Why This "Excellent" Stock Market Indicator Should Be on Your Radar Screen Now

Stock-Markets / Stock Market 2021 Feb 18, 2021 - 04:42 PM GMTBy: EWI

"No crowd buys stocks of other countries intelligently"

"No crowd buys stocks of other countries intelligently"

Elliott Wave International's 25+ analysts regularly review more than 100+ market indicators to keep subscribers ahead of major turns.

Many of those are "technical" indicators. Others are "sentiment" related.

Let's focus on a key sentiment measure which has a stellar track record. As the book Prechter's Perspective says:

For decades, heavy foreign buying in the U.S. stock market has served as an excellent indicator of major tops.

This indicator also works elsewhere around the globe. For instance, in the late 1980s, after years of indifference, overseas investors became net buyers of Japanese stocks. This occurred right before the zenith of one of the biggest bull markets of all time.

But, getting back to the U.S., the heavy foreign buying (or selling) indicator certainly applied in 2007.

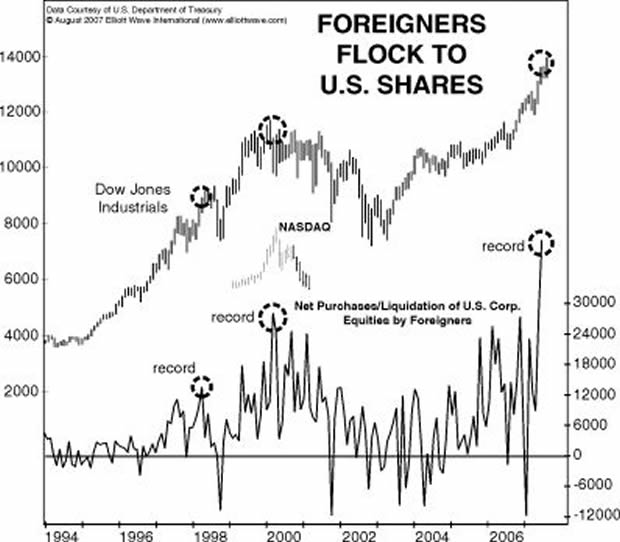

Let's take you back to this chart and commentary from the August 2007 Elliott Wave Financial Forecast, a monthly publication which provides subscribers with analysis of major U.S. financial markets:

This chart of the Dow and foreigners' net purchases of U.S. equities shows how the correlation held for U.S. shares through the bull market of the 1990s. After briefly fleeing the U.S. market in a record net selling month last December, foreigners jumped into the U.S. market like never before in May. The new record was a full third higher than the old one, which was set in February 2000, one month after the Dow Industrials' 2000 peak and one month before the NASDAQ's all-time high. The first five months of [2007] produced what was easily the biggest gusher of net foreign buying in history. The record suggests that falling prices lie directly ahead for the U.S. market.

Well, just two months later, the DJIA topped and then tumbled 54% into March 2009.

The reason for calling your attention to this indicator here in 2021 is that the just-published February 2021 Elliott Wave Financial Forecast provides subscribers with the latest available data on foreign purchases of U.S. shares -- and it's stunning.

The DJIA's Elliott wave structure is also attention-grabbing and very much worth your time to review and ponder.

If you'd like to learn more about the Elliott wave method for analyzing financial markets, you are encouraged to read the Wall Street classic book, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter. Here's an excerpt:

[T]he Wave Principle often indicates in advance the relative magnitude of the next period of market progress or regress. Living in harmony with those trends can make the difference between success and failure in financial affairs.

If you'd like to access the entire online version of the book for free, all that's required is a Club EWI membership.

Club EWI is the world's largest Elliott wave educational community and is free to join. Members enjoy unlimited and free access to a wealth of Elliott wave resources on financial markets, investing and trading.

The way to get started is to follow this link: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline Why This "Excellent" Stock Market Indicator Should Be on Your Radar Screen Now. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.