Biden Stimulus And Consumers Are The Keys To Further US/Global Economic Recovery

Economics / US Economy Mar 11, 2021 - 03:15 PM GMTBy: Chris_Vermeulen

At this point in our lives, we are hoping the new COVID-19 vaccines will do their part to help move the world towards more normal consumer and economic activities. The US Senate recently a new $1.9 Trillion stimulus package that should continue to provide assistance to various levels of consumer, state governments, and corporate enterprises. The next question in our mind is “what will the recovery look like if/when it happens?”. We need to look at three critical components of the global economy to help answer this question: Consumer Activity, Debt, and Supply/Demand Functions.

Consumer activity makes up more than 60% of the US GDP. It also drives money flow as consumers engage in economic activity, create credit for new purchases and help to balance the supply/demand equilibrium functioning properly. The participation of the consumer within an economy is essential for a healthy growing economy.

Where Are Consumers Now & Where Will They Be In The Future?

The US has passed more than $4 Trillion in COVID-19 stimulus over the past 12+ months. At the same time, global central banks have also engaged in various easy money policies to spark global economic activity. When we combine the efforts of world governments and central banks, we’ve seen an unprecedented amount of money deployed throughout the globe recently – and that money needs to find its purpose and use in the global economy quickly of the global economy is going to recover enough to spark a new wave of economic growth.

We believe two key components of consumer engagement are at play right now; investing/trading in the US and global markets and Real Estate. Whereas US consumers have been reducing debt exposure on credit cards and tightening their spending in other ways, trading volumes in the stock market Indexes and ETFs have increased dramatically over the past 12 months. Additionally, low supply and low interest rates have kept the US housing market active, in addition to the boost in activity from people moving to more rural areas as the work-from-home phenomenon settles into the new normal.

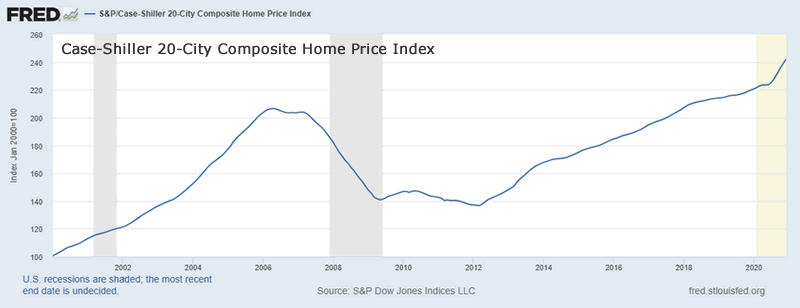

Case-Shiller Home Price Index

This Case-Shiller 20-City Composite Home Price Index chart, below shows how quickly home prices have rallied over the past 12 months. Just prior to the COVID-19 pandemic, this index was flattening. Then the moratorium on foreclosures and extended assistance for homeowners pulled many homes back off the market in early 2020. That reduced supply and prompted a rally in home prices across the US.

The assistance provided to these “at-risk” homeowners accomplished two very important economic benefits. It eliminated a wave of new foreclosures (albeit possibly temporarily) and it prompted a seller’s market because supply had been constricted. The result is that many homeowners witnessed a 6% to 10% increase in their home values over the last 12+ months.

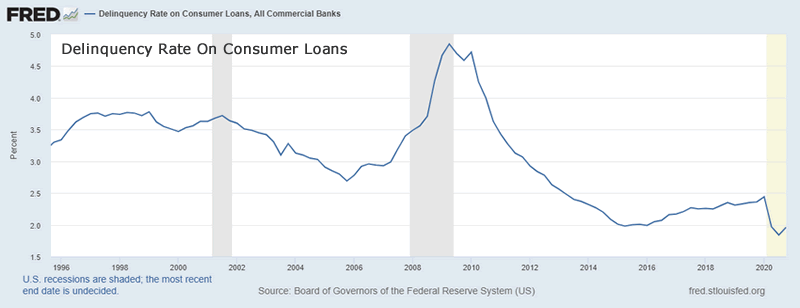

Delinquency Rates On Consumer Loans

Unlike in 2006-2008 when delinquency rates skyrocketed during the housing crisis, throughout the COVID-19 pandemic, delinquency rates collapsed to the lowest levels over the past 25+ years. Consumers took their extra capital, stimulus checks, and federal assistance and used the past 12+ months to eliminate certain debts. Even though we are starting to see an uptick in delinquency rates in Q4 2020, these levels would have to climb considerably before we get close to the levels before the COVID-19 pandemic.

Join Chris Vermeulen and Neil Szczepanski at the Mad Hedge Fund Trader’s “Traders & Investors Summit” on March 10th and 11th – register for FREE now to RESERVE YOUR SEAT !

This suggests that a broad spectrum of US consumers are in a much better economic position related to revolving debt, or credit card debt, than they were before the COVID-19 pandemic. If these consumers begin to engage in a new economic recovery by engaging in a healthy credit expansion, we may see a boost to certain sectors of the economy over the next 24 to 36+ months.

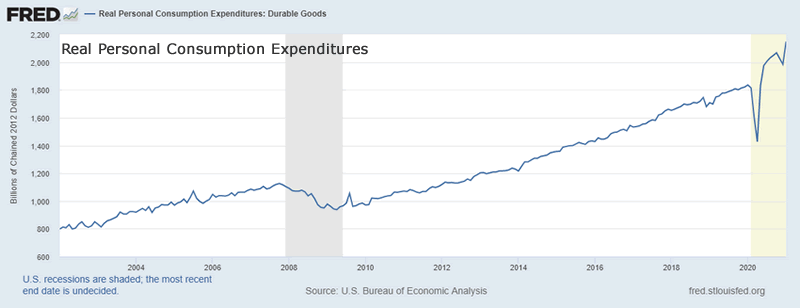

Real Personal Consumption Expenditures

Unlike many other indicators, Real Personal Consumption has risen past the pre-COVID-19 peak levels. This suggests that consumers are still spending money on Durable Goods and are continuing to buy essential items to support their lifestyles and families. Yes, there are a number of people that are unemployed or have transitioned to other types of work, but the stimulus efforts and extended unemployment assistance has translated into real consumer engagement for Durable Goods, as we can see from the chart below.

Remember, Durable Goods are not typically found at Grocery Stores or Walmart. They are items that have extended life-cycles (greater than three years); such as cars, planes, trains, furniture, appliances, jewelry, and books. This rise in Durable Goods suggests that a large segment of the US consumer is actively engaged in making bigger-ticket purchases recently – possibly as a result of buying a new home, transitioning away from traditional work environments, and/or repositioning family essentials in preparation for a post COVID-19 world. This type of economic engagement may continue for many months forward.

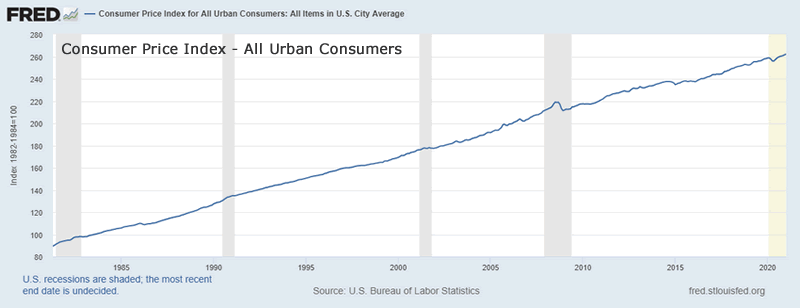

Consumer Price Index – All Urban Consumers

The following Consumer Price Index chart shows that general consumer prices briefly dipped when COVID-19 hit in March 2020, but they have since rallied to new highs. This is partially a result of the rise in home prices and rising commodity prices, which contribute to a rise in price levels for consumers.

All of this data is showing that the US consumer is actually much more economically healthy than consumers were in the midst of the 2007-08 housing crisis. The stimulus efforts and partial economic shutdown did result in a large number of displaced or disadvantaged consumers, but it also shows that many US consumers were able to quickly transition into a different type of economic environment with very little extended economic risks.

The new $1.9 Trillion stimulus package will offer even more assistance to consumers. This new stimulus will be spent as new COVID-19 vaccines are being rolled out, suggesting the US is quickly moving away from extended risks related to the pandemic. This means consumers will likely start attempting to go back to normal in certain ways. Does this mean that the recovery efforts will strengthen the bullish price trend in the future and the US stock markets will continue to rally?

In our effort to better identify opportunities for traders and investors as the post-COVID-19 recovery unfolds, we will continue to identify various market sectors that my research team and I believe have a strong potential for increased bullish price trends. All of the data we’ve presented so far suggests the US consumer is much healthier than many people consider and that many US consumers are still actively engaged in some type of work/income solution. The only reason why housing, durable goods, CPI, and other economic indicators continue to rise is because US consumers are actively engaged in buying/consuming bigger, durable goods. This suggests the new $1.9 Trillion COVID relief effort may begin to push the US economy further into overdrive, and possibly pushing the supply/demand balance even further beyond the equilibrium zone.

Don’t miss the opportunities in the broad market sectors in 2021, which will be an incredible year for traders of the BAN strategy. You can sign up now for my FREE webinar that teaches you how to find, enter, and profit from only those sectors that have the most strength and momentum. Staying ahead of sector trends is going to be key to success in volatile markets.

For those who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you with daily market reports, research, and trade alerts. More frequent or experienced traders have been killing it trading options, ETFs, and stocks using my BAN Hotlist ranking the hottest ETFs, which is updated daily for my premium subscribers.

In Part II of this article, we’ll take the data we’ve reviewed already and apply it to current market conditions, trends, and technical setups as we look for new opportunities in consumer-based sectors. My team and I believe some very big sector trends are going to set up as a result of everything that is converging on the US and global markets. It’s time to get ready for some big trends.

Happy trading!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.