Resting Stock Bulls and Gold Question Mark

Stock-Markets / Stock Market 2021 Mar 15, 2021 - 04:13 PM GMTBy: Monica_Kingsley

Stock bulls went right for all time highs yesterday, clearing the 3,900 threshold in this correction – one that is in its very late innings indeed. But the preceding upswing has been sharp, and not all the internals support such a swift recovery, which is why I am still looking for consolidation to strike at any moment.

We might be actually experiencing such a daily one right now, as today‘s premarket session has sent S&P 500 futures a few dozen points down. The big picture is though one of of the stock market getting used to rising rates, which are rising in reflection of the economic growth. But what about the snapback short-term rally in long-term Treasuries?

It‘s not materializing as the instrument went down again yesterday – unconvincingly bobbing above recent lows. The defensive sectors such as consumer staples and utilities, reversed yesterday (at a time when technology rose), sending a warning that we‘re about to see higher rates again. Probably not happening as fast as through Feb, but still. Let‘s bring up my recent perspective on high rates, what they are exactly:

(…) the „high rates“ we‘re experiencing currently, do not compare to the early 1980s, which underscores the fragility of the current monetary order. The Fed knows that, and it has been evident in the long preparatory period and baby steps in the prior rate raising and balance sheet shrinking cycle.

The market will see through this, and the central bank would be forced to move to bring long-term rates down through yield curve control or a twist program, which would break the dollar, drive emerging markets, and not exactly control inflation – real rates would drop like a stone in such a scenario, turning around gold profoundly.

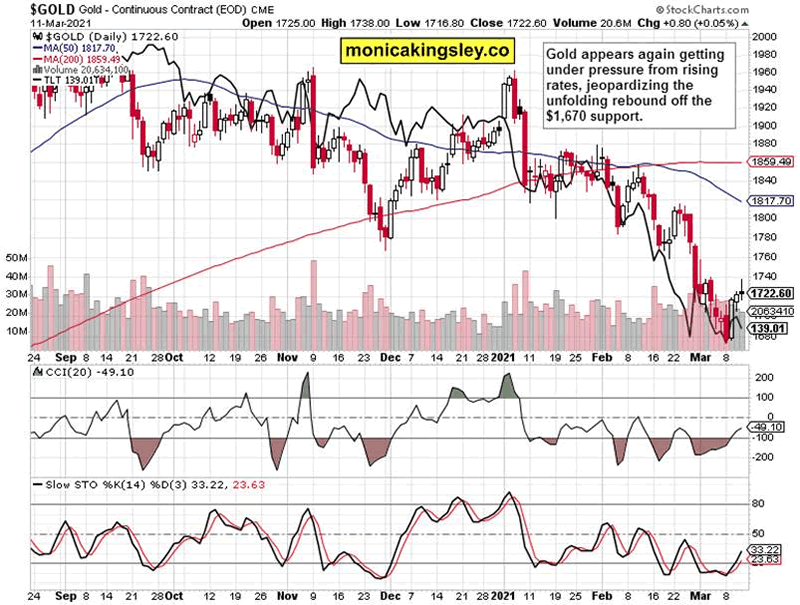

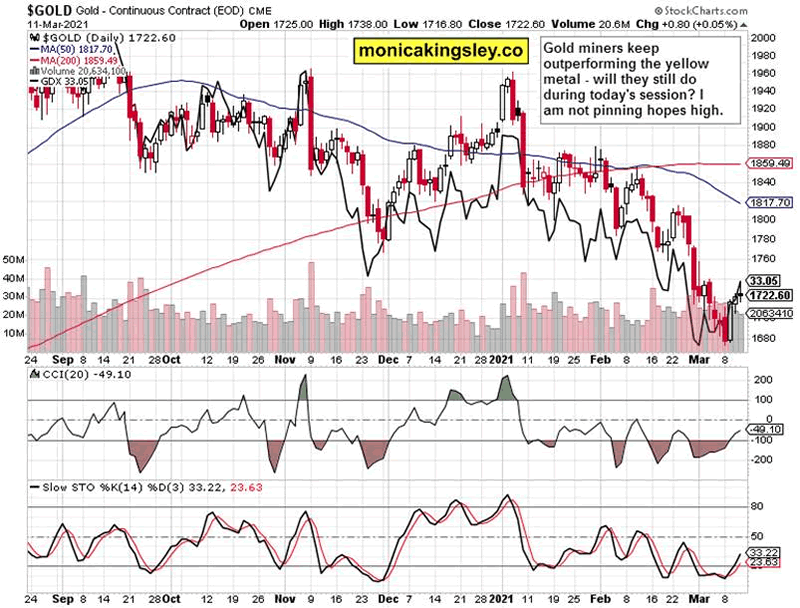

But the market knows the Fed isn‘t getting ready to really do anything more than it does right now. Gold rebounded on Tuesday, and the rally took it above $1,730 but the daily reversal is concerning. As I wrote yesterday in the title, the gold bulls can‘t rest – but they are resting, and prices are back at the lower end of the $1,720 volume profile.

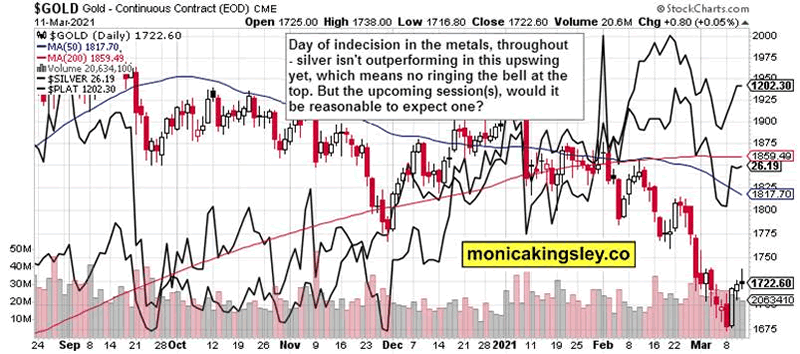

Assessing the damage in the early stages of today‘s session will clarify whether the rally‘s dynamics are still intact, or not – regardless of today‘s headwinds. Silver isn‘t exactly at its strongest today, and we‘re likely to get soon into the session an idea about where miners‘ strength is. And it‘s more likely that it won‘t be anything to write home about.

Let‘s recall my yesterday‘s words, and pick what‘s relevant to the metals:

(…) While the Fed is prepping the markets for (temporary, they say) higher inflation readings, gold didn‘t react too bullishly to yesterday‘s mildly positive CPI data – just wait for PPI data which would reflect the surging commodity prices more adequately. At the moment, evaluating the strength and internals of precious metals rebound, is the way to go as we might very well have seen the gold bottom, with the timid $1,670 zone test being all the bears could muster. Time and my dutiful reporting will tell.

Commodities are likely to do well in this reflationary phase, and the same goes for its turn to inflation. With precious metals, much depends upon their discounting mechanism‘s timing – when would they start doubting the transitory inflation utterances.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

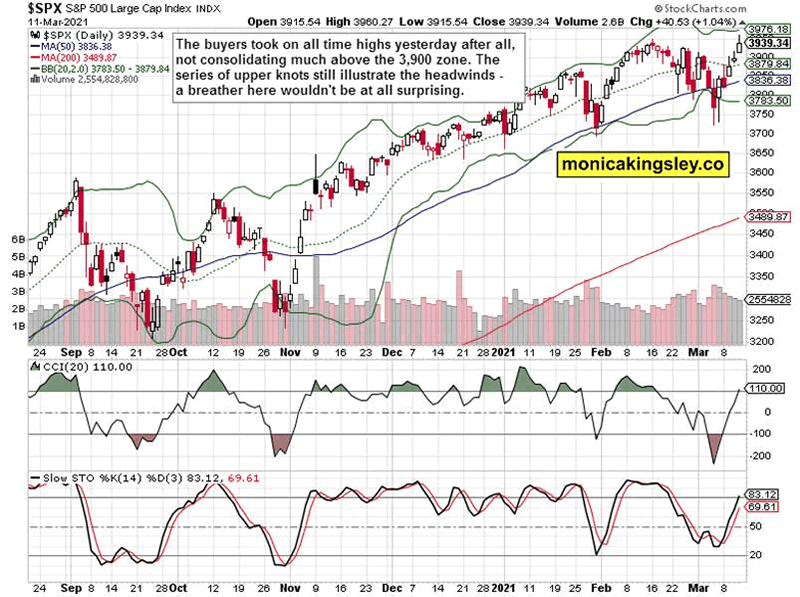

S&P 500 Outlook

The S&P 500 upswing continues in pretty much a straight line, and the frequency of upper knots raises the probability of a short-term reprieve. Yes, it‘s risk-on, but a little pause would be healthy.

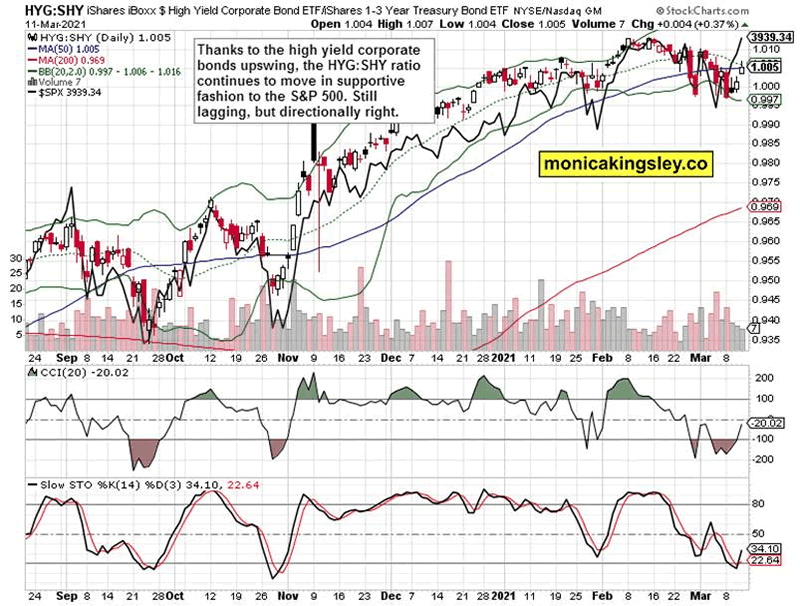

Credit Markets

High yield corporate bonds have moved higher yesterday, mirroring the S&P 500 advance. That‘s encouraging even though the high yield corporate bonds to short-dated Treasuries (HYG:SHY) ratio is still visibly lagging behind stocks. The non-confirmation‘s seriousness has though decreased markedly over the two last sessions, pointing to improving internals of the upcoming stock market upleg.

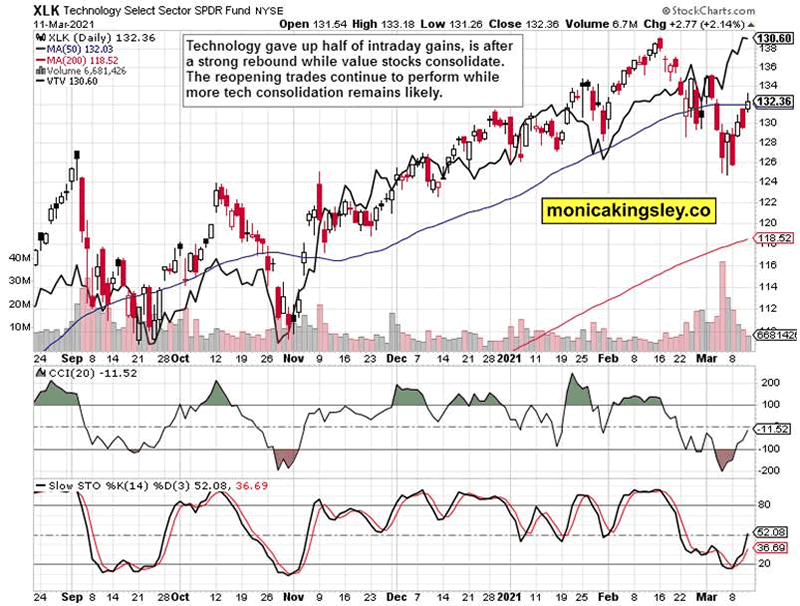

Technology and Value

Technology has been rallying on decreasing volume, also demonstrating a prominent upper knot. If there is one sector where the coming S&P 500 consolidation would originate, it would be here. Value stocks held their own yesterday, in a nod to the high beta reopening trades. I am not looking for VTV to weaken distinctly here.

Gold and Yields

The gold upswing reversed intraday while long-term Treasuries (TLT ETF) hadn‘t really moved in their tight daily range. Erasing much of the overnight selling today, would be probably the most the bulls would be able to achieve today. But even that isn‘t the deciding factor to determine the fate of the recovery off the $1,670 area.

Upswing in the Balance

Gold miners are still painting a positive picture. They are outperforming gold while silver isn‘t spiking – the white metal is under even more pressure today than gold itself. So, the signs from miners and silver balance each other out to a degree.

The whole sectors keeps hanging in the balance after yesterday‘s session. Each day or even hour the bulls don‘t utilize to reverse today‘s setback, is questioning the upswing continuation. Not much to add here as the daily momentum apprears shifting to the bears again.

Summary

Having conquered the 3,900 zone, the S&P 500 is likely to consolidate the gains next. The put/call ratio and volatility are at relatively lower readings, and the next setback for stocks would come from tech again. Not overly dramatic, but a brief challenge still.

The gold upswing stalled, and its fate is being decided. Having fallen through the volume profile defined support at $1,720, the bulls objective is to recapture this zone. Tall order..

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.