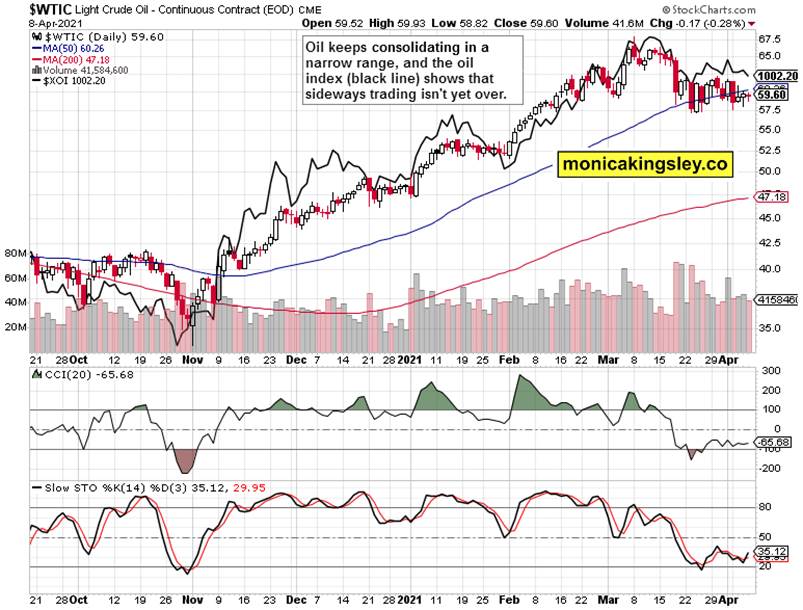

Crude Oil

Precious few directional signals in oil, yet higher prices are still favored by the oil index ($XOI). This consolidation is still relatively young, and not even a crash to roughly $52.50 would break the uptrend.

Summary

S&P 500 keeps consolidating in a vulnerable and stretched position, yet offers no signs of an immediate retracement of a portion of prior gains. The current setup is unfavorable for short-term oriented (bullish leaning) traders who prefer higher signal clarity to the tight correlation we‘ve seen this week.

After yesterday‘s fireworks, miners hold the key in today‘s session as the $1,760s are still a tough nut to crack – the precious metals‘ upswing health will be tested.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.