Stocks are Heating Up

Stock-Markets / Stock Market 2021 Apr 14, 2021 - 10:17 AM GMTBy: Paul_Rejczak

In keeping with its historical performance, April has started off white-hot. We ended March, and Q1 for that matter, with more questions than answers.

But April 2021 started with a blowout jobs report, and the indices haven't looked back since. Right now, the S&P 500 is at yet another record, the Dow is just about at a record, and we've seen a furious comeback for Big Tech and growth stocks.

The sentiment is certainly better now than it was just a couple of weeks ago. However, I implore you to remember that every month in 2021 thus far has started off hot and saw a pullback/volatility occur in the second half of the month.

Think about it. In January, we had the GameStop trade spooking investors. In February and March, we had surging bond yields, inflation fears, or Jay Powell comments that rubbed people the wrong way. These concerns won't just disappear because we want them to. If we could make things magically disappear, COVID would've been over yesterday.

But, as I mentioned before, April historically is a strong month for stocks. According to Ryan Detrick , chief market strategist at LPL Financial, "Other than my Cincinnati Bengals breaking my heart, few things are more consistent than stocks higher in April."

During April, the S&P 500 has gained in 14 of the past 15 years. April has also been the strongest month for stocks over the past 20 years.

The market concerns, though, are still intact. We still have to worry about inflation, bond yields, and stocks peaking. According to Binky Chadha , Deutsche Bank's chief U.S. equity strategist, we could see a significant pullback between 6% and 10% over the next three months.

Another thing I'm a bit concerned about is the $2 trillion infrastructure plan. While this is great for America's crumbling infrastructure, do we really need to spend any more trillions?

Plus, how do you think this will be paid for? Hiking taxes- namely corporate taxes . Those gains that high growth stocks saw after Trump cut corporate taxes in 2017 could very well go away. While President Biden has indicated a willingness to negotiate his 28% corporate tax proposal, it's still a tax hike.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

We're hot right now.

However, we could see more volatility and more muted gains than what we've come to know over the last year.

April is historically strong, but please continue to monitor inflation, yields, and potential tax hikes. Be optimistic but realistic. A decline above ~20%, leading to a bear market, appears unlikely. Yet, we could eventually see a minor pullback by the summer, as Deutsche Bank said.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Russell 2000- Still Buyable?

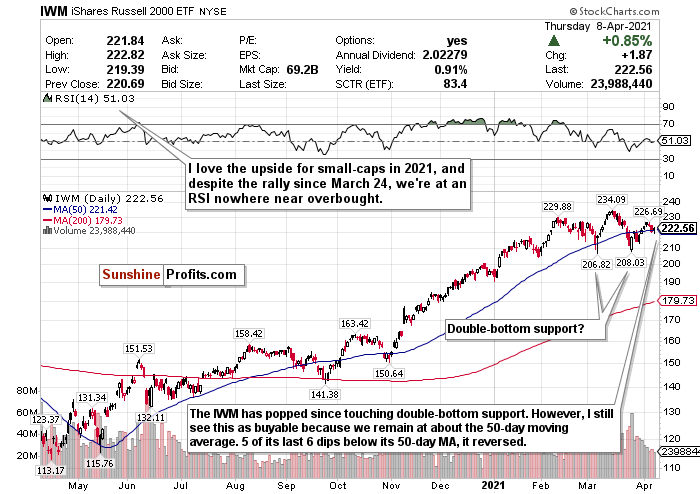

Figure 1- iShares Russell 2000 ETF (IWM)

I proudly switched my call on the iShares Russell 2000 ETF (IWM) to a BUY on March 24. I kicked myself for not calling BUY on the Russell after seeing a minor downturn during the second half of February and swore I wouldn’t make that mistake again.

We’re up to over 5% since then.

The climate right now supports the Russell 2000. The current economic policy is tailor-made for small-caps. The best part, though? The Russell is still very buyable.

The RSI is still hovering around 50. I also checked out the chart and noticed that almost every time the IWM touched or minorly declined below its 50-day moving average, it reversed.

Excluding the recovery in April from last year’s crash, 5 out of the previous 6 times the Russell did this with its 50-day, it saw a sharp reversal. The only time it didn’t was in October 2020, when the distance between its 50-day and its 200-day moving average was a lot more narrow.

Fast forward to now. The Russell 2000, despite its gains since tanking on March 23, remains right at about its 50-day moving average.

Aggressive stimulus, friendly policies, and a reopening world bode well for small-caps in 2021. I think this is something you have to consider for the Russell 2000 and maybe overpay for.

According to the chart, we may have found double-bottom support too.

Based on the chart and macro-level tailwinds, I feel that you can still BUY this index. In fact, it may be the most buyable of them all.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Matthew Levy, CFA

Stock Trading Strategist

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Matthew Levy, CFA, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Levy is not a Registered Securities Advisor. By reading Matthew Levy, CFA’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading, and speculation in any financial markets may involve high risk of loss. Matthew Levy, CFA, Sunshine Profits' employees, and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.