Why I’m Avoiding These “Bottle Rocket” Stocks Like GameStop

Companies / Investing 2021 Feb 18, 2021 - 11:56 AM GMTBy: Stephen_McBride

Should I be investing? What are the “hot” stocks? How much money do I need? Stephen! HELP!

My phone’s been lighting up over the past few weeks. Old friends from college who I haven’t talked to in years are texting me about stocks—for the first time ever. I’m not surprised. They’ve been seeing “GameStop short squeeze” and similar headlines plastered across their Facebook and Twitter feeds 24/7.

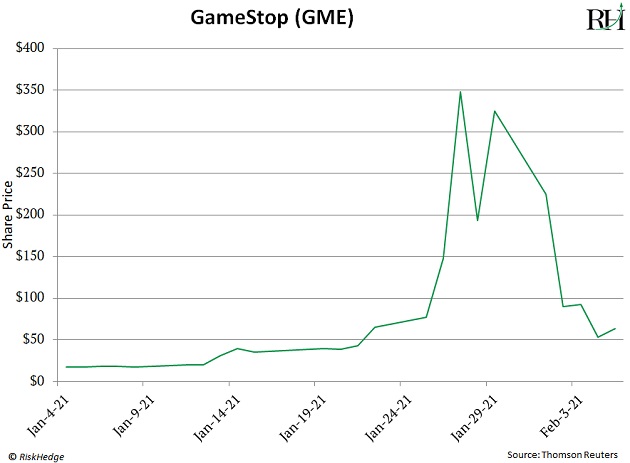

They’re intrigued. They’re confused. They want to know how they can get rich! One even asked if he should put $5,000 into GameStop (GME) after it had already surged a mind-boggling 1,900%. I told him not to touch it.

He would have gotten taken to the cleaners (and probably scared off from ever investing again). As you’ve probably seen, shares have fallen off a cliff recently, crashing 85%. Which would have shrunk his $5K into less than $600—in a matter of days.

Some Say This Craziness Is A Sign Of The Top

And yes, it would be completely normal—and healthy—for the market to pull back here. After all, the S&P 500 has rallied nearly 20% over the past 3 months alone. But I’m happy to see folks getting interested in investing for the first time ever.

It’s all part of what of a new megatrend that will propel stocks higher for years. You see, Millennials—the largest (and soon to be richest) generation in American history—are pouring into the stock market for the first time ever.

And it’s a GREAT thing. Tens of millions of young investors are flooding into the market. And that’s a wonderful thing for stock prices. These Millennials aren’t interested in owning boring bonds. This is a generation of stock pickers. Fundstrat estimates $6 trillion could flood into stocks over the next decade. You don’t want to be sitting on the sidelines as this massive shift kicks into high gear.

In a minute, I’ll share the type of I recommend buying. It’s also one of the single greatest ways to build long-lasting wealth.

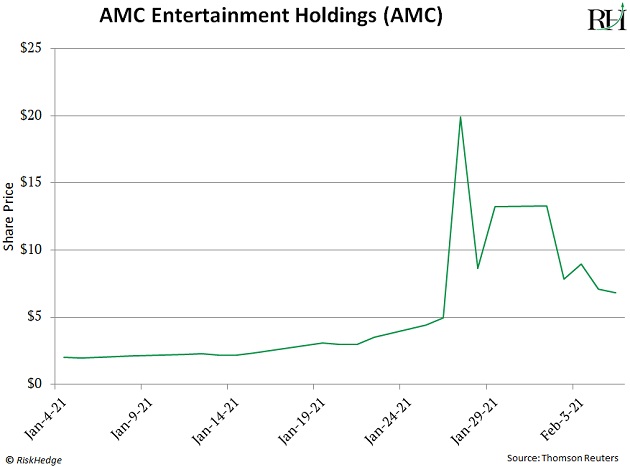

But first, here’s how NOT to build long-lasting wealth. After GameStop, my friends started asking me about the other “flavor of the week” stocks. Like AMC Entertainment (AMC):

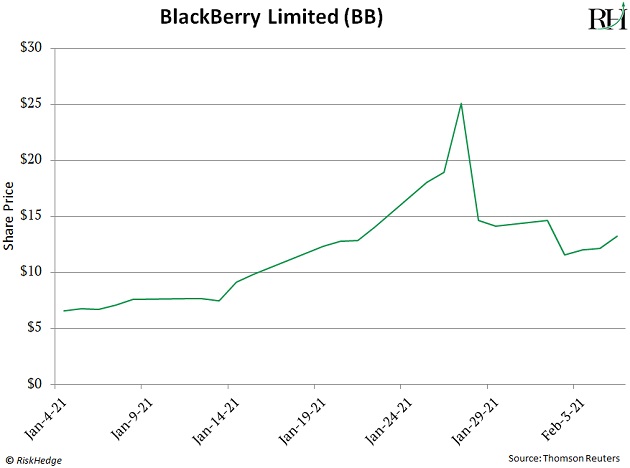

And BlackBerry (BB):

After soaring to the moon, these stocks are falling back down to earth just as fast. Both plummeting more than 50% in a week. This isn’t how you succeed in the markets. This is how you go BROKE.

GameStop, AMC, Blackberry, And Others Are “Bottle Rocket” Stocks

Bottle rockets shoot up, then plunge back to earth. It’s exciting. But it’s over in an instant. That’s exactly what we saw with all of these pumped-up stocks over the past week.

I told my friends to stay away and never look back. Then I sent them this essay I penned last year.

As I explain in that essay, owning stocks is the single best way to get rich over time. But you have to be smart and patient. When you save and invest your savings in a successful business, you accumulate assets that earn money while you sleep.

That last part is key. Investing in successful businesses. That’s the opposite of GameStop, the dying video game retailer that’s following the same dark path as Blockbuster. Or AMC, which owns and operates a chain of movie theaters. Its business has been decimated by COVID, not to mention the explosive growth in streaming.

Instead, you want to own world-class businesses. Companies that are changing the world. Ones that will dominate for a long time.

I Call These “disruptors”

Disruptors are companies that create and transform whole industries. In other words, disruptors invent the future. Netflix wasn’t just another TV network. It changed the way we watch TV. Priceline wasn’t just another travel agent. It changed the way we book travel. And Amazon wasn’t just another department store. It changed the way we buy things.

They completely flipped their industries upside down. And most important, disruptors can hand you investing profits you simply won’t find elsewhere. For example:

- Southwest Airlines (LUV) disrupted flying when it pioneered discount air travel. It forced the whole industry to rethink their business strategy and slash ticket prices. From 1980 to 1999 it handed investors 7,450% gains.

- Starbucks (SBUX) got America hooked on high-end coffee. It normalized paying $6 for a latte. Although it spawned a dozen competitors, Starbucks still managed to hand investors 9,050% gains from 1992 to 2012.

- Intuit (INTU) disrupted personal finance. Through its development of do-it-yourself financial programs QuickBooks and TurboTax, it freed millions of Americans from having to hire an expensive accountant. Investors who got in around 1993 collected gains of 2,460%.

In short: You want to own UNSTOPPABLE DISRUPTORS. Not bottle-rocket stocks that pop off then fade away.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.