Dow Stock Market Long-term Trend Analysis

Stock-Markets / Stock Market 2021 Mar 18, 2021 - 04:26 PM GMTBy: Nadeem_Walayat

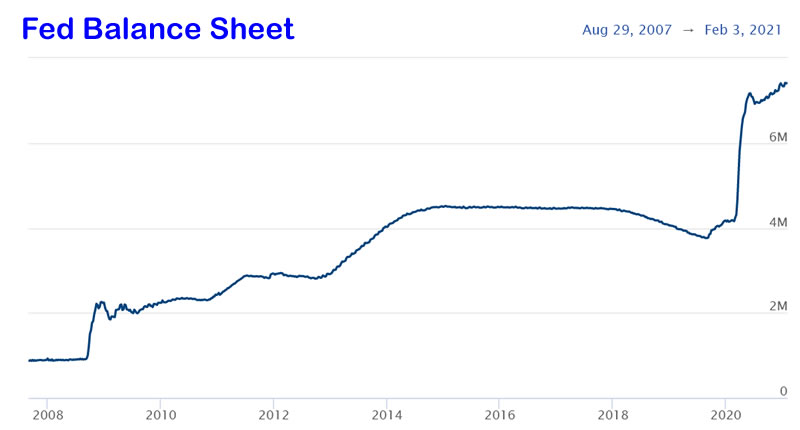

FED Balance Sheet

Not to forget the inflation mega-trend courtesy of rampant central bank money printing to monetize government debt coupled with the fake inflation indices. So you really think US inflation is just 1%? it's more like 6%! Anyway the money printing binge now totals $7.4 trillion, up from $4 trillion at the start of 2020.

The bottom line is forget what the bond market is implying because interest rates are manipulated, instead the real impact of money printing 'should' be seen in a falling Dollar, though every central bank is printing money, so it's going to be a bumpy ride. In the meantime if you think there is deflation compare the price of the stuff that you really want against what they were selling for a year ago! That's if you can get what you want because the tech market is OUT OF STOCK of GPU's, CPUs, and MEMORY! A market that is seeing price hikes on a near DAILY basis to near DOUBLE MSRP!

This analysis is part 2 of 3 that concludes in a detailed Stock Market trend forecast for 2021, the whole of which has first been made available to Patrons who support my work.

Dow Stock Market Trend Forecast 2021

- UK Coronavirus Pandemic Current State

- US Coronavirus Pandemic Current State

- Stock Market Forecasts and Analysis Review of 2020

- The Stock Market Big Picture

- Post Covid Economic Boom

- GAMESTOP MANIA BUBBLE BURSTS

- FED Balance Sheet

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- ELLIOTT WAVES

- SEASONAL ANALYSIS / Presidential Cycle

- Stocks Bear Market / Crash Indicator (CI18)

- Dow Stock Market 2021 Outlook Forecast Conclusion

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

DJIA Stock Market Technical Trend Analysis

Dow Short-term Analysis

The stock market has fully recovered from the Chinese Coronavirus catastrophe. Remember the Dow traded down to a low of just 18,213 on 23rd of March 2020 and then over the next 10 months recovered to trade at a series of new all time highs into 2021, all whilst the virus has continued to rage on, delivering the US and UK WORSE second peaks in terms of infections and deaths.

(Charts courtesy of stockcharts.com)

February's rally has clearly caught most market commentators by surprise especially those who see every dip as the start of a bear market as the stock market has once more busted their perma bear flush of every high being the final fifth of the fifth of the fifth bull market top. The recent correction found support at just below 30,000 before swiftly ending and propelling the stocks bull market to another new all time closing yesterday of 31385 with scope to continue climbing higher all the way to 32,000.

Long-term Trend Analysis

The Dow has broken out to new all time highs above 29,600 which successfully held as support during the January correction.

TREND CHANNELS - The Dow crashed out of it's 2019 trading channel which it recovered to trade into during November with the lower channel extending to 33k into the end of 2021, and the upper channel to 35,500 thus implies to expect the Dow to trade within this channel during the year. Whilst the newer channels since the Pandemic crash low extend to a range of 34,000 to 35,000 into the end of 2021.

So a bullish 2021 should see the Dow trade between 34,000 and 35,500 during the year, with significant support at 30,000 during the first half of the year.

TREND ANALYSIS - The Dow continues to trend higher making higher highs and lows, and given the behaviour during the January correction there may not be much downside opportunities to accumulate into during the year.

RESISTANCE - Resistance lies at the 32,000, 33,000, 34,000 and 35k.

SUPPORT - There is heavy support between 29,600 and 30,000. I cannot see the Dow trading much below 30,000 during the remainder of 2021.

TRENDLINES - There are 2 rising trend lines off the post pandemic crash lows with the upper acting as short-term support and resistance and the second as key support for 2021, which implies that 30k is unlikely to break on any correction into Mid year.

MACD - MACD is neutral so supportive of a continuing bull run for a couple of months or so.

ELLIOTT WAVES

My commonsense interpretation of EWT continues to resolve in accurate outcomes as the chart of my last analysis implied to expect a strong 5 wave impulse advance into 2021 that has come to pass.

If elliott waves followed a similar pattern in time rather than price which would imply that the larger Wave 3 bull run will terminate early May and correct ABC style which chimes well with "Sell in May and Go Away".

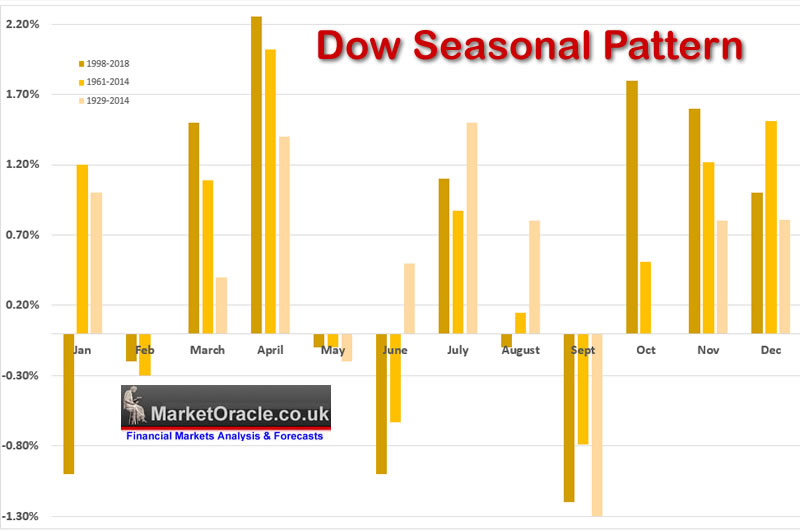

SEASONAL ANALYSIS

The seasonal pattern suggests after a pause in Feb, then higher into late April the correct from early May into late June followed by a volatile summer terminating in a swing low during September that should set the scene for a bull run into the Christmas Holidays with of course intra month volatility during October that tends to resolve to the upside just as the perma-bears crow their loudest about the market having topped.

Of course last year we saw the March Pandemic CRASH, which did divert the stock market TEMPORARILY away from it's seasonal trend, so if anything similar happens again BUY THE DEVIATION! Just as we did during March, but given the weight of the above analysis I am not seeing what could give is such a deviation to the downside during 2021, not even Covid-20, not whilst the Fed keeps printing.

US Presidential Cycle

The post election year tends to be positive, not as strong as election years though of course this time round we had the pandemic crash in it's midst, which therefore suggests 2021 could turn out to be a strongly bullish year with the market trading up by at least 10% towards the end of the year, in fact could surprise to the upside, 15%, 20% even?

Again this analysis (2 of 3) is an excerpt form recent extensive analysis that concludes in detailed stock market trend forecast for 2021 that has first been made available to Patrons who support my work.

Dow Stock Market Trend Forecast 2021

- UK Coronavirus Pandemic Current State

- US Coronavirus Pandemic Current State

- Stock Market Forecasts and Analysis Review of 2020

- The Stock Market Big Picture

- Post Covid Economic Boom

- GAMESTOP MANIA BUBBLE BURSTS

- FED Balance Sheet

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- ELLIOTT WAVES

- SEASONAL ANALYSIS / Presidential Cycle

- Stocks Bear Market / Crash Indicator (CI18)

- Dow Stock Market 2021 Outlook Forecast Conclusion

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And my MORE recent analysis posted - AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

My analysis schedule includes:

- High Risk Tech Stocks

- UK house prices trend forecast

- Bitcoin price trend forecast

- How to Get Rich

- US Dollar and British Pound analysis

Get PAID to Heat Your Home!

And finally, if you have a system with a GPU that's less than 3 years old, then it may prove profitable to consider crypto mining in the background which is now relatively easy with the likes of Nice Hash. With the added bonus at this time of year of the crypto crazy effectively delivering FREE HEATING curteosy of ones 400 watt crypto mining heater.

So if you have a decent GPU then could be a good idea to consider looking into crypto mining in the background with the likes of Nice Hash (refferral link).

Your crazy crypto mining free room heating analyst.

By Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.