Top 5 AI Tech Stocks Investing 2021 Analysis

Companies / AI Apr 08, 2021 - 03:26 PM GMTBy: Nadeem_Walayat

This excerpt from of my most recent investing in AI tech stocks series focused on the top 5 AI stocks on my list, with remainder of the stocks to follow in part 3 to in about a weeks time. However the whole of this extensive analysis was first made available to Patrons who support my work:

AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

- AI Tech Stocks Buying Levels and Valuations 2021 Explained

- Coronavirus Pandemic Vaccines Indicator Current State

- Post Pandemic Summer 2021 Social Unrest ?

- Get Ready for Inflation Mega-trend to Surge 2021

- The AI Megatrend Big Picture

- Human Brain vs High End Desktop PC in 2021

- AI Stocks Investing 2021 - Top 14 Stocks Analysis

- AI Stocks Portfolio Table 2021

- Stocks Bear Market / Crash Indicator (CI18)

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

As well access to my latest analysis due to be posted within the next 24 hours - How to Invest in High Risk Tech Stocks for 2021 and Beyond

Firstly - How to Get FREE Access to My Patreon Content for the Next 5 Years!

The crypto mania is continuing to offer a short window of opportunity for likely only a few more months as Bitcoin continues to trade near well above $50,000 which means virtually anyone with a decent GPU in their desktop PC can make easy money crypto mining in the background, and here's how my desktop PC is actually earning a net $6.50 per day crypto mining in the background, which within 3 weeks earned $136 net of UK electricity costs that resolves to $200 per month, more than enough to cover 5 years of Patreon fees at $3 per month ($180)!

Check out my video if you want FREE money, and yes my eyes rolled when I wrote that, sounds too good to be true. Though I do cover the risks in the video such as that the Bitcoin price WILL CRASH, and mining profits are GPU dependant. Nevertheless crypto mining in the background with Nicehash is generating $6.5 profit per day for me, so do look into crypto mining with your desktop PC whilst it lasts (referral link).

Video Contents:

00:20 Mining with NiceHash Intro

01:20 Limit GPU System Power Draw

02:58 3 Weeks Mining Earnings

03:38 Calculating Profitability

07:24 GPU settings for Mining in the background

08:46 Which GPU's are profitable

10:03 How long to crypto mine for

11:04 What to do with your bitcoin earnings

12.30 Spend Your Bitcoin when Price is High

13.30 Bitcoin Price Could CRASH

14:45 Mine whilst profitable to do so

16:33 What to do if Bitcoin Crashes

The bottom line is that the current free easy money crypto mining environment is time limited, how long will it persist for? Whilst I will do an analysis on the future prospects for the Bitcoin price in forthcoming piece. However, I don't see this crypto mania party extending much beyond say 3 or 4 months at best, so don't waste this opportunity as the likes of NiceHash make crypto mining with ones desktop PC a breeze. And if you do mine, don't hold onto your coins!

AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

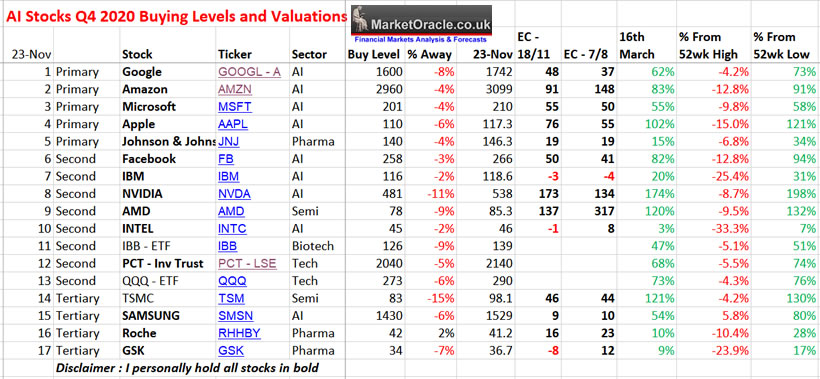

My last look at AI stocks buying levels late November 2020 had some of the must own AI stocks trading at high valuations for instance Apple was trading on an EC of 76 against a target of 50, Nvidia on 173 against about 100! Whilst IBM was dirt cheap on -3, so I could not resist buying more where I am sure several years from now many investors will be kicking themselves for not having had the foresight to pick up IBM when it was trading so cheaply. Next I picked up some more Google as numero uno and Facebook given it's continuing VR market success despite the dying lame stream media lobbying governments to get the tech giants to share ad revenues with them. And I also sought to pick up some Amazon on trading below $3000.

As well as looking to pick up some more AMD given its moderating valuation in response to unlimited demand for it's CPU's. With Nvidia still a little pricey to prompt fresh buying despite the success of it's RTX 3000 series of GPU's that literally allows Nvidia to PRINT MONEY! Sell as many GPU processors as it can produce (most Nvidia GPU's are made by third parties using their GPU processors).

And lastly there was TSM that I was eager to buy despite not being exactly cheaper on an EC of 46, nevertheless to gain exposure to another company that can literally print money then one needs to bite the bullet and hit the buy button to gain exposure.

This analysis will seek to act as a major update to my AI stocks portfolio in terms of a reordering of the layout as well as seeking incorporate a number of higher risk smaller cap tech stocks that I have been researching over the past couple of months, though remember that I consider sub $100 billion small caps, and not sub $1 billion stocks which I consider high risk penny stock gambles to steer well clear of. Nevertheless incorporating higher risk stocks at a low % of the portfolio for the long-run should add some spice to the portfolio, where hopefully we can achieve some of the buying levels else like TSMC be forced to bite the bullet and pay top dollar for a top stock.

Firstly what are Buying Levels?

Buying levels are high probability technical levels that a stock 'could' trade down to during a correction i.e. it's an achievable technical chart level that could be used to for instance to put in buy limit orders at just above the buying level if one is looking to accumulate more stock in any particular company i.e. the Buying Level for Google (Alphabet) was $1395, so a limit order at $1395 or higher would be the objective depending on how eager one is to gain exposure to the stock i.e. If I really wanted to buy more Google then the limit order would be OVER $1400 as stocks tend to find support at round numbers.

Stocks Expensive or Cheap Indicator (EC)

This basically condenses down some 12 financial indicators I track for most stocks to determine if they are expensive or cheap (EC), as stock prices are usually not a good indicator of value.

At it's most basic the higher the number the more expensive a stock is and conversely the lower the number the cheaper a stock is. Where a reading of 20-60 tends to be the sweet spot for most AI stocks as it implies earnings growth coupled with sustainable speculative interest and thus results in good trending charts with support during corrections, where value tends to be fair so as to enable one to accumulate stock.

Whilst readings above 60 increasingly indicate high levels of speculative interest in future earnings growth. However, this does not automatically mean that a stock trading over 60 should not be bought or sold, it just means that there is a lot of speculative interest in that stock so expect greater price volatility as investors are more likely to react to news events. So I would still invest in a stocks trading over 60 if they have a good reason to justify such speculative interest i.e. such as AMD and Nvidia as being higher risk stocks. Or Amazon of a say 6 months ago that was set to greatly profit from covid-19 lockdown's.

Over 100 is where stocks are becoming a bit to hot to handle where holding let alone buying depends on understanding what's in the pipeline, what it is driving the stocks into the stratospheric valuations such as AMD first killing Intel and now giving Nvidia a run for it's money. Whilst there will be some such as Amazon, I can't quite fathom the high valuation hence reduce my exposure to.

Whilst readings Under 20 suggests little speculative interest to drive stock prices significantly higher, so likely to expect trading ranges and thus tend to be sleeping giants in the AI mega-trend. Also could be signaling problems with the stocks i.e. such as Intel losing the CPU war to AMD which has has made Intel a disliked stock to hold whilst AMD has been heavily bid up into fever making it an expensive buy.

The AI Megatrend Big Picture Reminder

Stock markets are soaring on the back of vaccines that herald the end game to the Covid nightmare. However the vaccines, covid-19 are all mere blips in the long-term trend trajectory that is being driven by AI and it's full spectrum application. For instance these are the key areas that I identified to focus upon over 5 years ago, though the number is always increasing as AI encroaches into every aspect of our lives which is why my focus primarily on core AI stocks rather than applications of AI.

The bottom line is that we are on exponential curve in terms of technological developments, which means expect things to change FAST! And likely most of us won't even beware of most of critical changes as they take place given the rapid pace of development, just that the implications of the developments WILL be discounted by the stock market through higher stock prices.

For instance imagine a world where super conductors operate at room temperature! We'll that world could start becoming manifest as early as next year with EXPONENTIAL CONSQUENCES across a wide spectrum of sectors starting with applications that currently require liquid nitrogen cooling such as Quantum computers. Another key sector that is waiting on room temperature super conductors to deliver several orders of magnitude of efficiencies is in electricity generation, transmission and storage (batteries).

And here's a reminder of the stock market BIG PICTURE, where basically I am expecting AI stocks on average to increase 6 fold on where they were trading in Mid 2020 by 2027. (Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!)

So GET INVESTED and STAY INVESTED then at the least we can protect our wealth and at best get rich.

The AI Mega-trend ensures that investors can make mistakes, buy stocks at the wrong time and still win in the long-run. So understand the secret to investing is to REMAIN INVESTED in Mega-trends, buy when cheap and then basically forget about your holdings. That's my basic advice, invest and forget for the next 5 years if you want to follow the easy route.

Of course, like most including me, we think we can time purchases to maximise returns such as the opportunity that the March crash gave us. But the simple truth is this, GOOD STOCKS rarely give buying opportunities. We basically got lucky in March. So all we can do is look for anomalies and follow the rule of the greater the deviation from the high then the greater buying opportunity being presented i.e. such as what Intel has been offering for the past 6 months., as it most definitely is an AI stock but it's behaving like some high street retailer. Of course when one looks under the hood one see's reasons why its under performing, as there are always reasons why a stock goes up or down that are usually clear with the benefit of hindsight, nevertheless Intel IS an AI mega-trend stock so PRIMARY is to UNDERSTAND THAT FACT ABOVE ALL ELSE!

Basically what I am saying is that to ride the AI Mega-trend one needs to the exposed to AI mega-trend stocks, and that there is a huge margin of error built into this trend in that YOU CAN MAKE MISKATES AND STILL PROFIT IN THE LONG-RUN i.e I am pretty sure Intel will come good in the long-run.

Human Brain vs High End Desktop PC in 2021

Where do we stand on the path towards your desktop computer becoming more intelligent than you! Currently the best retail desktop GPU is the Nvidia RTX 3090 that carries an MSRP of $1500, though the crypto boom means right now it is very difficult to get hold of and even then prices start at $2000 typically rising to $2200. Still it is easier to obtain then the lower skew RTX 3080 that us supposed to sell for $699 but instead available supply is typically being sold on on ebay for $1200-$1400!

Nevertheless how does the processing power of an RTX 3090 GPU compare to that of a human brain. The RTX 3090 has 10,496 parallel processors and operates at 1.7ghz. That converts into 36 teraflops of raw processing power.

The human brain has 80 billion parallel processors (neurons) and operates roughly at 30hz that converts into roughly 1 exoflops of processing power.

Which means the human brain has about 27,778 times the processing power of an RTX 3090 GPU. Though of course this is not taking into account -

a. Energy usage, the human brain operates at about 25 watts per hour whilst the equivalent number of RTX 3090 GPU's would require 9,722 kwatts of power per hour! That's enough to power about 10,000 homes!

b. Memory, an RTX 3090 has 24gb of GDDR6X memory against the human brain which likely has more than 1 million times that!

So we are some way from the point when a high end desktop is going to come anywhere near matching the processing power of a human brain. In fact looking at the above numbers, I think sooner rather than later we will start seeing biological computers, where parallel processing at low power wattage is done trough the use of human neurons. In fact there are already startups such as Cortical Labs working on such solutions.

Meanwhile the primary route towards post human level intelligence remain the super computers where today's top dog is Japan's Fugaku that is twice as powerful as the next system on the list (Oak Ridge Summit) and has 7,630,848 cores with processing power of 442 peta flops, or about HALF that of a human brain!

Back in 2016, I concluded in a video that super computers would start passing the processing power of the human brain during 2021, we'll that forecast will soon become a reality which coupled with Deep learning (AI) means we are soon going to be living in a world where machine intelligence exceeds human understanding and ability to control, and that the trend is exponential from half to equal to ten times within a few short years, so we are fast approaching the point of no return.

And don't forget the impact of Quantum Computers which are pending several breakthroughs such as room temperature super conductors, and multi million qubit machines, where my best guess will start to deliver on what they promise in about 12-15 years time, though given the amount of money that is going to be thrown at the sector could happen sooner, say in 10 years time.

Nevertheless the time to invest in Quantum Computers is NOW, and NOT AFTER the breakthroughs, for the more one researches quantum computing the more one realises how great the potential is of QC has to change every aspect of our lives in terms of modeling that which cannot be modeled accurately today such as the behaviour of molecules hence why I am not worried about the lack of stock performance to date by the likes of IBM and Intel because I know what's coming down the road.

For instance Google in 2016 simulated a pair of Hydrogen atoms using their 56 qubit chip, in 2017 IBM simulated Lithium Hydride (Li-H), and IONG in 2019 simulated water (H2O).

AI Stocks Investing 2021

I have reorganised the AI stocks portfolio into 5 sections with rough guides on what percentages to hold.

- Primary - 60%

- Secondary - 12%

- High Risk - 8% (next analysis)

- Sleepers - 10%

- Funds - 10%

Apart form usual buying levels of where stocks 'could' trade down to during a correction. i have also included a Buy percent indictor on how good of a buy a stock is right now which is primarily based on valuations though does take into account of trend. So 100% means a VERY GOOD BUY, whilst 0% means a bad buy with 50% neutral. Note this is in terms of BUYING and NOT SELLING! So understand 0% is NOT a SELL rating, it just means that it's a good time to buy a particular stock in terms of price and valuation right now.

Again the key thing to remember is to HAVE exposure to the AI mega-trend stocks.

1. Google (Alphabet) $2021 - Deep Mind

Google stock has just rocketed higher after under performing it's brethren, and coming from it's last great buying opportunity low during September that saw Google trade down to $1400. This illustrates the primary point that we don't know precisely WHEN an individual stock will surge higher i.e. the AI stocks are not going to all move in lock step together. So it is pointless to ask questions such as why is Amazon soaring but Google is not, if a stock is good then eventually it will come good in terms of price performance and Google is literally PRIMARY which means that Google is likely to be the first mega-corp to be run by an AI in all but name. So the existence and scope of the AI's control and management needs will need to be inferred where one big clue will be inexplicable to most stock price movements that to me reveal the handiwork of post human intelligence - DEEP MIND!

Despite the 15% surge in stock price, in valuation terms Google is cheaper today then when it was trading at $1700 with EC falling from 48 to 44, and putting Google on a Buy rating of 75% (remember 50% is neutral, 100% Very Strong and 0% Bad Buy).

Google delivered us it's last big buying opportunity late September when Google traded down to $1400.

Google reached and broke above it's next resistance level of $2,000. In fact Google gapped through $2000, where this gap does give Google some support though which I would expect Google to fill before going higher, so it looks like Google is going to trade below $2000, to fill the gap from $1970 with Google's major support zone between $1820 and $1930 which is where I would expect Google to trade into before preparing for it's next leg higher. Whilst nearest trend line support is at $1930. Which could terminate any correction. This is a tough call, $1930 is significant support, though which could see a short lived spike under it to run stops, which resolves to a Buying zone of $1820 to $1930 with the midway point being $1875. Though if you really want to own Google. The question an investor would need to ask if Google were trading at $1930, do I want to risk not buying google with a Limit order at $1875, some 0.3%?

2. Amazon $3092 - PRIMEDAY SALE

First Amazon stock soared into the stratosphere and now so have Amazon earnings doubling, sales up 44%.Gone is Amazons EC of 148! Gone too is the relatively pricey valuation of 91 of November 2020, and here we now stand barely 3 months on with Amazon priced on par with Google trading on an EC of just 42. What does this mean, it means Amazon is CHEAP! And thus the Buy Percentage is 100%!

Unfortunately this means the odds are stacked against all those looking for lower prices. Of course we can get lucky and the market panics and takes the likes of Amazon with it but in technical and valuation terms seems very unlikely.

(Charts courtesy of stockcharts.com)

Amazon has broken out of it's converging triangle to the downside, which is a bearish signal which implies a down leg to below the 2871. However all things considered I expect this to be a false break lower as the amazon stock price is clearly consolidating ahead of its next big move which given the fundamentals should be upwards! My existing relatively nearby buying level is 2960, which Amazon has come close to achieving though just missing which is a sign of strength. Therefore the new buying level has to be lifted to a level which is actually achievable to $3050, which is where Amazon traded earlier in the week. So as I stated back in November, I still don't see much downside for Amazon especially given the fact that fundamentals have caught up with the earlier stock price surge. So all those waiting and hoping for Amazon to revisit the low 2000's need to delete that expectation from their mind as likely in the not too distant future they will be hoping for Amazon to revisit the low 3000's!

And just as I stated when Amazon was trading below $2000 in 2020, that I would not be surprised if Amazon trades at $3000 before the end of the year, similarly now I would not be surprised if Amazon trades to over $4000 during 2021!

So was I wrong to sell half my Amazon stock holdings in early September 2020? No, because Amazon is still trading well below the price I sold the stock at. And in GBP terms has moved a further 10% in my favour since (fx only matters when buying or selling). Whilst it's overbought state as measured by the MACD no longer exists. And in the meantime Amazon's valuation have moved in the stock prices favour. So I did the right thing at the right time for the right reasons.

3. Microsoft $232

Microsoft stocks risen by 10% since my last update but the valuations have stayed constant on an EC of 55, which is why Microsoft remains a great primary stock that stealthily continues to deliver as AI is driving this tech giants exponential growth continuing to beat Wall street expectations after all the analysts think linear whilst the trend trajectory is exponential. With Microsoft AI Azure cloud computing division growing by 50% per annum, converts into a Buy rating of 65%.

Same old story in technical terms, a stock that does not have much downside to it. Microsoft is currently trading at trendline support around $230. Below which are a series of previous highs from 224 to 227. So there is heavy support under Microsoft. It's difficult to see Microsoft trading much lower than where it currently is, perhaps $220 is possible. Therefore a probable buying level for MSFT is $226.

4. Apple $121

As anticipated in my last update, Apple has under performed the other key AI stocks, little changed from Novembers $117 due to being over valued, a stock that remains pending earnings to play catchup to the stock price, current EC is 73, against 76 before. Yes, APPLEs earnings growth is good, but overall fundamentals are still a tad bit expensive thus implies Apples going to find it difficult to sustain new highs hence why the stock is back down at $121. Therefore the Buy rating is a fairly neutral 50%.

.

.

Apple was unable to hold on to it's January new high of $145 in advance of earnings, since which it has given up all of its gains for 2021, returning the stock firmly to it's trading range of $107 to $137. Other than having unwound an overbought state, I am not seeing any significant technical signs that Apple could resume it's bull run to new highs any time soon. Having tested the upside the stock appears to be gravitating towards testing the downside where support exists at $103 and $106. Therefore Apples Buy Level remains unchanged at $110 as the stock looks like it's going to take a breather for at least the first half of 2021 to continue to digest 2020's gains.

However don't take this luke warm analysis as a reason to make the mistake of selling out of Apple, remember Apple remains a Primary AI Stock riding an exponential trend!

5. Facebook $258 : AI WAR on Australia

Through the prism of the AI mega-trend. Why would facebook do that? Why would facebook go to war against Australia? IF AI is a true AI corp. which they should be given the data on 3 billion users they collate and analyse then Facebook will have game played what is going to happen and thus the outcome will be to Facebook's advantage, if not than that will be a red flag that Facebook is not as robust a corp as I perceive it to be.

The way I see it at each crisis the governments of the world have given up more and more power. I don't want to go to far back in history but Nixon taking the US off the gold standard comes to mind which created the monster that is the F/X market, floating exchange rates.

Then the governments gave power to the bankers, with the first modern action being Nixon's though there were a number of events since too numerous to list. Such as the Savings and Loans saga, Scrapping of banking regulations during the 1990's (Glass Seagull?). Tony Blair's government handing over power to the Bank of England etc and we all know how all that ended in 2007 when those two Hedge Funds went belie up in June 2007 and started the financial crisis ball rolling.

And the Rise of power of Silicon Valley is just the latest manifestation of Governments handing over power to the Tech giants.

Each time they did it for the same reason. The perception that it would herald financial and economic stability when instead all of the decisions tend to eventually blow up in their faces as will the AI mega-trend i.e. Post human super intelligence.

Thus Facebook has WON regardless of the spin politicians put on whatever is eventually decided because governments want only one thing, stability in the present and immediate future, they don't tend to ever connect the dots to see what are the natural consequences of their actions years or even decades down the road, China comes to mind, again it was the banking crime syndicate that started and encouraged the globalisation china factory of the world mega-trend that would strip the West of over 100 million jobs! Which is one of the reasons why I expected Trump would win in 2016.

Wy would they do something so stupid? It's because THAT IS what governments DO! And understanding this alone will make you RICH! If you understand the government is stupid then you know they will F things up!

Then again I could be wrong and am giving Facebook too much credence, anyway the stock charts don't lie.

Facebook's EC has fallen to 28 from 50, following a stellar earnings report that beat wall street expectations which on face value makes Facebook at current values CHEAP! Therefore resolves to a Buy rating of 85%, so second only to Amazon. I am definitely tempted to buy both Amazon and Facebook stock, but what do the technical's say?

A falling wedge, a corrective pattern. Facebook remains in full corrective mode with investors too scared to to expose themselves to Facebook in it's war on Australia. So on the one hand we get good earnings and on the other hand the stock is weak, usually that says that something wrong is going under the hood.

Facebook stock has strong support at $244, So there is not much downside. Basically the technical picture for Facebook is very similar to November, downside limited to between $244 and $258, with next support at $240. There should not be much downside, Therefore my buying Level remains largely as before at $254. Similarly to my November update, upside is limited. We are not likely to see $300 anytime soon.

MAYBE WE WILL GET LUCKY and the market takes fright and sends Facebook below $244 support towards $210. At this point that is a low probability event but there is something under the hood that I am not quite perceiving properly. THOUGH once more - AI EXPONENTIAL MEGA-TREND, any decline would be TEMPORARY! Especially given Facebook's Ace card, virtual reality the future of social media and gaming!

The rest of this extensive analysis that concludes in AI Stock buy ratings, levels and valuation analysis for investing in 2021 has first been made available to Patrons who support my work:

AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

- AI Tech Stocks Buying Levels and Valuations 2021 Explained

- Coronavirus Pandemic Vaccines Indicator Current State

- Post Pandemic Summer 2021 Social Unrest ?

- Get Ready for Inflation Mega-trend to Surge 2021

- The AI Megatrend Big Picture

- Human Brain vs High End Desktop PC in 2021

- AI Stocks Investing 2021 - Top 14 Stocks Analysis

- AI Stocks Portfolio Table 2021

- Stocks Bear Market / Crash Indicator (CI18)

So do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat. Including access to my recent analysis - AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

As well access to my latest analysis due to be posted within the next 24 hours

How to Invest in High Risk Tech Stocks for 2021 and Beyond

My analysis schedule includes:

- UK house prices trend forecast

- Bitcoin price trend forecast

- How to Get Rich!

- US Dollar and British Pound analysis

Your analyst profiting form the crypto mania bubble whilst it lasts.

By Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.